2106 Form 2016

What is the 2106 Form

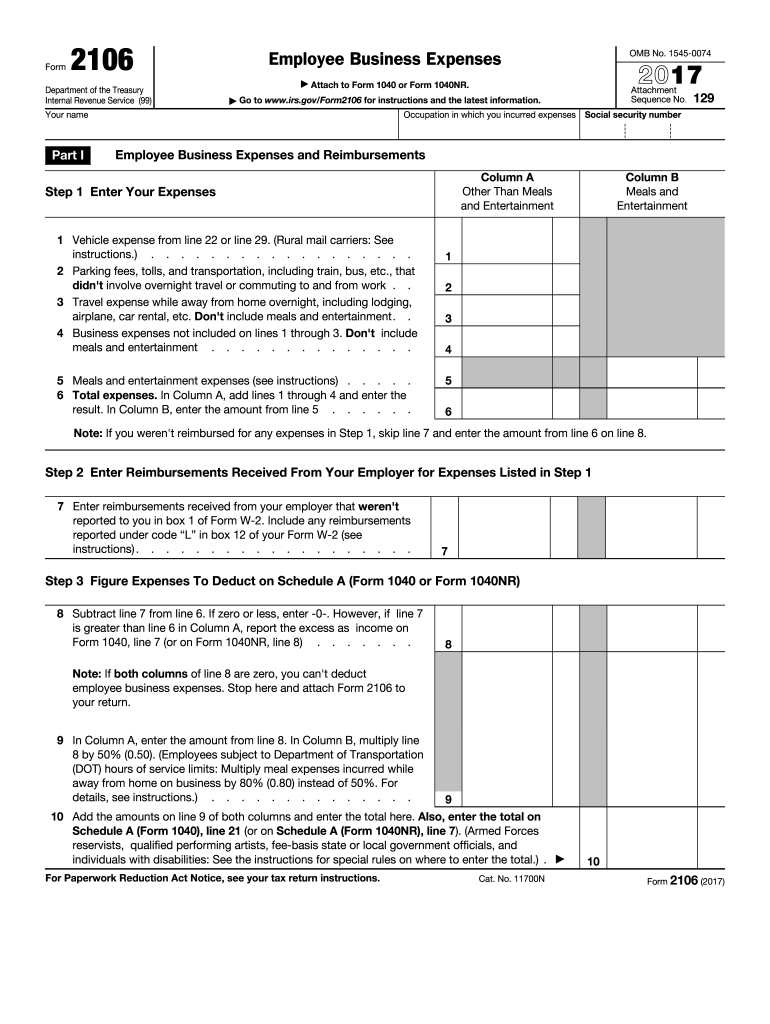

The 2106 Form, officially known as the Employee Business Expenses form, is used by employees to report unreimbursed business expenses. This form is particularly relevant for employees who incur costs related to their job that are not covered by their employer. Common expenses include travel, meals, and supplies necessary for job performance. Completing this form allows employees to claim these expenses as deductions on their tax returns, potentially reducing their taxable income.

How to use the 2106 Form

To effectively use the 2106 Form, start by gathering all relevant documentation of your business expenses. This may include receipts, invoices, and any other proof of payment. Next, fill out the form by categorizing your expenses into sections such as travel, meals, and other business-related costs. Be sure to provide accurate figures and descriptions for each expense. Once completed, the form can be submitted with your tax return to the IRS, allowing you to claim your deductions.

Steps to complete the 2106 Form

Completing the 2106 Form involves several key steps:

- Gather all necessary documentation, including receipts and invoices.

- Fill in your personal information at the top of the form.

- List your business expenses in the appropriate sections, ensuring accuracy.

- Calculate the total of your expenses and enter this figure in the designated area.

- Review the form for completeness and accuracy before submission.

Legal use of the 2106 Form

The legal use of the 2106 Form is governed by IRS regulations. Employees must ensure that their claimed expenses are ordinary and necessary for their job. Additionally, the expenses must not have been reimbursed by the employer. Proper documentation and adherence to IRS guidelines are essential to avoid penalties and ensure that the deductions are accepted during tax filing.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 2106 Form. It is important to familiarize yourself with these rules to ensure compliance. Key points include the types of expenses that qualify, the requirement for detailed record-keeping, and the necessity of submitting the form with your tax return. Understanding these guidelines helps in accurately reporting expenses and maximizing potential deductions.

Filing Deadlines / Important Dates

Filing deadlines for the 2106 Form align with the standard tax return deadlines. Typically, individual tax returns are due by April fifteenth each year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is crucial to stay informed about these dates to ensure timely submission of your tax documents.

Quick guide on how to complete 2106 2016 form

Complete 2106 Form effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle 2106 Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

How to alter and electronically sign 2106 Form without any hassle

- Obtain 2106 Form and then click Retrieve Form to get started.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click the Finish button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 2106 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2106 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 2106 2016 form

How to generate an eSignature for the 2106 2016 Form online

How to create an electronic signature for the 2106 2016 Form in Chrome

How to create an electronic signature for signing the 2106 2016 Form in Gmail

How to make an eSignature for the 2106 2016 Form right from your mobile device

How to create an eSignature for the 2106 2016 Form on iOS devices

How to make an eSignature for the 2106 2016 Form on Android devices

People also ask

-

What is the 2106 Form and why is it important?

The 2106 Form, also known as the Employee Business Expenses form, is essential for employees who wish to deduct certain business expenses on their taxes. By utilizing the 2106 Form, employees can report unreimbursed expenses related to their job, which can lead to potential tax savings. This form is particularly important for individuals who travel for work or incur other job-related costs.

-

How can airSlate SignNow help with the 2106 Form process?

airSlate SignNow streamlines the process of completing and submitting the 2106 Form by allowing users to eSign and send documents quickly and securely. With our intuitive platform, you can easily fill out the 2106 Form, ensuring that all necessary information is included for accurate tax reporting. Our solution simplifies the paperwork, making it easier for you to focus on your business.

-

Is airSlate SignNow a cost-effective solution for managing the 2106 Form?

Yes, airSlate SignNow is a cost-effective solution for managing the 2106 Form and other essential documents. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you get the best value without compromising on features. By using our platform, you not only save time but also reduce costs associated with document management.

-

What features does airSlate SignNow offer for handling the 2106 Form?

airSlate SignNow offers a range of features that enhance the handling of the 2106 Form, including customizable templates, secure eSignature capabilities, and cloud storage. These features enable you to easily create, edit, and manage your forms while ensuring compliance with legal standards. Additionally, our intuitive interface makes it simple for users to navigate through the documentation process.

-

Can I integrate airSlate SignNow with other software for the 2106 Form?

Yes, airSlate SignNow offers seamless integrations with various business applications, making it easier to manage the 2106 Form within your existing workflow. Our platform can connect with popular tools like Google Drive, Salesforce, and more, ensuring that your document management process is efficient and streamlined. This integration capability helps you centralize all your business operations.

-

What are the benefits of using airSlate SignNow for the 2106 Form?

Using airSlate SignNow for the 2106 Form provides numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our eSignature solution ensures that your documents are signed and processed quickly, reducing turnaround times. Moreover, our platform is designed to keep your sensitive information secure while facilitating easy access for all parties involved.

-

How secure is my information when using airSlate SignNow for the 2106 Form?

airSlate SignNow prioritizes the security of your information, implementing robust encryption protocols and secure cloud storage for all documents, including the 2106 Form. We adhere to industry standards for data protection, ensuring that your sensitive information remains confidential. You can trust our platform to provide a secure environment for managing your business documents.

Get more for 2106 Form

Find out other 2106 Form

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy