Cole 2106 Form 2106 Department of the Treasury Internal 2021

Understanding Form 2106

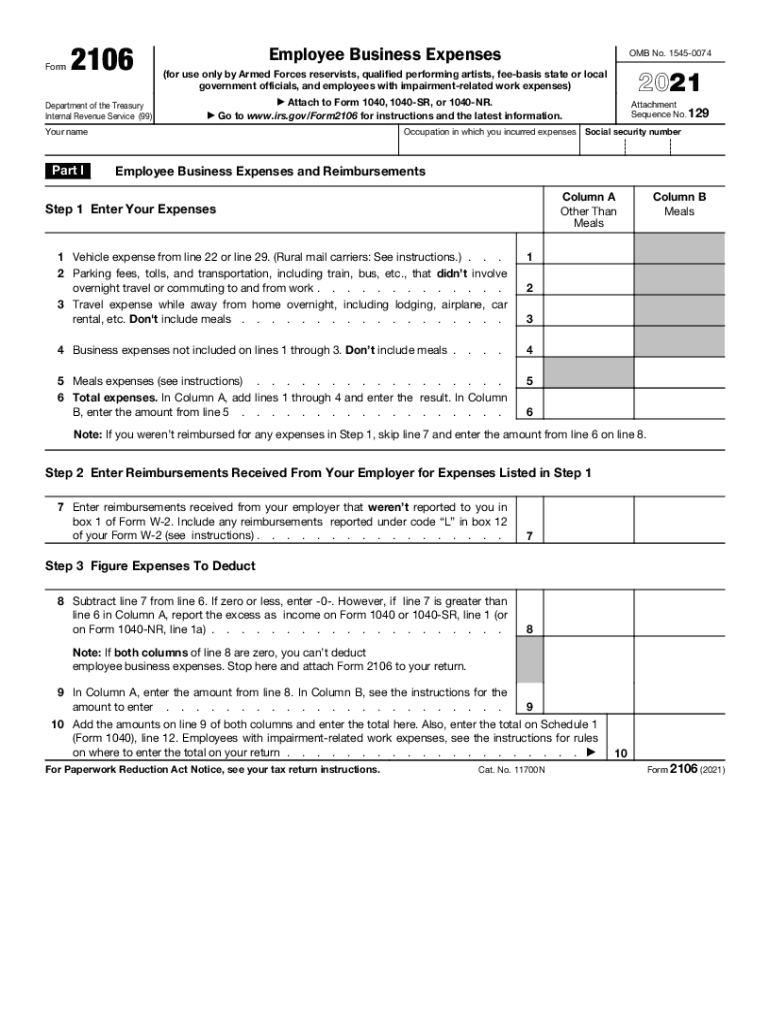

The IRS Form 2106 is designed for employees to report business expenses that are not reimbursed by their employers. This form is particularly relevant for those who are self-employed or work in professions where they incur significant out-of-pocket expenses. The form allows taxpayers to deduct certain expenses related to their work, which can help reduce their taxable income. Common expenses reported on Form 2106 include travel costs, vehicle expenses, and other necessary expenditures incurred while performing job duties.

Steps to Complete Form 2106

Completing Form 2106 involves several key steps to ensure accuracy and compliance with IRS guidelines. Begin by gathering all necessary documentation, including receipts and records of your business expenses. Next, fill out the personal information section, including your name and Social Security number. Then, categorize your expenses into the appropriate sections of the form, such as travel, meals, and entertainment. Be sure to calculate totals accurately and keep a copy of the completed form for your records. Finally, submit the form with your tax return or as a standalone document if required.

Legal Use of Form 2106

Form 2106 is legally recognized by the IRS for reporting employee business expenses. To ensure compliance, it is essential to adhere to IRS guidelines regarding what constitutes a deductible expense. Only expenses that are ordinary and necessary for your job qualify for deduction. Additionally, maintaining thorough records and documentation is crucial in case of an audit. Using a reliable digital tool can help streamline the process, ensuring that your form is completed accurately and securely.

Filing Deadlines and Important Dates

Understanding the filing deadlines for Form 2106 is critical for taxpayers. Typically, the form must be submitted along with your annual tax return, which is due on April fifteenth for most individuals. If you require additional time to file, you may request an extension, but this does not extend the time to pay any taxes owed. It is advisable to keep track of any changes in tax laws that may affect deadlines or filing requirements.

Required Documents for Form 2106

When preparing to complete Form 2106, gather all necessary documents to support your expense claims. This includes receipts for travel, meals, and other business-related costs. Additionally, maintain records of your mileage if you are claiming vehicle expenses, including dates, destinations, and purpose of travel. Having detailed documentation will not only assist in completing the form but also provide evidence in the event of an IRS inquiry.

Examples of Using Form 2106

Form 2106 can be utilized in various scenarios to report business expenses. For instance, a traveling salesperson might use the form to deduct costs associated with hotel stays, meals, and transportation. Similarly, a remote worker may claim home office expenses or costs incurred while attending professional conferences. Each situation requires careful documentation to substantiate the claims made on the form, ensuring compliance with IRS regulations.

Quick guide on how to complete cole 2106 form 2106 department of the treasury internal

Complete Cole 2106 Form 2106 Department Of The Treasury Internal effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Cole 2106 Form 2106 Department Of The Treasury Internal on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Cole 2106 Form 2106 Department Of The Treasury Internal with ease

- Obtain Cole 2106 Form 2106 Department Of The Treasury Internal and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Cole 2106 Form 2106 Department Of The Treasury Internal and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cole 2106 form 2106 department of the treasury internal

Create this form in 5 minutes!

How to create an eSignature for the cole 2106 form 2106 department of the treasury internal

The way to create an e-signature for a PDF file in the online mode

The way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is form 2106, and how can airSlate SignNow help with it?

Form 2106 is used to report employee business expenses for tax purposes. With airSlate SignNow, users can easily create, send, and eSign this form, streamlining the process and ensuring that all necessary signatures are captured efficiently.

-

Is there a cost to use airSlate SignNow for form 2106?

airSlate SignNow offers various pricing plans that accommodate different business needs. You can access essential features for managing form 2106 with affordable subscription options, allowing you to choose a plan that fits your budget.

-

What features does airSlate SignNow provide for managing form 2106?

airSlate SignNow offers numerous features such as template creation, automated workflows, and real-time tracking for form 2106. These tools help businesses minimize paperwork and enhance their document management processes.

-

How does airSlate SignNow enhance the workflow for form 2106?

By utilizing airSlate SignNow, businesses can automate the entire workflow related to form 2106. This includes sending reminders for signatures, tracking document status, and securely storing completed forms to improve organization and efficiency.

-

Can I integrate airSlate SignNow with other software for managing form 2106?

Yes, airSlate SignNow supports integration with various third-party applications, which can help streamline the completion of form 2106. Users can connect with CRM systems, cloud storage, and other tools to enhance productivity and gain better access to their documents.

-

How secure is airSlate SignNow when handling form 2106?

airSlate SignNow prioritizes the security of your documents, including form 2106, through advanced encryption and data protection measures. This ensures that sensitive information remains confidential and is accessible only to authorized users.

-

What benefits does airSlate SignNow offer for businesses using form 2106?

Using airSlate SignNow for form 2106 signNowly reduces paperwork and enhances efficiency. Businesses benefit from fast document turnaround times, reduced errors, and the convenience of electronic signatures, making the tax filing process smoother and hassle-free.

Get more for Cole 2106 Form 2106 Department Of The Treasury Internal

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property georgia form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential georgia form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property georgia form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property georgia form

- Ga change form

- Georgia change form

- Agreed written termination of lease by landlord and tenant georgia form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497303777 form

Find out other Cole 2106 Form 2106 Department Of The Treasury Internal

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe