Apps Irs Govglobalmedia4491othertaxesOther Taxes IRS Tax Forms 2021

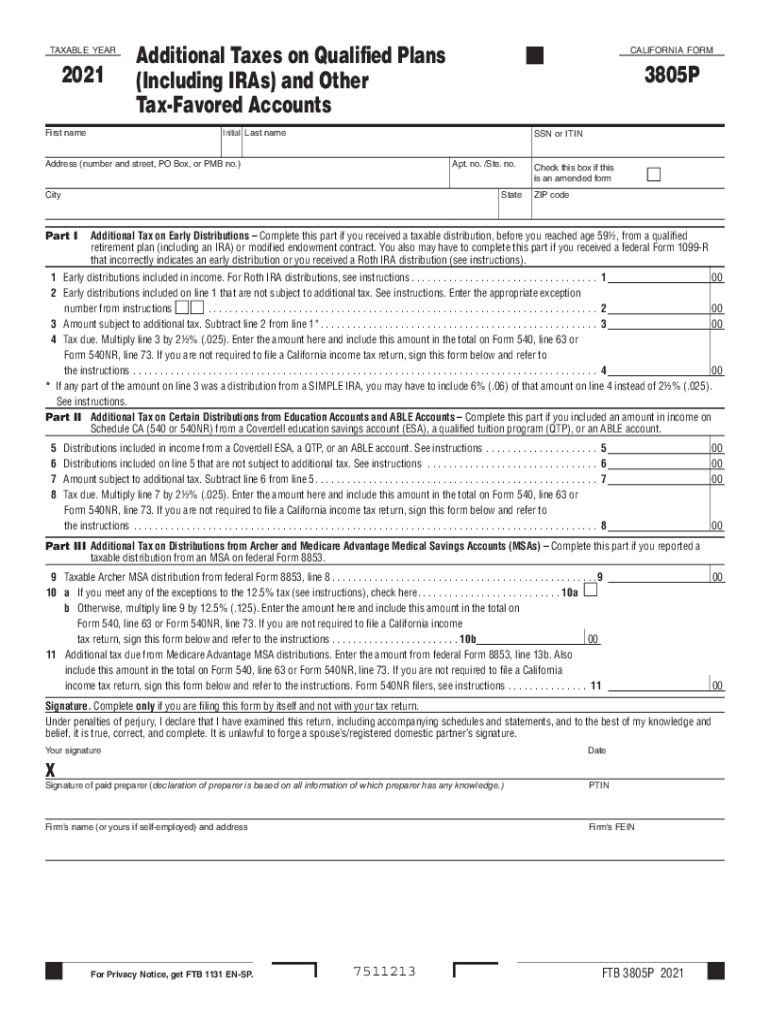

Understanding the California 3805P Form

The California 3805P form is a crucial document for taxpayers who wish to manage their Individual Retirement Accounts (IRAs) effectively. This form is specifically designed for California residents and is used to report contributions to a California qualified tax plan. Understanding its purpose and requirements is essential for ensuring compliance with state tax regulations.

Steps to Complete the California 3805P Form

Completing the California 3805P form involves several key steps:

- Gather necessary information, including your personal details and IRA account information.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring that all information is complete and correct.

- Review your entries for any errors or omissions before submission.

- Submit the completed form either electronically or by mail, following the specified guidelines.

Legal Use of the California 3805P Form

The California 3805P form is legally binding when completed correctly. To ensure its validity, it must meet the requirements set forth by California tax laws. This includes obtaining the necessary signatures and ensuring that the information provided is truthful and accurate. Utilizing a reliable electronic signature tool can further enhance the form's legal standing.

Filing Deadlines for the California 3805P Form

It is important to be aware of the filing deadlines associated with the California 3805P form. Typically, this form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, if you are filing for an extension, ensure that you adhere to the extended deadline to avoid penalties.

Required Documents for the California 3805P Form

When preparing to complete the California 3805P form, certain documents may be required. These include:

- Proof of IRA contributions.

- Personal identification information, such as your Social Security number.

- Any relevant tax documents that support your claims.

Common Penalties for Non-Compliance

Failure to comply with the requirements of the California 3805P form can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure that the form is filled out accurately and submitted on time to avoid these consequences.

Quick guide on how to complete appsirsgovglobalmedia4491othertaxesother taxes irs tax forms

Prepare Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork since you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms with ease

- Locate Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Annotate relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct appsirsgovglobalmedia4491othertaxesother taxes irs tax forms

Create this form in 5 minutes!

People also ask

-

What is form 3805p and how does it work with airSlate SignNow?

Form 3805p is a vital tax form used in California for personal income tax purposes. With airSlate SignNow, you can easily create, send, and eSign this form digitally, simplifying the submission process and ensuring compliance. Our platform streamlines the workflow, making it simple to manage your tax documentation from anywhere.

-

How can I integrate form 3805p into my current workflow?

Integrating form 3805p with airSlate SignNow is easy! Our platform offers seamless integration with various applications and tools that businesses commonly use. You can sync your existing systems with airSlate SignNow to ensure that the creation and tracking of form 3805p is fully automated, saving you valuable time.

-

What are the pricing options for using airSlate SignNow to manage form 3805p?

AirSlate SignNow offers a variety of pricing plans tailored to different business needs, including options for individuals, small businesses, and enterprises. Our plans provide cost-effective solutions for managing documents like form 3805p, with features that grow alongside your business. Visit our pricing page to find the plan that best fits your requirements.

-

Can I collaborate with my team on form 3805p using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate on form 3805p in real-time. You can share documents, track changes, and provide feedback directly within the platform, ensuring that your team can efficiently work together, regardless of their location.

-

What security measures does airSlate SignNow use for form 3805p?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to protect your sensitive documents, including form 3805p. Our platform is compliant with industry standards to ensure that your data remains confidential and secure during all transactions.

-

Is it easy to eSign form 3805p with airSlate SignNow?

Yes, eSigning form 3805p with airSlate SignNow is incredibly easy and intuitive. Users can simply upload the document, add the necessary signers, and send it off for eSignature in just a few clicks. Our user-friendly interface ensures that everyone, regardless of technical skill, can complete the signing process with ease.

-

What are the benefits of using airSlate SignNow for form 3805p?

Using airSlate SignNow for form 3805p provides numerous benefits, including increased efficiency, reduced paper usage, and improved compliance. Our platform accelerates the document workflow, allowing you to focus on more important tasks while we handle the paperwork. Additionally, our powerful tracking features help you stay organized and informed throughout the process.

Get more for Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms

- Ohio warranty deed form

- Limited warranty deed from individual to husband and wife ohio form

- General warranty deed from individual to a trust ohio form

- General warranty deed from husband and wife to a trust ohio form

- General warranty deed from husband to himself and wife ohio form

- Quitclaim deed from husband to himself and wife ohio form

- Ohio husband wife 497322129 form

- Quitclaim deed from husband and wife to husband and wife ohio form

Find out other Apps irs govglobalmedia4491othertaxesOther Taxes IRS Tax Forms

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online