Form 2106 Employee Business Expenses 2020

What is the Form 2106 Employee Business Expenses

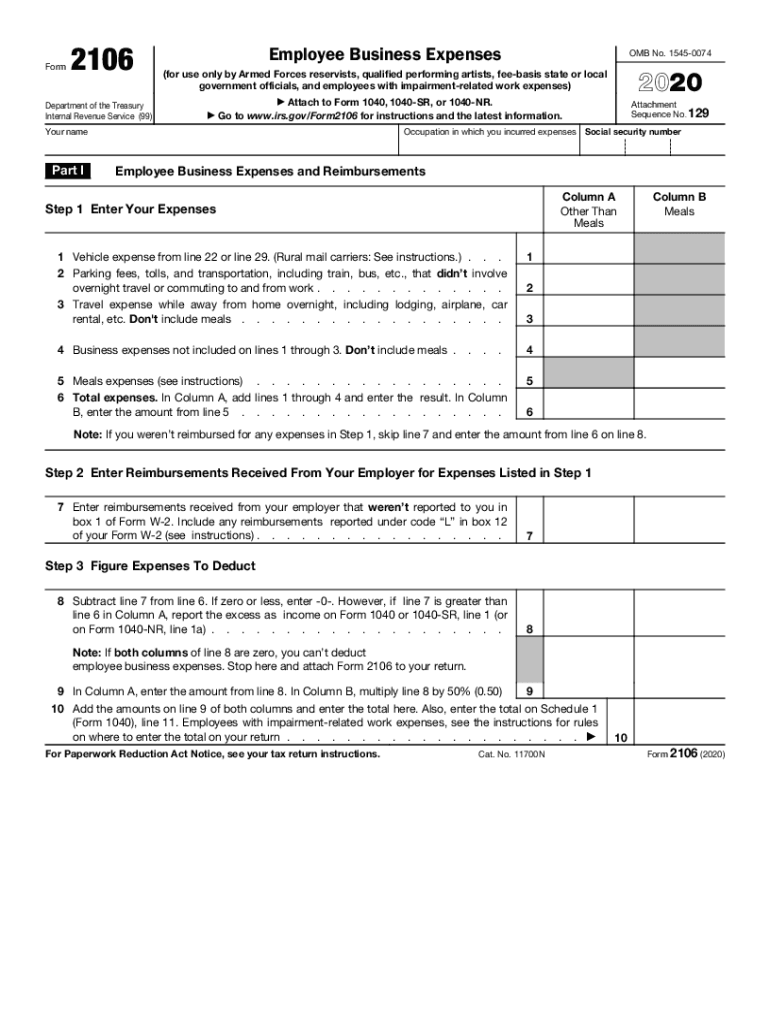

The Form 2106, known as the Employee Business Expenses form, is a tax document used by employees to report unreimbursed business expenses. This form allows employees to deduct certain costs incurred while performing their job duties, which can include travel expenses, meals, and other necessary expenditures related to their employment. It is essential for employees who do not receive reimbursement from their employers for these costs, as it helps reduce their taxable income.

How to use the Form 2106 Employee Business Expenses

Using the Form 2106 involves several steps to ensure accurate reporting of business expenses. First, gather all relevant receipts and documentation for expenses incurred during the tax year. Next, complete the form by providing personal information, including your name and Social Security number, as well as details about your employer. You will then categorize your expenses, such as travel, meals, and other business-related costs. After filling out the form, it should be submitted with your federal tax return to the IRS.

Steps to complete the Form 2106 Employee Business Expenses

Completing the Form 2106 requires careful attention to detail. Follow these steps:

- Gather all receipts and records related to your business expenses.

- Fill in your personal information at the top of the form.

- List your employer's name and address.

- Detail your expenses in the appropriate sections, ensuring you categorize them correctly.

- Calculate the total of each category and enter the amounts in the designated fields.

- Review your entries for accuracy before submitting the form.

Key elements of the Form 2106 Employee Business Expenses

Several key elements must be included when filling out the Form 2106. These include:

- Personal Information: Your name, address, and Social Security number.

- Employer Information: The name and address of your employer.

- Expense Categories: Sections for travel, meals, entertainment, and other business expenses.

- Total Expenses: A summary of all categorized expenses to determine the total deduction.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 2106. It is important to adhere to these guidelines to ensure compliance and avoid penalties. The IRS outlines what qualifies as a deductible business expense and the documentation required to support these deductions. Familiarizing yourself with these guidelines can help maximize your deductions and ensure that your form is filled out correctly.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 2106 is crucial for timely submission. Typically, the form must be filed by the tax return deadline, which is usually April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but it is essential to check for any changes in deadlines that may occur due to specific circumstances or IRS announcements.

Quick guide on how to complete 2020 form 2106 employee business expenses

Complete Form 2106 Employee Business Expenses effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the precise form and securely save it online. airSlate SignNow equips you with all the tools you require to generate, modify, and eSign your documents swiftly without delays. Handle Form 2106 Employee Business Expenses on any gadget with airSlate SignNow Android or iOS applications and simplify any document-focused task today.

The easiest way to modify and eSign Form 2106 Employee Business Expenses without any hassle

- Locate Form 2106 Employee Business Expenses and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 2106 Employee Business Expenses to guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 2106 employee business expenses

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 2106 employee business expenses

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 2016 Form 2106 and why is it important?

The 2016 Form 2106 is used by employees to deduct unreimbursed business expenses on their taxes. Understanding this form is essential for ensuring you claim all eligible expenses and maximize your tax deductions. By using airSlate SignNow, you can easily eSign and send your completed Form 2106, making the tax filing process more straightforward.

-

How can airSlate SignNow help with the 2016 Form 2106?

AirSlate SignNow streamlines the signing process for the 2016 Form 2106 by allowing users to complete and eSign documents effortlessly. With its user-friendly interface, you can quickly fill out the required fields and send your form to the relevant parties without any hassle. This eliminates the need for printing, scanning, or physically mailing documents.

-

Is there a cost associated with using airSlate SignNow for the 2016 Form 2106?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for small businesses to enterprises. The investment in airSlate SignNow can provide signNow savings by making your document handling more efficient, especially when dealing with forms like the 2016 Form 2106. Check our pricing page for detailed information.

-

Are there any features specifically beneficial for filing the 2016 Form 2106?

AirSlate SignNow provides features like templates, automated workflows, and comprehensive audit trails that are particularly beneficial for filing the 2016 Form 2106. These features help ensure that all necessary information is correctly included and that the signing process is compliant with legal standards. Enhanced security measures also protect sensitive tax information.

-

Can I collaborate with my accountant using airSlate SignNow for the 2016 Form 2106?

Absolutely! AirSlate SignNow allows you to share documents like the 2016 Form 2106 with your accountant or financial advisor easily. You can invite others to review, edit, or sign the document, allowing for a seamless collaboration process that keeps everyone on the same page.

-

Does airSlate SignNow integrate with popular accounting software for the 2016 Form 2106?

Yes, airSlate SignNow integrates with numerous accounting software platforms, making it easy to manage documents related to the 2016 Form 2106 alongside your other financial records. This integration simplifies your workflow by linking eSignature capabilities with your existing accounting systems, ensuring a smooth data exchange.

-

What are the benefits of using airSlate SignNow for the 2016 Form 2106?

Using airSlate SignNow for the 2016 Form 2106 offers several benefits, including increased efficiency, reduced turnaround time, and enhanced organization. With eSigning, you can finalize and submit your forms faster, minimizing delays typical with traditional methods. Moreover, cloud storage options enable you to access your documents from anywhere at any time.

Get more for Form 2106 Employee Business Expenses

- United kingdom sheltered housing form

- Cdncocodoccomcocodoc form pdfpdfplace ampamp regeneration development management service guildhall

- Home search hull form

- Salary form

- Srs 2 scoring worksheet form

- Rite aid vaccine form

- Pilot history form pikwest

- Fillable online subcontractor information form attach

Find out other Form 2106 Employee Business Expenses

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement