4 Sp 2018

What is the 4 Spanish Form?

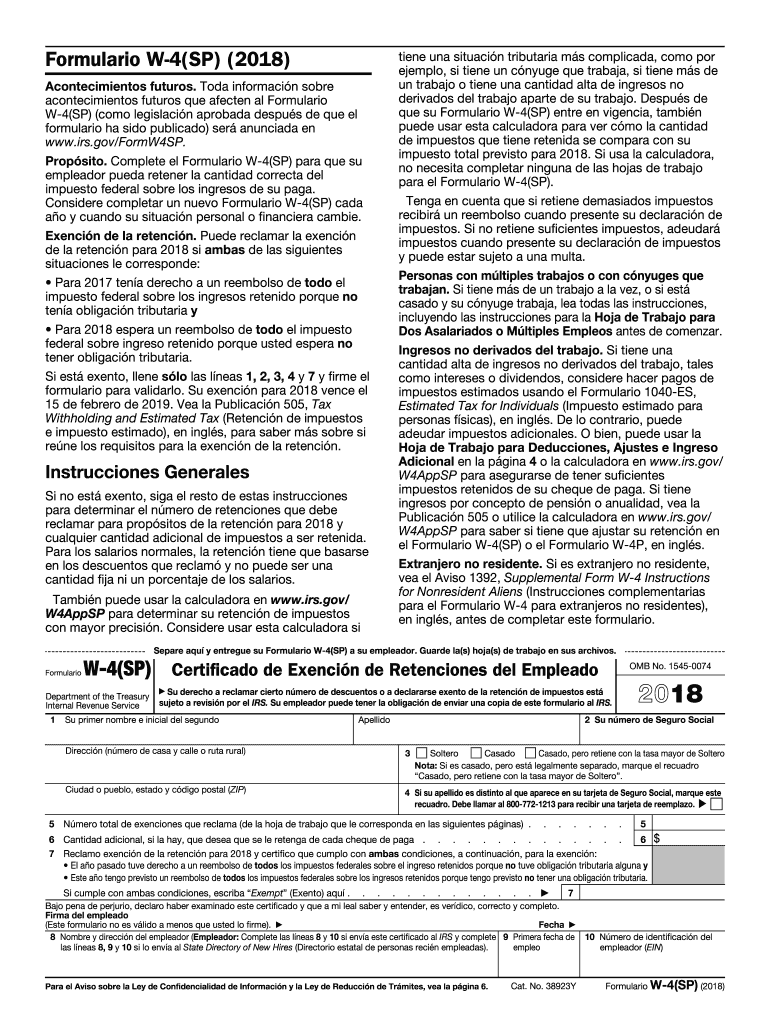

The 4 Spanish form, commonly referred to as the Form W-4 in Spanish, is a crucial document used by employees in the United States to indicate their tax withholding preferences. This form allows employees to specify the amount of federal income tax to be withheld from their paychecks. By completing the 4 Spanish form, employees can ensure that the correct amount of taxes is withheld, preventing underpayment or overpayment of taxes throughout the year.

How to Use the 4 Spanish Form

Using the 4 Spanish form involves several straightforward steps. First, employees need to obtain the form, which can be downloaded from the IRS website or obtained from their employer. Once the form is in hand, employees should fill out their personal information, including name, address, and Social Security number. Next, they need to indicate their filing status and any additional allowances they wish to claim. Finally, the completed form should be submitted to the employer's payroll department for processing.

Steps to Complete the 4 Spanish Form

Completing the 4 Spanish form requires careful attention to detail. Here are the essential steps:

- Obtain the form: Access the form from the IRS website or request it from your employer.

- Fill in personal details: Enter your name, address, and Social Security number accurately.

- Select your filing status: Choose whether you are single, married, or head of household.

- Claim allowances: Indicate the number of allowances you are claiming based on your personal situation.

- Sign and date: Ensure you sign and date the form before submission to validate it.

Legal Use of the 4 Spanish Form

The 4 Spanish form is legally binding when completed and submitted correctly. It must be filled out in accordance with IRS guidelines to ensure compliance with federal tax laws. Employers are required to keep these forms on file for their records, and they play a significant role in determining the amount of tax withheld from employee paychecks. Failure to submit a properly completed form may result in default withholding rates, which could lead to unexpected tax liabilities.

IRS Guidelines for the 4 Spanish Form

The IRS provides specific guidelines for completing the 4 Spanish form. Employees should refer to the IRS instructions to understand how to calculate allowances and withholding amounts accurately. These guidelines also outline the circumstances under which an employee may need to adjust their withholding, such as changes in marital status or additional income sources. Staying informed about these guidelines helps ensure that employees meet their tax obligations effectively.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 4 Spanish form. Typically, employees should submit the form to their employer as soon as they start a new job or experience a significant life change that affects their tax situation. Employers are required to implement the withholding changes by the next payroll period following the submission of the form. Keeping track of these deadlines helps employees manage their tax withholding proactively.

Quick guide on how to complete 4 sp 2018 2019 form

Complete 4 Sp effortlessly on any device

Online document management has become widely adopted by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without hindrance. Manage 4 Sp on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The easiest way to modify and eSign 4 Sp with ease

- Obtain 4 Sp and click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Select important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form retrieval, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 4 Sp and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4 sp 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 4 sp 2018 2019 form

How to make an electronic signature for the 4 Sp 2018 2019 Form online

How to make an eSignature for the 4 Sp 2018 2019 Form in Chrome

How to generate an eSignature for signing the 4 Sp 2018 2019 Form in Gmail

How to make an eSignature for the 4 Sp 2018 2019 Form right from your smart phone

How to create an electronic signature for the 4 Sp 2018 2019 Form on iOS

How to make an eSignature for the 4 Sp 2018 2019 Form on Android

People also ask

-

What is the 4 Spanish form and how can it help my business?

The 4 Spanish form is a customizable electronic document that allows you to efficiently collect information in Spanish. By using this form in your business processes, you can enhance communication with Spanish-speaking clients and improve user experience, ultimately leading to better customer satisfaction.

-

How much does it cost to use airSlate SignNow for the 4 Spanish form?

airSlate SignNow offers competitive pricing plans tailored to different business needs that include the features for creating and managing the 4 Spanish form. Pricing varies based on the number of users and the required features, so I recommend checking our website for the most current pricing information and any available discounts.

-

Can I integrate the 4 Spanish form with other applications?

Yes, airSlate SignNow allows seamless integration with various applications, making it easy to incorporate the 4 Spanish form into your existing workflows. Whether you use CRM systems, project management tools, or email platforms, SignNow can connect to streamline processes and increase efficiency.

-

Are there any templates available for the 4 Spanish form?

Absolutely! airSlate SignNow provides a variety of templates, including the 4 Spanish form, which you can customize to suit your specific needs. These templates help save time and ensure you gather all necessary information correctly from Spanish-speaking clients.

-

What features does airSlate SignNow offer for the 4 Spanish form?

With airSlate SignNow, the 4 Spanish form comes equipped with features such as electronic signatures, real-time tracking, and secure storage. These features enhance the convenience and security of handling documents while ensuring compliance with legal requirements.

-

How can the 4 Spanish form enhance my customer engagement?

Utilizing the 4 Spanish form can signNowly improve customer engagement by providing a simple and accessible way for Spanish-speaking clients to interact with your business. This fosters a better relationship, as clients can fill out forms in their preferred language without any barriers.

-

Is the 4 Spanish form compliant with legal standards?

Yes, the 4 Spanish form created through airSlate SignNow complies with various legal standards for electronic signatures and document handling. This ensures that your documents are legally binding and secure, giving you peace of mind when managing important agreements.

Get more for 4 Sp

Find out other 4 Sp

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement