Irs Form 990 Schedule B 2016

What is the Irs Form 990 Schedule B

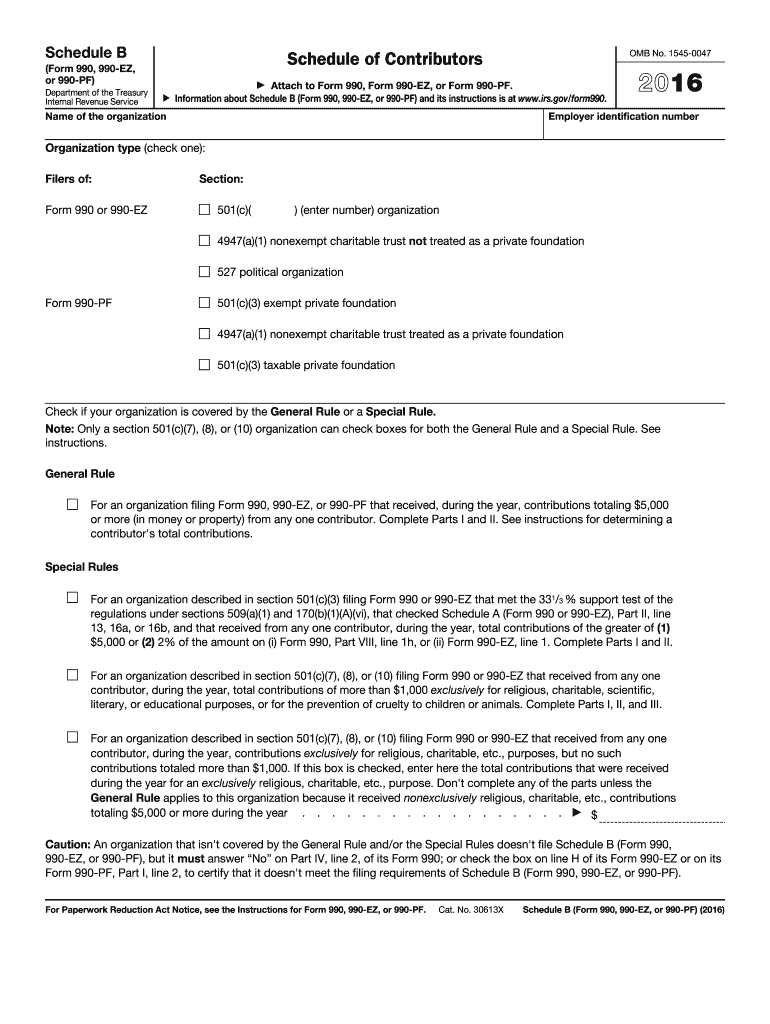

The Irs Form 990 Schedule B is a supplemental form used by tax-exempt organizations to report their significant contributors. This form is part of the larger Form 990, which is filed annually by non-profit organizations to provide the IRS with information about their financial activities, governance, and compliance with tax regulations. Schedule B specifically focuses on the identities of donors who contribute more than a specified amount, ensuring transparency in the funding sources of these organizations.

How to use the Irs Form 990 Schedule B

Using the Irs Form 990 Schedule B involves accurately reporting contributions from significant donors. Organizations must list each donor's name, address, and the amount contributed. It is essential to ensure that the information is complete and accurate, as this form is subject to scrutiny by the IRS. Organizations should maintain careful records of contributions to facilitate the completion of this schedule and ensure compliance with federal regulations.

Steps to complete the Irs Form 990 Schedule B

Completing the Irs Form 990 Schedule B requires several steps:

- Gather information about all significant contributors who donated more than the threshold amount.

- Fill in the contributor's name, address, and the total contribution amount for each individual or entity.

- Review the completed schedule for accuracy and completeness.

- Attach the Schedule B to the main Form 990 when filing.

Following these steps helps ensure that the organization meets its reporting obligations and maintains compliance with IRS regulations.

Legal use of the Irs Form 990 Schedule B

The legal use of the Irs Form 990 Schedule B is crucial for maintaining transparency and accountability in the non-profit sector. Organizations must comply with IRS requirements to disclose significant contributors, which helps prevent potential abuse of tax-exempt status. Failure to accurately report this information can result in penalties, including loss of tax-exempt status. It is important for organizations to understand their legal obligations regarding donor disclosure and to use this form appropriately.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 990 Schedule B align with the overall deadlines for Form 990. Generally, organizations must file their Form 990 by the 15th day of the fifth month after the end of their fiscal year. For organizations with a fiscal year ending December 31, the deadline is May 15 of the following year. It is important to note that extensions may be available, but organizations must submit the appropriate forms to avoid penalties for late filing.

Disclosure Requirements

Disclosure requirements for the Irs Form 990 Schedule B mandate that organizations report the names and addresses of donors who contribute above a certain threshold. This transparency is designed to provide insight into the funding sources of tax-exempt organizations. Organizations must ensure that they are aware of the current threshold amounts and comply with all reporting obligations to maintain their tax-exempt status and avoid potential penalties.

Quick guide on how to complete irs form 990 schedule b 2016

Effortlessly Prepare Irs Form 990 Schedule B on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, alter, and electronically sign your documents promptly without delays. Manage Irs Form 990 Schedule B on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to Edit and eSign Irs Form 990 Schedule B with Ease

- Obtain Irs Form 990 Schedule B and click on Get Form to initiate the process.

- Utilize the features we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Irs Form 990 Schedule B and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 990 schedule b 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 990 schedule b 2016

How to make an eSignature for your Irs Form 990 Schedule B 2016 online

How to make an eSignature for the Irs Form 990 Schedule B 2016 in Chrome

How to create an eSignature for putting it on the Irs Form 990 Schedule B 2016 in Gmail

How to generate an eSignature for the Irs Form 990 Schedule B 2016 straight from your mobile device

How to make an eSignature for the Irs Form 990 Schedule B 2016 on iOS

How to generate an electronic signature for the Irs Form 990 Schedule B 2016 on Android devices

People also ask

-

What is the purpose of the IRS Form 990 Schedule B?

The IRS Form 990 Schedule B is used by tax-exempt organizations to report their signNow contributors. Understanding this form is essential for ensuring compliance with IRS regulations and maintaining tax-exempt status, making it a critical aspect of nonprofit financial reporting.

-

How does airSlate SignNow simplify the process of managing IRS Form 990 Schedule B?

airSlate SignNow streamlines the document management workflow for IRS Form 990 Schedule B by allowing users to create, send, and e-sign documents easily. This ensures that the necessary signatures and approvals are acquired efficiently, reducing the time spent on manual processes.

-

Are there any pricing options available for using airSlate SignNow for IRS Form 990 Schedule B?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for organizations handling IRS Form 990 Schedule B. Whether you're a small nonprofit or a larger organization, you can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for IRS Form 990 Schedule B?

airSlate SignNow includes features such as template creation, document tracking, and automated reminders that are particularly useful for managing IRS Form 990 Schedule B. These features help ensure that documents are prepared accurately and sent timely, facilitating compliance.

-

Can I integrate airSlate SignNow with other software for IRS Form 990 Schedule B management?

Yes, airSlate SignNow offers integrations with various third-party applications, allowing seamless management of IRS Form 990 Schedule B. This capability enhances your workflow by connecting different tools you already use, making document handling more efficient.

-

What are the benefits of using airSlate SignNow for my IRS Form 990 Schedule B filings?

Using airSlate SignNow for IRS Form 990 Schedule B filings offers numerous benefits, including enhanced productivity through elimination of paper-based processes and real-time collaboration features. Additionally, it ensures that signatures are gathered expeditiously, which is crucial for timely filings.

-

Is airSlate SignNow secure for managing sensitive IRS Form 990 Schedule B data?

Absolutely, airSlate SignNow prioritizes data security for documents like the IRS Form 990 Schedule B. With robust encryption and compliance with various regulations, you can be confident that your sensitive information is protected.

Get more for Irs Form 990 Schedule B

Find out other Irs Form 990 Schedule B

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template