Greater Kansas City Community Foundation Form 990 Tax Year Public 2012

What is the Greater Kansas City Community Foundation Form 990 Tax Year Public

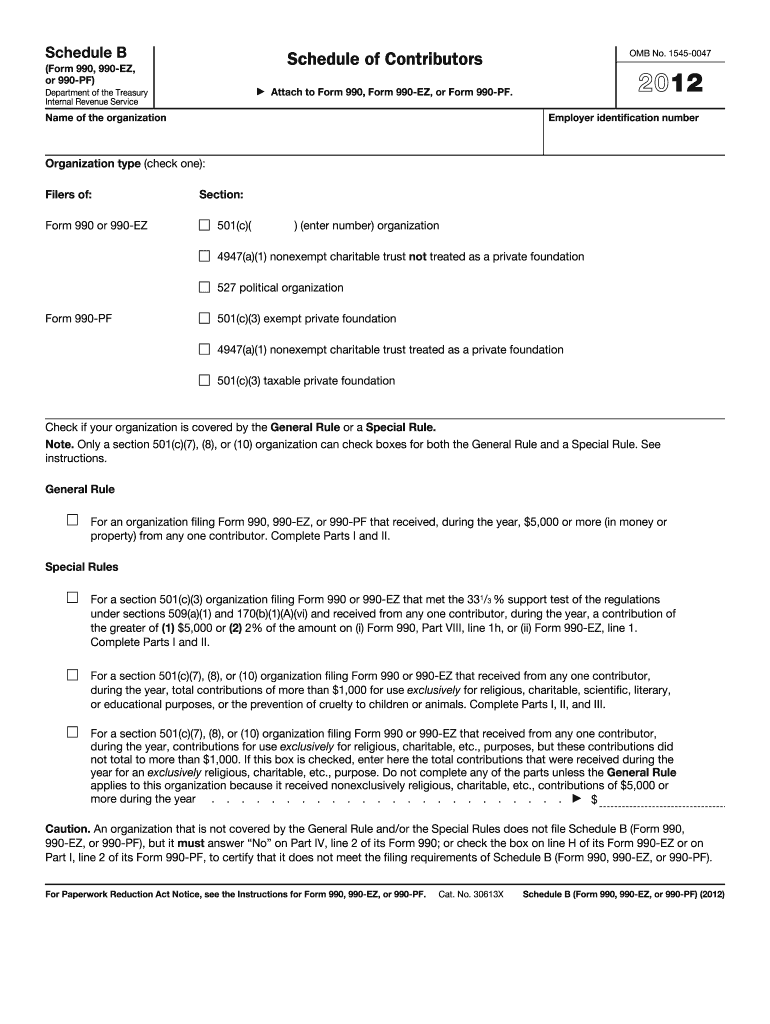

The Greater Kansas City Community Foundation Form 990 Tax Year Public is a tax document that provides detailed financial information about the foundation's operations during a specific tax year. This form is essential for transparency and accountability, as it outlines the foundation's revenue, expenses, and activities. Nonprofit organizations, including community foundations, are required to file Form 990 with the Internal Revenue Service (IRS) annually. This form helps the public understand how funds are utilized and supports informed decision-making for donors and stakeholders.

How to use the Greater Kansas City Community Foundation Form 990 Tax Year Public

Using the Greater Kansas City Community Foundation Form 990 Tax Year Public involves several steps to ensure accurate completion and compliance with IRS regulations. First, gather all necessary financial documents, including income statements and expense reports. Next, review the form's sections, which include details on revenue sources, program expenses, and administrative costs. Each section must be filled out with precise figures to reflect the foundation's financial activities accurately. Once completed, the form should be submitted to the IRS and made available for public access, ensuring transparency.

Steps to complete the Greater Kansas City Community Foundation Form 990 Tax Year Public

Completing the Greater Kansas City Community Foundation Form 990 requires a systematic approach. Begin by collecting financial records for the tax year in question. Follow these steps:

- Fill out the foundation's basic information, including name, address, and EIN (Employer Identification Number).

- Report total revenue, including contributions and grants received.

- Detail expenses, categorizing them into program services, management, and fundraising.

- Include information about the foundation's governance, including board members and their compensation.

- Review the completed form for accuracy and compliance with IRS guidelines.

Legal use of the Greater Kansas City Community Foundation Form 990 Tax Year Public

The legal use of the Greater Kansas City Community Foundation Form 990 Tax Year Public is crucial for maintaining compliance with federal and state regulations. Nonprofits are legally obligated to file this form annually, ensuring that their financial practices align with IRS requirements. The information provided in the form must be truthful and reflective of the foundation's financial status. Failure to comply with these legal obligations can result in penalties, including fines and loss of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the Greater Kansas City Community Foundation Form 990 are critical for compliance. Generally, the form must be submitted by the 15th day of the fifth month after the end of the foundation's fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid penalties. Keeping track of these important dates helps ensure timely submission and adherence to legal requirements.

Form Submission Methods (Online / Mail / In-Person)

The Greater Kansas City Community Foundation Form 990 can be submitted through various methods, accommodating different preferences and needs. Organizations may choose to file online using the IRS e-file system, which offers a streamlined process and quicker confirmation of receipt. Alternatively, the form can be mailed directly to the IRS, ensuring it is sent well before the deadline to avoid delays. In-person submissions are not typically available for Form 990, making online and mail options the most practical solutions for compliance.

Quick guide on how to complete greater kansas city community foundation form 990 tax year public

Effortlessly Prepare Greater Kansas City Community Foundation Form 990 Tax Year Public on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and seamlessly. Manage Greater Kansas City Community Foundation Form 990 Tax Year Public on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Edit and eSign Greater Kansas City Community Foundation Form 990 Tax Year Public with Ease

- Obtain Greater Kansas City Community Foundation Form 990 Tax Year Public and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Greater Kansas City Community Foundation Form 990 Tax Year Public and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct greater kansas city community foundation form 990 tax year public

Create this form in 5 minutes!

How to create an eSignature for the greater kansas city community foundation form 990 tax year public

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Greater Kansas City Community Foundation Form 990 Tax Year Public?

The Greater Kansas City Community Foundation Form 990 Tax Year Public is a financial document that nonprofit organizations must file annually, disclosing their financial status, governance, and program activities. This form provides transparency and accountability, allowing donors and stakeholders to understand the organization’s financial health and operations.

-

How does airSlate SignNow help in managing the Greater Kansas City Community Foundation Form 990 Tax Year Public?

airSlate SignNow streamlines the process of managing the Greater Kansas City Community Foundation Form 990 Tax Year Public by simplifying document preparation, eSigning, and sharing. With our platform, users can easily create, edit, and securely send their Form 990, ensuring compliance and timely submissions.

-

What are the benefits of using airSlate SignNow for the Greater Kansas City Community Foundation Form 990 Tax Year Public?

Using airSlate SignNow for the Greater Kansas City Community Foundation Form 990 Tax Year Public offers several benefits, including increased efficiency in document workflows, reduced time in obtaining signatures, and improved collaboration among teams. Our platform also ensures that your form is secure and accessible from anywhere.

-

Is airSlate SignNow cost-effective for nonprofits filing the Greater Kansas City Community Foundation Form 990 Tax Year Public?

Yes, airSlate SignNow provides a cost-effective solution for nonprofits to manage their Greater Kansas City Community Foundation Form 990 Tax Year Public. Our flexible pricing plans are designed to accommodate organizations of all sizes, ensuring that you only pay for the features you need.

-

Can airSlate SignNow integrate with other software for managing the Greater Kansas City Community Foundation Form 990 Tax Year Public?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and nonprofit management software, making it easier to manage the Greater Kansas City Community Foundation Form 990 Tax Year Public alongside your other financial documents. This integration allows for a smoother workflow and better data accuracy.

-

What features does airSlate SignNow offer for the Greater Kansas City Community Foundation Form 990 Tax Year Public?

airSlate SignNow offers key features for the Greater Kansas City Community Foundation Form 990 Tax Year Public, including customizable templates, secure eSigning, real-time tracking, and automated reminders. These features enhance the efficiency and accuracy of your document management process.

-

How can I ensure my Greater Kansas City Community Foundation Form 990 Tax Year Public is compliant?

To ensure your Greater Kansas City Community Foundation Form 990 Tax Year Public is compliant, use airSlate SignNow's guided templates and compliance tools. Our platform is designed to help you adhere to regulatory requirements, providing you with peace of mind as you manage your documentation.

Get more for Greater Kansas City Community Foundation Form 990 Tax Year Public

- Secured promissory note with monthly installment payments kansas form

- Kansas estate contract form

- Commercial mortgage and security agreement kansas form

- Bill of sale of automobile and odometer statement kansas form

- Bill of sale for automobile or vehicle including odometer statement and promissory note kansas form

- Promissory note in connection with sale of vehicle or automobile kansas form

- Bill of sale for watercraft or boat kansas form

- Kansas as is form

Find out other Greater Kansas City Community Foundation Form 990 Tax Year Public

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors