Irs Ptin Form 2015

What is the IRS PTIN Form

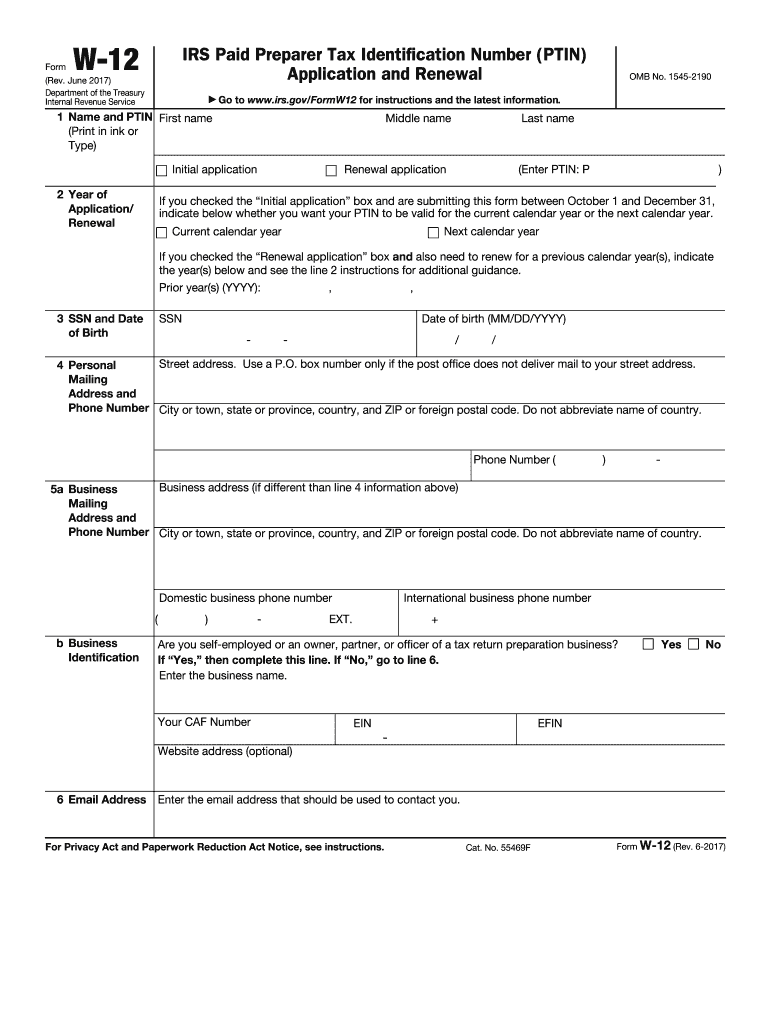

The IRS PTIN Form, officially known as Form W-12, is a document used by tax preparers to apply for a Preparer Tax Identification Number (PTIN). This number is essential for individuals who prepare or assist in preparing federal tax returns for compensation. The PTIN helps the IRS track tax preparers and ensures that they meet the necessary qualifications and standards. It is required for anyone who is paid to prepare or assist in preparing federal tax returns, including both individuals and businesses.

How to Obtain the IRS PTIN Form

To obtain the IRS PTIN Form, individuals can visit the IRS website where the form is available for download. The application process can be completed online, which is the most efficient method. Applicants must provide personal information, including their Social Security number, and may need to pay a fee. It is important to ensure all information is accurate to avoid delays in processing. Once the application is submitted, the IRS will review it and issue a PTIN if approved.

Steps to Complete the IRS PTIN Form

Completing the IRS PTIN Form involves several key steps:

- Gather required personal information, including your Social Security number and contact details.

- Access the IRS PTIN Form online via the IRS website.

- Fill out the form accurately, ensuring all information is complete.

- Review the form for any errors or omissions before submission.

- Submit the form online, along with any applicable fees.

After submission, applicants should monitor their email for confirmation and any further instructions from the IRS.

Legal Use of the IRS PTIN Form

The IRS PTIN Form is legally binding for tax preparers who are required to have a PTIN to prepare federal tax returns for compensation. Using a PTIN ensures compliance with IRS regulations, and it protects both the tax preparer and the taxpayer. It is important to use the PTIN correctly and to maintain it by renewing it annually, as failure to do so may lead to penalties or the inability to prepare tax returns legally.

IRS Guidelines

The IRS has established specific guidelines regarding the use of the PTIN. These guidelines include:

- Tax preparers must renew their PTIN annually.

- All paid tax return preparers must have a PTIN to legally prepare federal tax returns.

- Tax preparers must provide their PTIN on all tax returns they prepare.

Adhering to these guidelines is crucial for maintaining compliance and ensuring the integrity of the tax preparation process.

Required Documents

When applying for a PTIN, applicants need to provide certain documents and information, including:

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Contact information, including a valid email address and phone number.

- Payment information for the application fee, if applicable.

Having these documents ready can streamline the application process and reduce the likelihood of errors.

Quick guide on how to complete irs ptin 2015 form

Handle Irs Ptin Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents quickly without any holdups. Manage Irs Ptin Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Irs Ptin Form without any hassle

- Locate Irs Ptin Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that require printing new copies. airSlate SignNow satisfies your needs in document management in just a few clicks from any device you prefer. Modify and eSign Irs Ptin Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs ptin 2015 form

Create this form in 5 minutes!

How to create an eSignature for the irs ptin 2015 form

How to generate an eSignature for your Irs Ptin 2015 Form in the online mode

How to generate an eSignature for your Irs Ptin 2015 Form in Chrome

How to create an electronic signature for signing the Irs Ptin 2015 Form in Gmail

How to make an electronic signature for the Irs Ptin 2015 Form right from your smart phone

How to create an electronic signature for the Irs Ptin 2015 Form on iOS devices

How to create an electronic signature for the Irs Ptin 2015 Form on Android OS

People also ask

-

What is the IRS PTIN Form and why do I need it?

The IRS PTIN Form is a crucial document for tax professionals who need to obtain a Preparer Tax Identification Number (PTIN). This form allows you to legally prepare tax returns for clients, ensuring compliance with IRS regulations. Completing the IRS PTIN Form is essential for anyone looking to practice as a paid tax preparer.

-

How can airSlate SignNow help me with the IRS PTIN Form?

airSlate SignNow simplifies the process of completing and submitting the IRS PTIN Form by providing an easy-to-use eSigning platform. You can fill out the form digitally, sign it, and send it securely to the IRS without any hassle. This streamlines the application process, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the IRS PTIN Form?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs. By using our platform for the IRS PTIN Form, you can benefit from a cost-effective solution that enhances your document management and eSigning experience. Choose a plan that fits your budget and enjoy seamless document handling.

-

What are the key features of airSlate SignNow for handling the IRS PTIN Form?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time collaboration to assist you in managing the IRS PTIN Form. With our platform, you can easily track document status and receive notifications once your form is signed and submitted. This ensures a smooth process from start to finish.

-

Can I integrate airSlate SignNow with other applications for managing the IRS PTIN Form?

Absolutely! airSlate SignNow offers integrations with a variety of applications, including popular accounting and CRM software, to help you manage the IRS PTIN Form more efficiently. These integrations allow for seamless workflow automation, ensuring that your document processes are streamlined across platforms.

-

What benefits does airSlate SignNow provide for preparing the IRS PTIN Form?

Using airSlate SignNow for your IRS PTIN Form preparation provides benefits such as enhanced security, ease of use, and fast turnaround times. Our platform ensures that your sensitive information is protected while allowing you to complete forms quickly and efficiently. This means you can focus more on serving your clients rather than on paperwork.

-

How secure is my information when using airSlate SignNow for the IRS PTIN Form?

Security is a top priority at airSlate SignNow. When you use our platform for the IRS PTIN Form, your information is protected with advanced encryption and secure server storage. We comply with industry standards to ensure that your data remains confidential and safe from unauthorized access.

Get more for Irs Ptin Form

Find out other Irs Ptin Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document