IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin 2022

What is the IRS Form W-12?

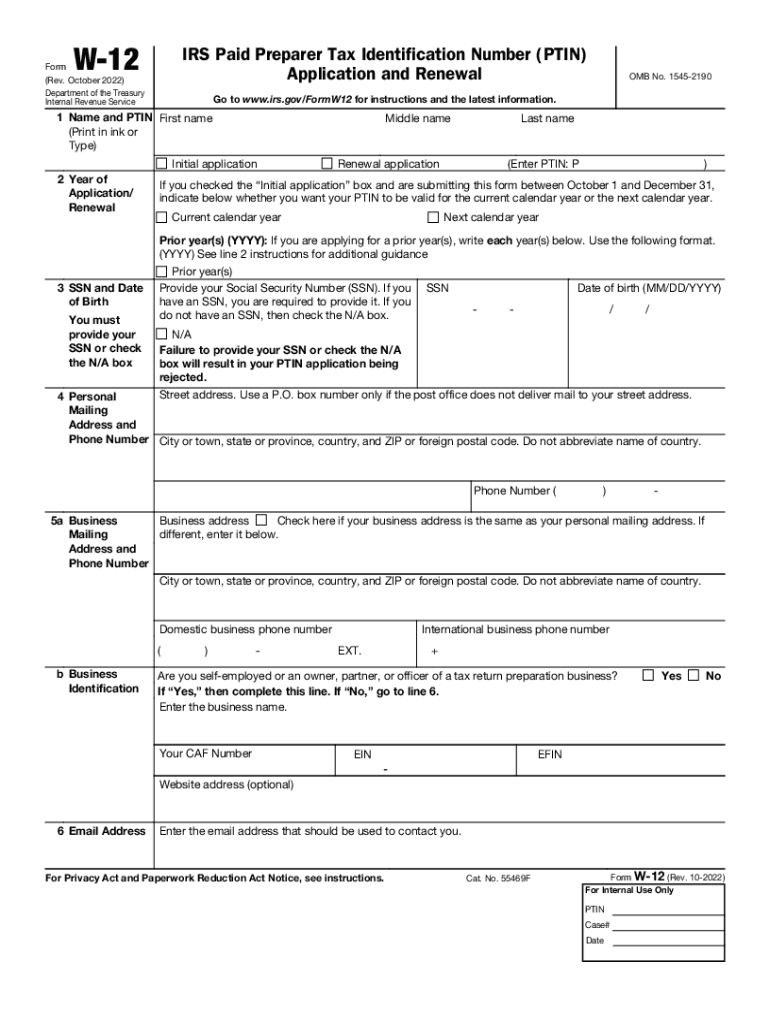

The IRS Form W-12, also known as the IRS Paid Preparer Tax Identification Number (PTIN), is a crucial document for tax professionals in the United States. This form allows paid tax preparers to obtain a PTIN, which is necessary for anyone who prepares or assists in preparing federal tax returns for compensation. The PTIN serves as a unique identifier for tax preparers and ensures they are recognized by the IRS as qualified professionals. This identification is essential for maintaining compliance with IRS regulations and providing a level of accountability in the tax preparation industry.

How to Obtain the IRS Form W-12

To obtain the IRS Form W-12, individuals must complete an application process that can be done online or by mail. The online application is typically faster and allows for immediate processing. Applicants need to provide personal information, including their Social Security number, and may need to answer questions regarding their tax preparation experience. Once the application is submitted, the IRS will review it and issue a PTIN if all requirements are met. It is important to keep the PTIN renewed annually to remain compliant with IRS regulations.

Steps to Complete the IRS Form W-12

Completing the IRS Form W-12 involves several key steps:

- Gather necessary personal information, including your Social Security number.

- Visit the IRS website to access the Form W-12 application.

- Fill out the application accurately, ensuring all required fields are completed.

- Submit the form online or print it and send it by mail to the appropriate IRS address.

- Receive your PTIN from the IRS upon approval.

Following these steps carefully will help ensure a smooth application process for obtaining a PTIN.

Legal Use of the IRS Form W-12

The legal use of the IRS Form W-12 is essential for tax preparers who wish to operate within the law. By obtaining a PTIN through this form, tax preparers affirm their compliance with IRS regulations, which require that anyone who prepares tax returns for compensation must have a PTIN. This requirement helps protect taxpayers by ensuring that their returns are handled by qualified professionals. Additionally, using a PTIN can enhance a preparer's credibility and trustworthiness in the eyes of clients.

Filing Deadlines and Important Dates

Understanding the filing deadlines associated with the IRS Form W-12 is crucial for tax preparers. The application for a PTIN should be completed before the tax season begins to ensure that preparers are eligible to file tax returns on behalf of clients. Typically, the IRS opens the PTIN application process in October for the upcoming tax year. It is advisable for preparers to renew their PTINs annually to avoid any interruptions in their ability to prepare tax returns.

Required Documents for the IRS Form W-12

When applying for the IRS Form W-12, applicants must provide specific documentation to verify their identity and qualifications. Required documents may include:

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Personal identification, such as a driver's license or state ID.

- Any previous PTIN, if applicable.

Having these documents ready will facilitate a smoother application process and ensure compliance with IRS requirements.

Quick guide on how to complete irs form w 12 ampquotirs paid preparer tax identification number ptin

Complete IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without delays. Manage IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin with minimal effort

- Find IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin and click Retrieve Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Signature tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Finish button to save your modifications.

- Choose how you would like to submit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form w 12 ampquotirs paid preparer tax identification number ptin

Create this form in 5 minutes!

People also ask

-

What is a PTIN and why do I need it?

A PTIN, or Preparer Tax Identification Number, is essential for tax professionals who prepare or assist in preparing federal tax returns. If you work in an industry that requires filing taxes on behalf of others, having a PTIN ensures you comply with IRS regulations. Using airSlate SignNow, you can securely collect and manage PTINs for your clients' documents.

-

How does airSlate SignNow ensure the security of my PTIN?

airSlate SignNow employs robust security measures, including encryption and secure storage, to protect sensitive information like PTINs. Our platform ensures that data is accessible only to authorized users, so you can confidently manage documents and PTINs without worrying about data bsignNowes. Trust airSlate SignNow for safe eSigning and document management.

-

Can I use airSlate SignNow to share documents that require PTINs?

Yes, airSlate SignNow allows you to easily send and share documents that require PTINs. With user-friendly tools, you can create templates and securely request PTINs from your clients. This streamlines the process, making it more efficient for both you and your clients.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to suit businesses of all sizes. Whether you're an individual tax preparer or part of a large firm, you can choose a plan that fits your needs and budget. Plus, the value you receive includes easy management of crucial documents like those requiring a PTIN.

-

Does airSlate SignNow integrate with other tax software?

Absolutely! airSlate SignNow integrates seamlessly with popular tax software platforms, allowing you to manage PTINs and documents from one centralized location. This integration enhances your workflow, saving time and reducing the need for manual entry. Experience efficiency with airSlate SignNow's connectivity.

-

What features does airSlate SignNow offer for eSigning documents requiring PTINs?

airSlate SignNow offers a variety of features for eSigning, including customizable templates, automated reminders, and secure cloud storage. These tools are particularly useful for handling documents that require a PTIN, ensuring that all necessary information is collected accurately and efficiently. Elevate your document signing experience with airSlate SignNow.

-

Can I automate the collection of PTINs with airSlate SignNow?

Yes, you can automate the collection of PTINs using airSlate SignNow's advanced workflow features. By setting up custom templates and automated requests, you can streamline the process of gathering PTINs from clients with minimal effort. Let airSlate SignNow enhance your efficiency and organizational capabilities.

Get more for IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin

Find out other IRS Form W 12 "IRS Paid Preparer Tax Identification Number Ptin

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form