Form 3805P Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts , Form 3805P, Additional Taxes on Q 2023

Understanding Form 3805P

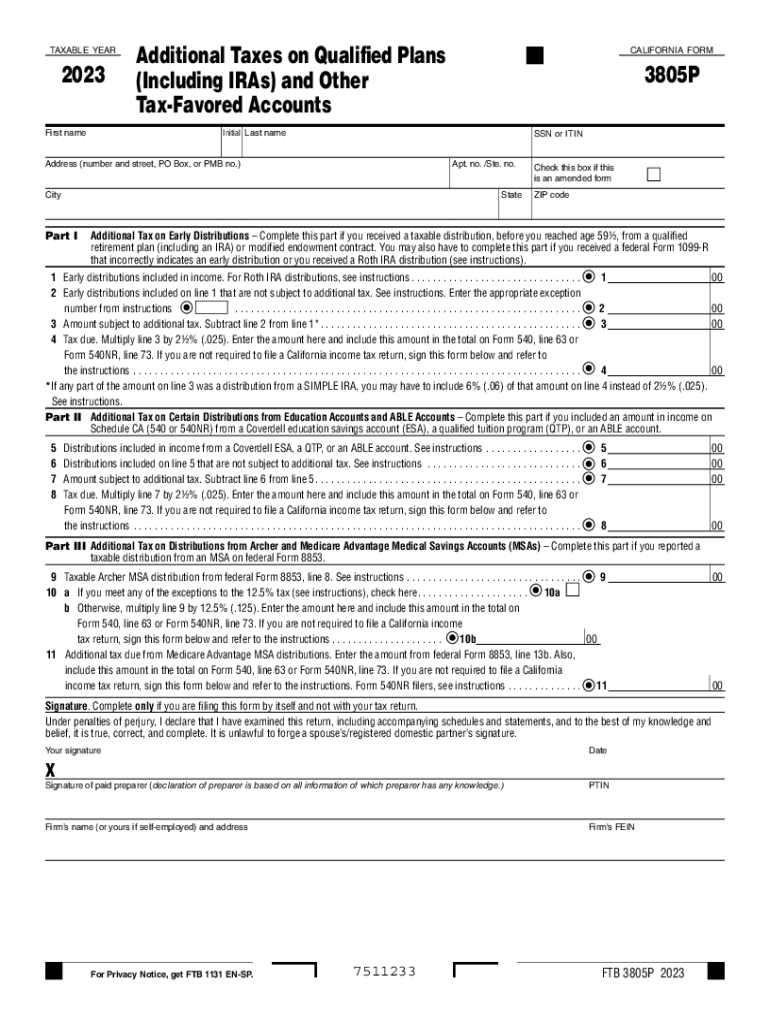

Form 3805P is a tax form used in California to report additional taxes on qualified plans, including Individual Retirement Accounts (IRAs) and other tax-favored accounts. This form is essential for taxpayers who have taken distributions from these accounts and need to report any additional taxes owed due to early withdrawals or other specific situations. The form ensures compliance with California tax regulations and helps taxpayers accurately calculate their tax liabilities.

Steps to Complete Form 3805P

Completing Form 3805P involves several key steps:

- Gather necessary documentation, including your tax returns and details of any distributions taken from your qualified plans.

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report the total distributions from your qualified plans in the designated section.

- Calculate any additional taxes owed based on the instructions provided with the form.

- Review your completed form for accuracy before submission.

Obtaining Form 3805P

To obtain Form 3805P, taxpayers can visit the California Franchise Tax Board (FTB) website or request a physical copy by contacting the FTB directly. The form is typically available for download in PDF format, allowing for easy access and printing. Ensure you have the most current version of the form to comply with the latest tax regulations.

Legal Use of Form 3805P

Form 3805P is legally required for California residents who have taken distributions from qualified plans and need to report any additional taxes. It is crucial for taxpayers to understand the legal implications of not filing this form when required, as it may result in penalties or additional interest on unpaid taxes. Compliance with state tax laws is essential to avoid complications with the California tax authorities.

Key Elements of Form 3805P

The key elements of Form 3805P include sections for personal information, details of distributions, calculations of additional taxes, and instructions for filing. Each section is designed to capture specific information necessary for accurate tax reporting. Understanding these elements helps taxpayers complete the form correctly and ensures they meet their tax obligations.

Filing Deadlines for Form 3805P

Taxpayers must be aware of the filing deadlines associated with Form 3805P. Generally, the form must be submitted along with your California tax return by the due date, which is typically April 15 for most individuals. If you require an extension for your tax return, ensure that Form 3805P is also submitted by the extended deadline to avoid penalties.

Quick guide on how to complete form 3805p additional taxes on qualified plans including iras and other tax favored accounts form 3805p additional taxes on

Complete Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can locate the appropriate template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q on any platform with the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q effortlessly

- Acquire Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3805p additional taxes on qualified plans including iras and other tax favored accounts form 3805p additional taxes on

Create this form in 5 minutes!

How to create an eSignature for the form 3805p additional taxes on qualified plans including iras and other tax favored accounts form 3805p additional taxes on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3805p?

Form 3805p is a specific document used in various business processes. It serves to facilitate transactions and improve efficiency through digital signing. Understanding how to utilize form 3805p effectively can greatly streamline workflows.

-

How does airSlate SignNow support form 3805p?

airSlate SignNow provides a robust platform for businesses to easily send, complete, and eSign form 3805p. The intuitive interface allows for quick setup and seamless communication between parties involved. With airSlate SignNow, managing form 3805p becomes more efficient.

-

Is there a cost associated with using airSlate SignNow for form 3805p?

Yes, there are different pricing plans available for airSlate SignNow that cater to various business needs. Depending on your requirements, you can choose a plan that allows unlimited access to features for managing form 3805p and other documents. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing form 3805p?

AirSlate SignNow offers various features, such as templates, automated workflows, and real-time tracking for form 3805p. These tools simplify the eSigning process and ensure that your documents are completed promptly. You'll also benefit from secure storage options for all your forms.

-

Can I integrate airSlate SignNow with other software for handling form 3805p?

Absolutely! airSlate SignNow supports integrations with numerous third-party applications, making it easy to incorporate form 3805p into your existing workflow. This means you can connect to CRM systems, cloud storage services, and more to enhance your document management processes.

-

What are the benefits of using airSlate SignNow for form 3805p?

Using airSlate SignNow for form 3805p offers signNow benefits such as increased efficiency, security, and collaboration. With digital signing, you reduce the turnaround time for transactions. Additionally, you can track the status of your documents and ensure compliance effortlessly.

-

How secure is my data when using airSlate SignNow for form 3805p?

AirSlate SignNow prioritizes data security and complies with industry standards to protect your information. When using form 3805p on our platform, your documents are encrypted and stored securely. This ensures that only authorized individuals can access sensitive data.

Get more for Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q

Find out other Form 3805P Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts , Form 3805P, Additional Taxes On Q

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template