Form 2106 2023

What is the Form 2106

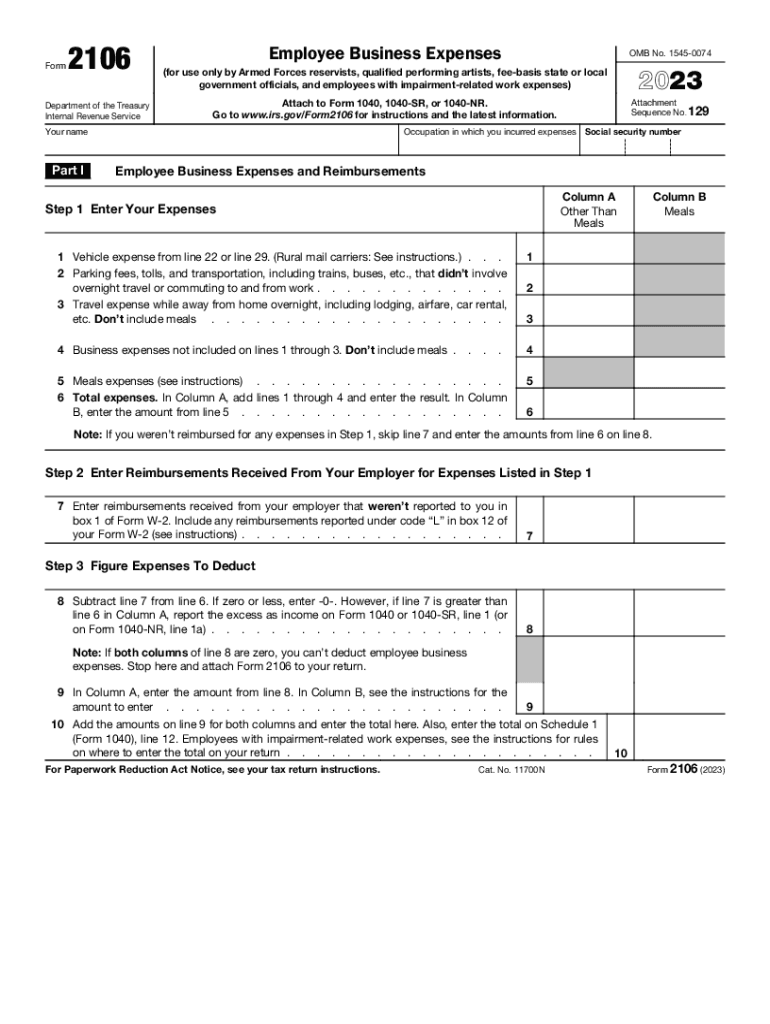

The Form 2106, also known as the Employee Business Expenses form, is utilized by employees to report unreimbursed business expenses. This form is particularly relevant for those who itemize deductions on their federal tax returns. It allows taxpayers to claim deductions for expenses incurred while performing job-related duties, which can include travel, meals, and other necessary expenditures. Understanding the purpose of Form 2106 is crucial for maximizing potential tax benefits.

How to use the Form 2106

Using Form 2106 involves several steps to ensure accurate reporting of expenses. First, gather all relevant documentation, including receipts and invoices for business-related costs. Next, complete the form by detailing each expense in the appropriate sections. It is essential to categorize expenses correctly, as this affects the overall deduction amount. After completing the form, it should be attached to your tax return when filing with the IRS. Proper use of this form can lead to significant tax savings.

Steps to complete the Form 2106

Completing Form 2106 requires careful attention to detail. Follow these steps for accurate submission:

- Start by entering your personal information, including name and Social Security number.

- Document your business expenses in the designated sections, ensuring to include all necessary details.

- Calculate the total of your expenses and transfer this amount to your tax return.

- Review the form for accuracy before submission to avoid delays or penalties.

IRS Guidelines

The IRS provides specific guidelines for completing Form 2106. It is important to adhere to these instructions to ensure compliance and maximize deductions. The IRS outlines what qualifies as a deductible expense and the documentation required to substantiate these claims. Familiarizing yourself with these guidelines can help prevent errors and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 2106 align with the general tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 each year. However, if additional time is needed, an extension can be requested, allowing for a later submission. It is important to keep track of these dates to avoid late fees and penalties.

Required Documents

To complete Form 2106, several documents are necessary. These include:

- Receipts for all business-related expenses.

- Records of mileage driven for business purposes, if applicable.

- Any relevant documentation that supports your claims, such as travel itineraries or invoices.

Having these documents organized will streamline the process of filling out the form and ensure that all deductions are substantiated.

Quick guide on how to complete form 2106 702543187

Prepare Form 2106 seamlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources to create, alter, and eSign your papers swiftly without interruptions. Manage Form 2106 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Form 2106 effortlessly

- Find Form 2106 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 2106 to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2106 702543187

Create this form in 5 minutes!

How to create an eSignature for the form 2106 702543187

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost of using airSlate SignNow for 2106?

The pricing for airSlate SignNow starts from competitive packages tailored for businesses. With basic plans ideal for startups to advanced options for large enterprises, you can find a solution that fits your budget and needs around the 2106 solution. Explore our pricing page to figure out which plan suits your organization best.

-

What features does airSlate SignNow offer related to the 2106?

AirSlate SignNow provides extensive features including document templates, customizable workflows, and advanced eSignature capabilities tailored for the 2106 needs. Additionally, it offers secure cloud storage and rich API integrations to streamline your business processes. These features enhance productivity and ensure compliance.

-

How does airSlate SignNow improve workflow efficiency with the 2106?

With airSlate SignNow, the 2106 process is simplified through automated workflows and real-time collaboration. This means reduced document turnaround times, minimized errors, and fewer bottlenecks. By optimizing workflows, businesses can focus more on growth and less on administrative tasks.

-

Is airSlate SignNow compliant with the 2106 regulations?

Yes, airSlate SignNow is designed to be compliant with various legal standards for digital signatures, including those relevant to the 2106. Our platform adheres to regulations such as ESIGN and UETA, ensuring that your documents are legally binding and secure. This compliance gives users peace of mind during their document management processes.

-

Can I integrate airSlate SignNow with other software for the 2106?

Absolutely! airSlate SignNow supports integration with numerous software solutions that can enhance your 2106 experience. Whether it's CRM, accounting, or project management tools, our integration options allow seamless data flow and improved operational efficiency. Check out our integrations to find compatible applications.

-

What are the benefits of using airSlate SignNow for the 2106 process?

Using airSlate SignNow for the 2106 process offers numerous benefits including cost savings, streamlined document workflows, and enhanced security. With unlimited eSigns and cloud accessibility, teams can work efficiently from anywhere. This not only saves time but also boosts overall productivity.

-

How secure is airSlate SignNow for the 2106 documentation?

AirSlate SignNow takes security seriously with end-to-end encryption, secure cloud storage, and comprehensive audit trails for the 2106 documentation. We implement robust security measures to ensure that sensitive information remains protected against unauthorized access. Your data integrity is our top priority.

Get more for Form 2106

Find out other Form 2106

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate