Instructions for Form W 12 IRS Paid Preparer Tax 2024

What is the Instructions For Form W-12 IRS Paid Preparer Tax

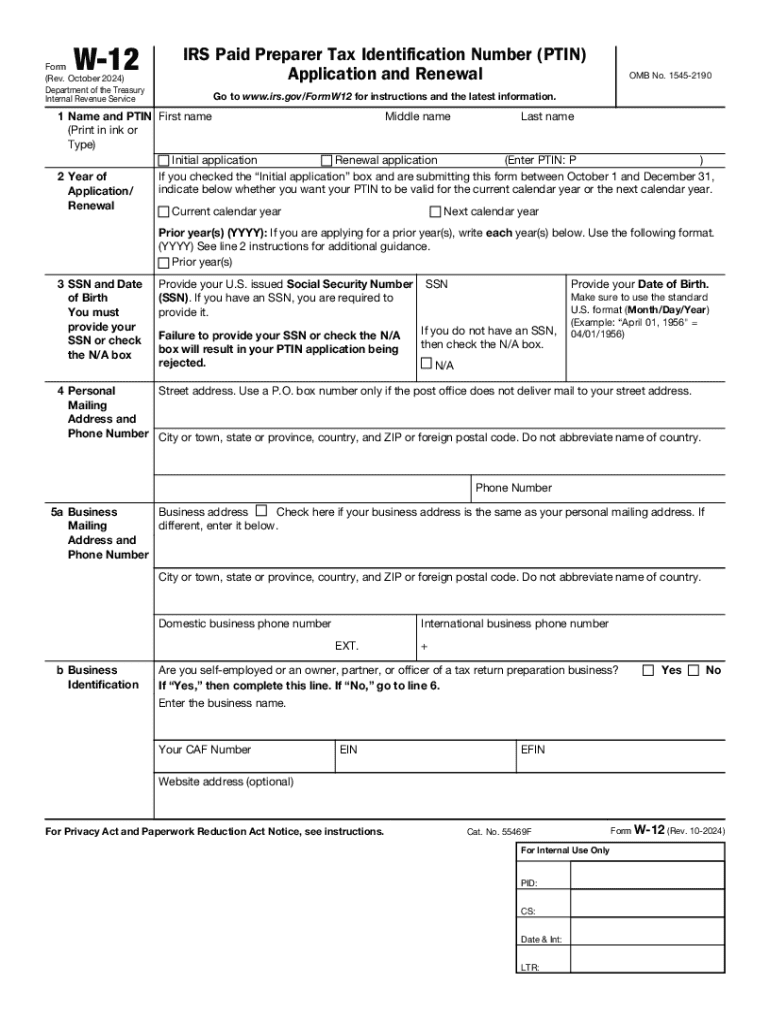

The Instructions for Form W-12 provide essential guidelines for paid preparers who need to apply for or renew their Preparer Tax Identification Number (PTIN). This form is crucial for tax professionals who prepare or assist in preparing federal tax returns for compensation. Understanding these instructions ensures compliance with IRS regulations and helps maintain the integrity of the tax preparation process.

How to use the Instructions For Form W-12 IRS Paid Preparer Tax

To effectively use the Instructions for Form W-12, follow the outlined steps carefully. Begin by reviewing the eligibility criteria to ensure you qualify for a PTIN. Next, gather all necessary documentation, including your Social Security number or Individual Taxpayer Identification Number (ITIN). Complete the form accurately, following each instruction closely to avoid delays in processing. Once completed, submit the form as directed, either online or by mail, depending on your preference.

Steps to complete the Instructions For Form W-12 IRS Paid Preparer Tax

Completing the Instructions for Form W-12 involves several key steps:

- Verify your eligibility to apply for a PTIN.

- Collect required personal information, including your Social Security number.

- Fill out Form W-12 accurately, ensuring all sections are completed.

- Review your application for any errors or omissions.

- Submit the form online through the IRS PTIN system or mail it to the specified address.

Legal use of the Instructions For Form W-12 IRS Paid Preparer Tax

The legal use of the Instructions for Form W-12 is governed by IRS regulations. Tax preparers must adhere to these guidelines to ensure they are compliant with federal law. Using the form correctly helps protect both the preparer and their clients from potential legal issues related to improper tax preparation practices. It is essential to maintain accurate records and follow the instructions to avoid penalties.

Required Documents

When applying for or renewing a PTIN using Form W-12, you must provide specific documents to support your application. These typically include:

- Your Social Security number or ITIN.

- Proof of identity, such as a driver's license or passport.

- Any previous PTINs if applicable.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with Form W-12. The IRS typically requires that all PTIN applications and renewals be completed by December 31 of the year preceding the tax season. Staying informed about these dates helps ensure that tax preparers remain compliant and can continue to serve their clients without interruption.

Handy tips for filling out Instructions For Form W 12 IRS Paid Preparer Tax online

Quick steps to complete and e-sign Instructions For Form W 12 IRS Paid Preparer Tax online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to e-sign and share Instructions For Form W 12 IRS Paid Preparer Tax for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form w 12 irs paid preparer tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for form w 12 irs paid preparer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for irs account login using airSlate SignNow?

To access your IRS account login through airSlate SignNow, simply navigate to the login page and enter your credentials. If you encounter any issues, ensure that your information is correct and that you have a stable internet connection. Our platform is designed to streamline this process for your convenience.

-

Are there any costs associated with using airSlate SignNow for irs account login?

airSlate SignNow offers a variety of pricing plans, including a free trial, allowing you to explore features related to irs account login without any initial investment. Once the trial period ends, you can choose a plan that best fits your business needs. Our pricing is competitive and designed to provide value.

-

What features does airSlate SignNow offer for managing irs account login?

airSlate SignNow provides robust features for managing your irs account login, including secure document storage, eSignature capabilities, and easy sharing options. These features ensure that your sensitive information is protected while allowing for efficient document management. You can also track the status of your documents in real-time.

-

How does airSlate SignNow enhance the security of my irs account login?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and multi-factor authentication to protect your irs account login and sensitive data. Our platform is compliant with industry standards, ensuring that your information remains safe and secure.

-

Can I integrate airSlate SignNow with other applications for my irs account login?

Yes, airSlate SignNow offers seamless integrations with various applications that can enhance your irs account login experience. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect with them to streamline your workflow. This integration capability helps you manage documents more efficiently.

-

What benefits does airSlate SignNow provide for businesses needing irs account login?

Using airSlate SignNow for your irs account login offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our user-friendly interface allows teams to work together seamlessly, ensuring that all necessary documents are signed and submitted on time. This can lead to faster processing of your IRS-related tasks.

-

Is there customer support available for issues related to irs account login?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any issues related to your irs account login. Our support team is available via chat, email, or phone to ensure that you receive timely assistance. We are committed to helping you resolve any challenges you may encounter.

Get more for Instructions For Form W 12 IRS Paid Preparer Tax

Find out other Instructions For Form W 12 IRS Paid Preparer Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors