Regulations under Sections 509a1 and 170b1Avi, that Checked Schedule a Form 990, Part II, Line 13, 16a, or 2024-2026

IRS Guidelines for Form 990-EZ

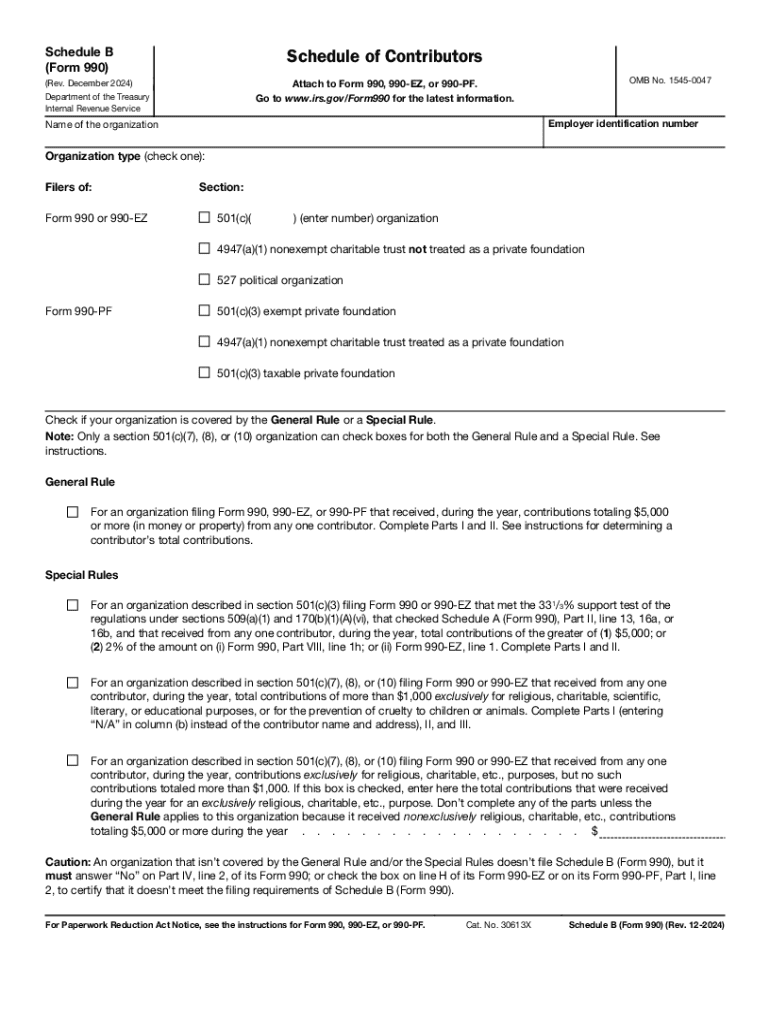

The IRS Form 990-EZ is a streamlined version of the standard Form 990, designed for smaller tax-exempt organizations with gross receipts under $200,000 and total assets under $500,000. It serves as an annual information return that provides the IRS and the public with financial information about the organization. Understanding the IRS guidelines for this form is crucial for compliance and transparency.

Organizations must ensure they accurately report their revenues, expenses, and net assets. The form requires detailed information about the organization’s mission, activities, and governance. Proper adherence to these guidelines helps maintain tax-exempt status and avoids penalties.

Filing Deadlines for Form 990-EZ

Timely filing of Form 990-EZ is essential to avoid penalties. The form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations that follow the calendar year, this typically means a deadline of May 15. Extensions may be requested, but they must be filed before the original deadline.

Failure to file on time can result in significant penalties, including a fine of $20 per day, up to a maximum of $10,000. Organizations should keep track of these deadlines to ensure compliance and avoid unnecessary fees.

Required Documents for Form 990-EZ

To complete Form 990-EZ, organizations must gather several key documents. These include financial statements, a list of board members, and records of contributions received. Accurate financial records are vital, as they support the figures reported on the form.

Additionally, organizations should have documentation of any grants or contracts and any relevant correspondence with the IRS. Having these documents readily available can streamline the filing process and ensure accuracy.

Steps to Complete Form 990-EZ Online

Completing Form 990-EZ online can simplify the filing process. Organizations should start by gathering all necessary documentation. Next, access the form through a reliable online platform that supports e-signatures and secure submission.

Fill out the form by entering the required information in each section, ensuring accuracy. Review the completed form for any errors or omissions before submitting it electronically. Finally, retain a copy of the submitted form for your records.

Penalties for Non-Compliance with Form 990-EZ

Non-compliance with Form 990-EZ can lead to significant penalties. Organizations that fail to file the form, file late, or provide inaccurate information may face fines. The IRS imposes a penalty of $20 per day for late filings, with a maximum penalty of $10,000.

In cases of willful neglect, penalties can be even more severe. Maintaining compliance is essential to avoid these financial repercussions and to uphold the organization’s tax-exempt status.

Digital vs. Paper Version of Form 990-EZ

Organizations have the option to file Form 990-EZ either digitally or via paper submission. The digital version offers several advantages, including faster processing times and immediate confirmation of receipt. Additionally, online filing often includes built-in checks for common errors, reducing the likelihood of mistakes.

On the other hand, some organizations may prefer paper filing for various reasons, including familiarity or lack of access to technology. Regardless of the method chosen, it is important to ensure that the form is completed accurately and submitted on time.

Create this form in 5 minutes or less

Find and fill out the correct regulations under sections 509a1 and 170b1avi that checked schedule a form 990 part ii line 13 16a or

Create this form in 5 minutes!

How to create an eSignature for the regulations under sections 509a1 and 170b1avi that checked schedule a form 990 part ii line 13 16a or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 990 EZ and how can I complete it online?

The IRS Form 990 EZ is a streamlined version of the standard Form 990, designed for smaller tax-exempt organizations. You can complete the IRS Form 990 EZ online using airSlate SignNow, which provides an easy-to-use platform for filling out and eSigning your documents securely.

-

How does airSlate SignNow simplify the process of filing IRS Form 990 EZ online?

airSlate SignNow simplifies the filing of IRS Form 990 EZ online by offering a user-friendly interface that guides you through each step. With features like templates and eSignature capabilities, you can efficiently complete and submit your form without any hassle.

-

What are the pricing options for using airSlate SignNow to file IRS Form 990 EZ online?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, ensuring you have access to all the necessary features for filing IRS Form 990 EZ online at a cost-effective rate.

-

Are there any integrations available with airSlate SignNow for IRS Form 990 EZ online?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when filing IRS Form 990 EZ online. You can connect with popular tools like Google Drive, Dropbox, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for IRS Form 990 EZ online?

Using airSlate SignNow for IRS Form 990 EZ online offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are stored safely and can be accessed anytime, making the filing process much more convenient.

-

Is it safe to eSign IRS Form 990 EZ online with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your data when eSigning IRS Form 990 EZ online. You can trust that your sensitive information is secure throughout the entire process.

-

Can I track the status of my IRS Form 990 EZ online submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your IRS Form 990 EZ online submission. You will receive notifications and updates, ensuring you are informed every step of the way.

Get more for Regulations Under Sections 509a1 And 170b1Avi, That Checked Schedule A Form 990, Part II, Line 13, 16a, Or

- Tin 1 application form download

- Iosh test exam papers with answers form

- Ration dealer application form

- Your phone could ruin your life form

- Goose creek police department ride along form

- Nyc buildings form pw2fill out and use this pdf

- Cleveland heights university heights city school district property owner affidavit o form

- Fhs athletic packet attention all athletes must h form

Find out other Regulations Under Sections 509a1 And 170b1Avi, That Checked Schedule A Form 990, Part II, Line 13, 16a, Or

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement