Form 3805P Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts 2024-2026

Understanding the 2024 Qualified Form

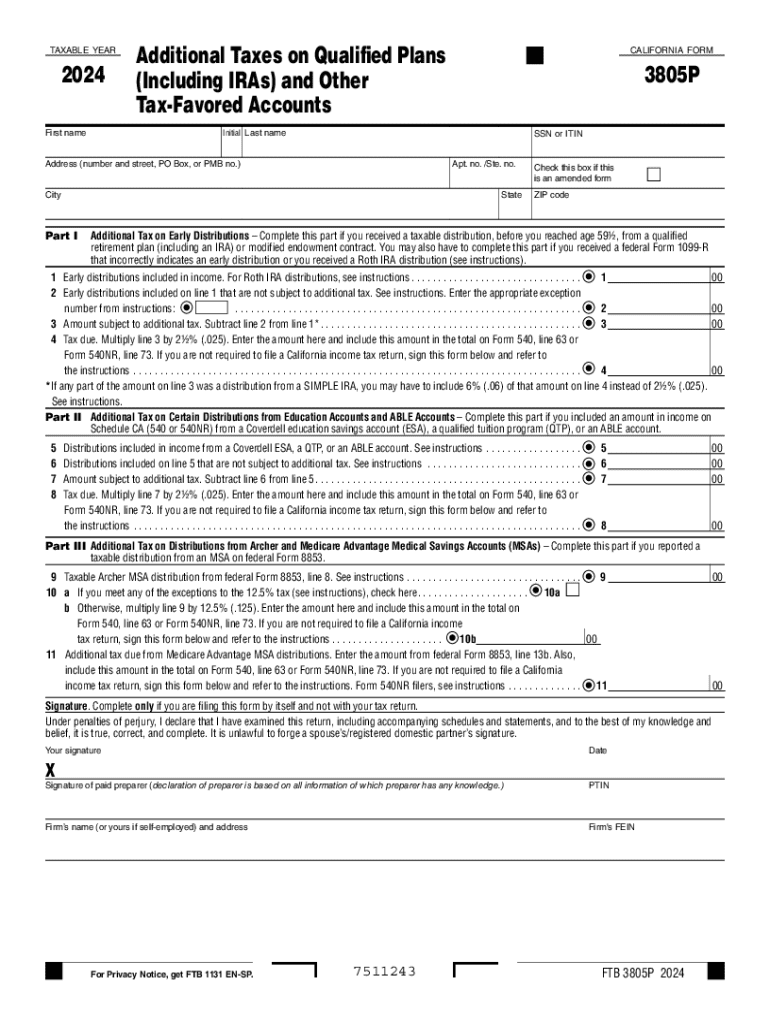

The 2024 qualified form, specifically the Form 3805P, is essential for reporting additional taxes on qualified plans, including IRAs and other tax-favored accounts. This form is particularly relevant for California taxpayers who need to disclose any additional taxes incurred from early withdrawals or other disqualifying distributions from their retirement accounts. Understanding this form is crucial for compliance with state tax regulations and to avoid potential penalties.

Steps to Complete the Form 3805P

Completing the Form 3805P involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your qualified plans, such as withdrawal statements and previous tax returns. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report the amounts of any additional taxes incurred due to early distributions. Finally, review the form for any errors before submission to ensure all information is accurate and complete.

Legal Use of the Form 3805P

The Form 3805P is legally required for California residents who have taken early distributions from their qualified plans. It serves as a declaration of any additional taxes owed to the state. Failure to file this form can result in penalties and interest on unpaid taxes. It is important to file the form accurately and on time to adhere to California tax laws and regulations.

Filing Deadlines and Important Dates

For the 2024 tax year, the deadline for submitting the Form 3805P typically aligns with the federal tax filing deadline, which is usually April 15. However, if you are filing for an extension, ensure that you submit the form by the extended deadline. Mark your calendar for these important dates to avoid any late fees or penalties associated with non-compliance.

Obtaining the Form 3805P

The Form 3805P can be obtained from the California Franchise Tax Board's official website or through various tax preparation software that supports California tax forms. It is advisable to ensure you have the most current version of the form for the 2024 tax year to avoid any issues during filing. Additionally, you may request a physical copy from the Franchise Tax Board if needed.

Examples of Using the Form 3805P

Common scenarios for using the Form 3805P include situations where individuals withdraw funds from their IRAs before reaching the age of fifty-nine and a half. For instance, if a taxpayer withdraws $10,000 from their IRA for a home purchase, they may incur additional taxes that must be reported on this form. Another example includes early withdrawals for medical expenses or education costs, where the taxpayer must calculate the additional tax owed based on the amount withdrawn.

Create this form in 5 minutes or less

Find and fill out the correct form 3805p additional taxes on qualified plans including iras and other tax favored accounts

Create this form in 5 minutes!

How to create an eSignature for the form 3805p additional taxes on qualified plans including iras and other tax favored accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2024 qualified form?

A 2024 qualified form is a document designed to meet specific regulatory requirements for the year 2024. It ensures that businesses comply with the latest standards while streamlining their documentation processes. Using airSlate SignNow, you can easily create and manage these forms for your organization.

-

How can airSlate SignNow help with 2024 qualified forms?

airSlate SignNow provides a user-friendly platform to create, send, and eSign 2024 qualified forms efficiently. Our solution simplifies the process, allowing you to focus on your business while ensuring compliance with the latest regulations. With customizable templates, you can tailor forms to meet your specific needs.

-

What are the pricing options for using airSlate SignNow for 2024 qualified forms?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need basic features or advanced functionalities for managing 2024 qualified forms, we have a plan that fits your budget. Visit our pricing page for detailed information on each plan.

-

Are there any integrations available for managing 2024 qualified forms?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for 2024 qualified forms. You can connect with popular tools like Google Drive, Salesforce, and more, ensuring that your document management process is streamlined and efficient. These integrations help you save time and reduce errors.

-

What are the benefits of using airSlate SignNow for 2024 qualified forms?

Using airSlate SignNow for 2024 qualified forms offers numerous benefits, including improved efficiency, enhanced security, and compliance with regulatory standards. Our platform allows for quick eSigning and document tracking, ensuring that your forms are processed without delays. This leads to faster turnaround times and better customer satisfaction.

-

Can I customize my 2024 qualified forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your 2024 qualified forms to suit your business needs. You can add your branding, modify fields, and create templates that reflect your organization's requirements. This flexibility ensures that your forms are not only compliant but also aligned with your brand identity.

-

Is there a mobile app for managing 2024 qualified forms?

Yes, airSlate SignNow offers a mobile app that enables you to manage your 2024 qualified forms on the go. With the app, you can send, sign, and track documents from your smartphone or tablet, ensuring that you never miss an important task. This mobility enhances your productivity and keeps your business running smoothly.

Get more for Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts

- Elite soccer academy form

- Power of attorney illinois pdf form

- Mva 47d flag form

- How to write up records for small business form

- Medical history form 459510659

- Coag sense ptinr test strip shipment qc log sheet form

- Corp 56 registration of fictitious name sos mo form

- Voluntary employment separation agreement template form

Find out other Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT