Other Taxes Internal Revenue Service 2020

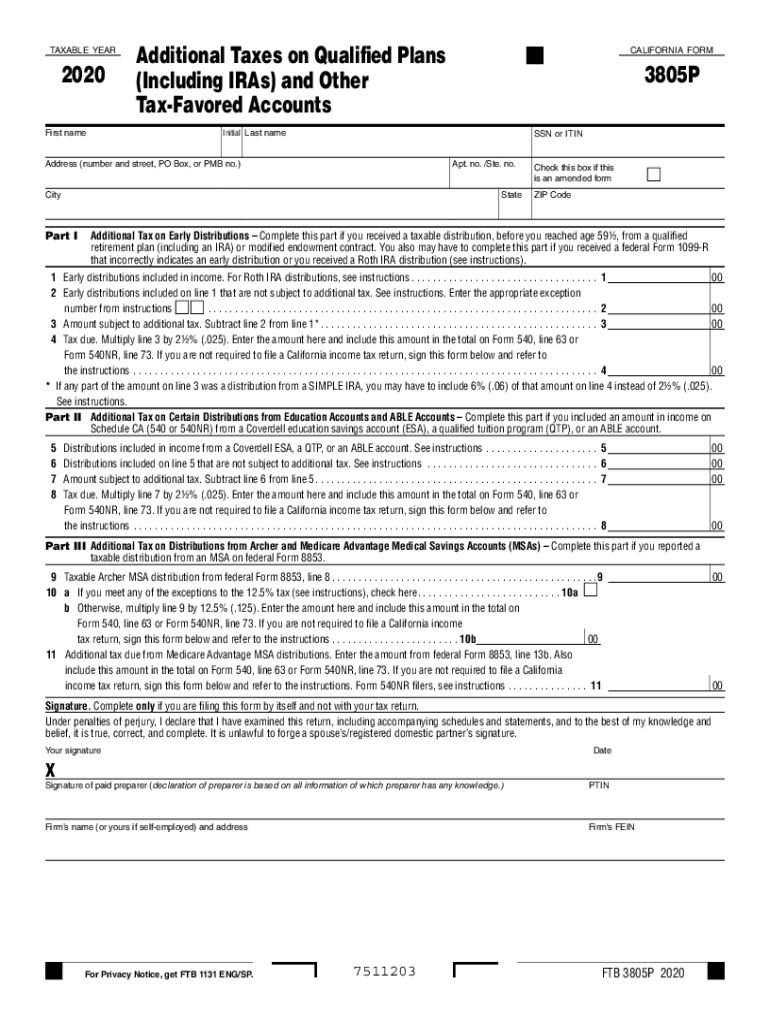

Understanding the 3805p Tax Form

The 3805p form, also known as the California IRA form, is essential for individuals who are looking to take advantage of tax-favored accounts in California. This form is specifically designed for reporting contributions and distributions from individual retirement accounts (IRAs) that qualify for state tax benefits. Understanding the requirements and proper usage of the 3805p is crucial for compliance and to maximize your tax advantages.

Steps to Complete the 3805p Tax Form

Completing the 3805p form involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary financial documents related to your IRA contributions and distributions. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Carefully report the amounts contributed to your IRA and any distributions taken during the tax year. Review your entries for accuracy before submitting the form.

Legal Use of the 3805p Tax Form

The 3805p form is legally recognized under California tax law, allowing individuals to report their IRA contributions and distributions accurately. To ensure the form's validity, it must be completed in accordance with the guidelines set forth by the California Franchise Tax Board. This includes adhering to deadlines and providing truthful information, as any discrepancies could lead to penalties or legal issues.

Filing Deadlines for the 3805p Tax Form

Filing the 3805p form is subject to specific deadlines that align with California's tax filing schedule. Typically, the form must be submitted by the same deadline as your state income tax return. It is essential to stay informed about any changes to these deadlines to avoid late fees or penalties. Keeping track of these dates can help ensure that you remain compliant and avoid complications with your tax filings.

Required Documents for the 3805p Tax Form

To complete the 3805p form accurately, certain documents are required. These may include your previous year’s tax return, records of IRA contributions, and any statements from your financial institution regarding your IRA account. Having these documents readily available will facilitate the completion of the form and help ensure that all information reported is accurate and complete.

IRS Guidelines for the 3805p Tax Form

The IRS provides specific guidelines that govern the use of the 3805p form. It is important to familiarize yourself with these guidelines to ensure compliance with federal tax laws as well. This includes understanding the eligibility criteria for tax-favored treatment of IRA contributions and the implications of distributions. Adhering to these guidelines can help you maximize your tax benefits while ensuring that you meet all legal requirements.

Quick guide on how to complete other taxes internal revenue service

Complete Other Taxes Internal Revenue Service seamlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary forms and safely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Other Taxes Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and electronically sign Other Taxes Internal Revenue Service with ease

- Locate Other Taxes Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tiresome form browsing, or mistakes that require new document copies to be printed. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign Other Taxes Internal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct other taxes internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the other taxes internal revenue service

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the airSlate SignNow 3805p solution?

The airSlate SignNow 3805p solution is designed to streamline document signing and management for businesses. This easy-to-use platform allows users to send, eSign, and track documents efficiently, ensuring quick turnaround times.

-

How much does the airSlate SignNow 3805p service cost?

Pricing for the airSlate SignNow 3805p service is competitive and focuses on delivering value for businesses of all sizes. Various plans are available, so you can choose the one that best fits your company's needs and budget.

-

What features are offered with the airSlate SignNow 3805p solution?

The airSlate SignNow 3805p solution includes features such as reusable templates, advanced security measures, and real-time tracking. These functionalities empower users to enhance document processes while ensuring compliance and security.

-

Is airSlate SignNow 3805p suitable for small businesses?

Absolutely! The airSlate SignNow 3805p solution is particularly beneficial for small businesses looking for an affordable and efficient way to manage document signing. Its user-friendly interface makes it easy for teams to adopt and integrate into daily operations.

-

How can I integrate airSlate SignNow 3805p with other software?

The airSlate SignNow 3805p offers seamless integration options with popular software like CRM systems, project management tools, and cloud storage services. This enhances workflow efficiency and ensures that document management fits into your existing tech stack.

-

What benefits does the airSlate SignNow 3805p solution provide?

The primary benefits of the airSlate SignNow 3805p solution include increased efficiency, reduced turnaround times for documents, and enhanced security for signed agreements. These advantages empower teams to focus on their core business operations without delays.

-

Can I try airSlate SignNow 3805p before committing to a subscription?

Yes, airSlate SignNow offers a free trial for the 3805p solution, allowing potential customers to explore its features and functionality. This trial provides a risk-free opportunity to experience how it can enhance your document workflow.

Get more for Other Taxes Internal Revenue Service

Find out other Other Taxes Internal Revenue Service

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed