2106 Form 2018

What is the 2106 Form

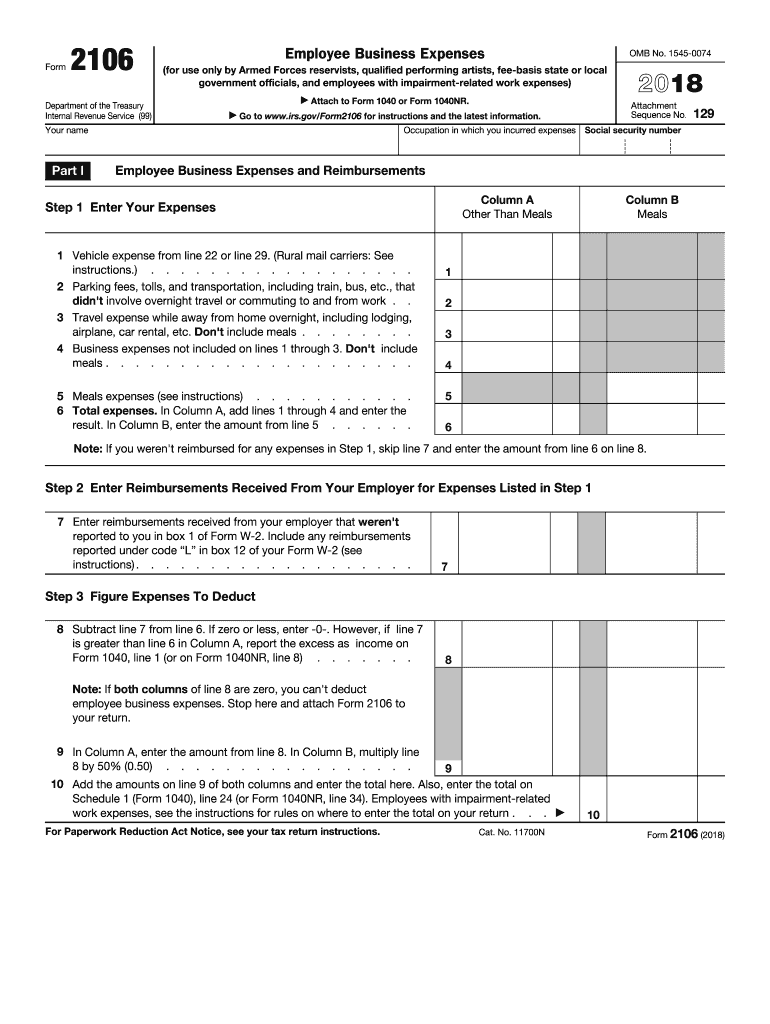

The 2016 form 2106, officially known as the Employee Business Expenses form, is utilized by employees to report unreimbursed business expenses. This form is particularly relevant for individuals who incur costs related to their job that are not reimbursed by their employer. Common expenses that can be claimed include travel, meals, and certain supplies necessary for work. Understanding the purpose of this form is crucial for accurately reporting these expenses on your tax return.

How to use the 2106 Form

Using the 2016 form 2106 involves several key steps. First, gather all relevant receipts and documentation for your business expenses. Next, fill out the form by providing your personal information and detailing the expenses incurred. It's important to categorize these expenses correctly, as this will affect your tax deductions. After completing the form, ensure all information is accurate before submitting it with your tax return. This form can help maximize your deductions, potentially lowering your taxable income.

Steps to complete the 2106 Form

Completing the 2016 form 2106 requires a systematic approach. Start by entering your name, address, and Social Security number at the top of the form. Next, list your business expenses in the appropriate sections, ensuring to include the date, amount, and purpose of each expense. If you used your vehicle for business, calculate and report your mileage. Once you have filled out all sections, review the form for accuracy. Finally, attach the completed form to your tax return when filing.

IRS Guidelines

The IRS has specific guidelines regarding the use of the 2016 form 2106. It is essential to understand what qualifies as a deductible business expense. The IRS allows deductions for expenses that are ordinary and necessary for your job. Additionally, the form must be filled out accurately to avoid issues with the IRS. Familiarizing yourself with IRS publications related to employee business expenses can provide further clarity on what can be claimed and how to report it correctly.

Filing Deadlines / Important Dates

Filing deadlines for the 2016 form 2106 align with the general tax filing deadlines. Typically, individual tax returns are due on April fifteenth of the following year. If you require additional time, you may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties. Keeping track of these dates ensures that you remain compliant and can take full advantage of any deductions available to you.

Required Documents

To complete the 2016 form 2106 accurately, you will need several supporting documents. These include receipts for all business-related expenses, a mileage log if applicable, and any additional documentation that substantiates your claims. Having these documents organized and readily available will streamline the process of filling out the form and help ensure that you do not miss any potential deductions.

Quick guide on how to complete 2017 irs form fillable 2018 2019

Uncover the most efficient method to complete and endorse your 2106 Form

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow provides a superior approach to complete and endorse your 2106 Form and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle documents swiftly and in compliance with official standards - powerful PDF editing, managing, securing, signing, and sharing tools all available within an intuitive interface.

Only a few steps are needed to complete to fill out and endorse your 2106 Form:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to enter in your 2106 Form.

- Navigate between the fields with the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the blanks with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure sections that are no longer necessary.

- Select Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed 2106 Form in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our solution also offers flexible file sharing options. There’s no need to print your forms when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 irs form fillable 2018 2019

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

Create this form in 5 minutes!

How to create an eSignature for the 2017 irs form fillable 2018 2019

How to make an eSignature for the 2017 Irs Form Fillable 2018 2019 online

How to create an electronic signature for the 2017 Irs Form Fillable 2018 2019 in Chrome

How to make an electronic signature for putting it on the 2017 Irs Form Fillable 2018 2019 in Gmail

How to create an electronic signature for the 2017 Irs Form Fillable 2018 2019 right from your smart phone

How to create an eSignature for the 2017 Irs Form Fillable 2018 2019 on iOS devices

How to create an eSignature for the 2017 Irs Form Fillable 2018 2019 on Android devices

People also ask

-

What is the 2016 form 2106 and who needs it?

The 2016 form 2106 is a document used for reporting employee business expenses. It is essential for employees who incur costs related to their job that are not reimbursed by their employer. Understanding how to fill out this form accurately can ensure that you claim all the eligible deductions.

-

How can airSlate SignNow help with the 2016 form 2106?

airSlate SignNow provides an effortless way to send and eSign the 2016 form 2106. With its user-friendly interface, you can complete the form and securely share it with others for signatures, enhancing the efficiency of your filing process.

-

What are the benefits of using airSlate SignNow for my 2016 form 2106?

Using airSlate SignNow for your 2016 form 2106 means you benefit from a streamlined eSigning process, increased security, and easy document management. These features simplify the signing process, ensuring your forms are completed correctly and submitted on time.

-

Is airSlate SignNow affordable for small businesses handling the 2016 form 2106?

Yes, airSlate SignNow offers a cost-effective solution for small businesses managing the 2016 form 2106. With various pricing plans to choose from, you can find an option that fits your budget while providing the essential features you need.

-

Does airSlate SignNow integrate with other tools for handling the 2016 form 2106?

AirSlate SignNow seamlessly integrates with various tools and applications, enhancing the process of preparing and signing the 2016 form 2106. These integrations enable you to synchronize your document workflows across platforms, making your business operations more efficient.

-

What document security features does airSlate SignNow provide for the 2016 form 2106?

AirSlate SignNow employs robust security measures to protect your 2016 form 2106, including encryption and secure cloud storage. These features ensure that your sensitive information remains confidential and is accessible only to authorized users.

-

Can I track the status of my 2016 form 2106 within airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your 2016 form 2106. The platform provides real-time updates, so you know when your document has been viewed and signed, allowing for better management of your business paperwork.

Get more for 2106 Form

Find out other 2106 Form

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy