Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application and Renewal 2021

What is the Form W-12 for PTIN Application and Renewal

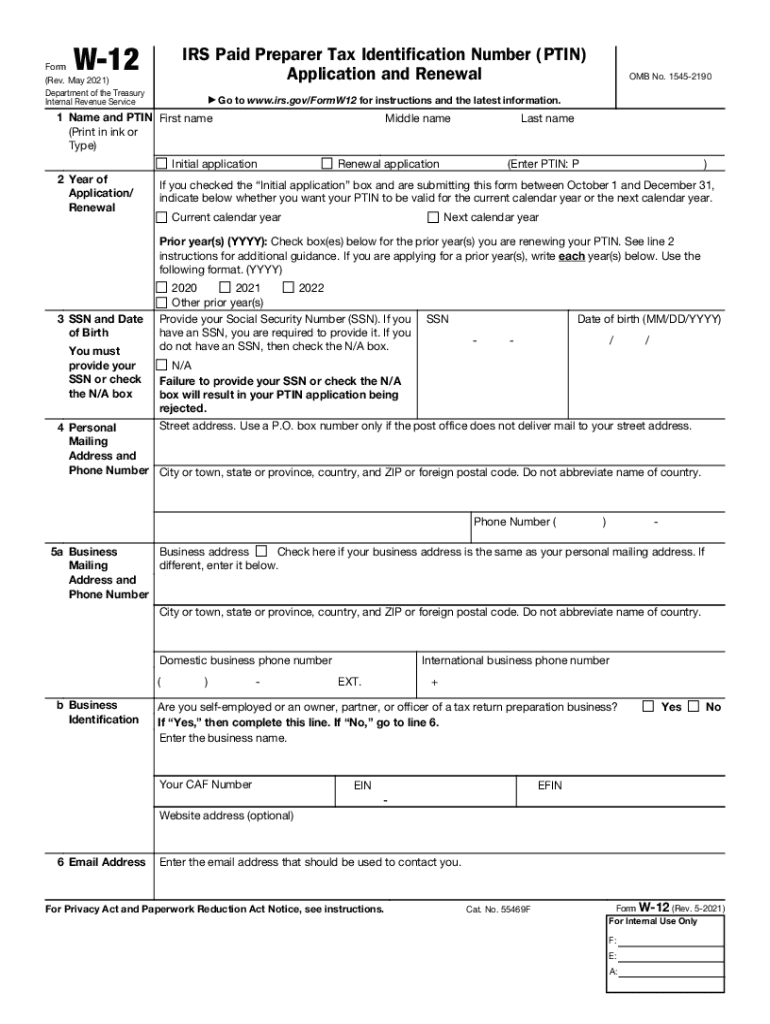

The Form W-12, officially known as the IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal, is a crucial document for tax professionals in the United States. This form allows paid tax preparers to apply for or renew their PTIN, which is necessary for anyone who prepares or assists in preparing federal tax returns for compensation. The PTIN serves as a unique identifier for tax preparers and ensures compliance with IRS regulations. Having a valid PTIN is essential for maintaining professional credibility and adhering to legal requirements in the tax preparation industry.

Steps to Complete the Form W-12

Completing the Form W-12 involves several straightforward steps. First, gather all necessary personal information, including your Social Security number and contact details. Next, accurately fill out the form, ensuring that all sections are completed, including your professional qualifications and any relevant certifications. After filling out the form, review it carefully for any errors or omissions. Finally, submit the form either online through the IRS website or by mailing it to the appropriate address provided in the instructions. Proper completion and submission of the W-12 ensure that your PTIN application or renewal is processed efficiently.

Legal Use of the Form W-12

The legal use of the Form W-12 is paramount for tax preparers. By obtaining a PTIN through this form, preparers comply with IRS regulations that mandate a PTIN for anyone preparing tax returns for compensation. This compliance not only protects the integrity of the tax preparation process but also safeguards taxpayers by ensuring that their returns are handled by qualified professionals. Failure to use the W-12 correctly can result in penalties or disqualification from preparing tax returns, making it essential for tax preparers to understand the legal implications of this form.

Eligibility Criteria for PTIN Application

To be eligible for a PTIN, applicants must meet specific criteria established by the IRS. Individuals must be paid preparers who prepare or assist in preparing federal tax returns for compensation. This includes certified public accountants, enrolled agents, and other tax professionals. Additionally, applicants must provide a valid Social Security number. Certain individuals, such as those who prepare tax returns solely for their employer or are not compensated for their services, may not need a PTIN. Understanding these eligibility criteria is vital for tax preparers to ensure compliance and avoid unnecessary complications.

Required Documents for Form W-12

When completing the Form W-12, applicants must provide specific documents to support their application. Essential documents include a valid Social Security number, personal identification information, and any relevant professional credentials or certifications. If applying online, additional verification may be required, such as a driver's license or state-issued ID. Ensuring that all required documents are submitted accurately and completely will facilitate a smoother application process and help prevent delays in obtaining or renewing a PTIN.

Form Submission Methods for W-12

The Form W-12 can be submitted through various methods, offering flexibility for applicants. The primary submission method is online through the IRS website, which allows for immediate processing and confirmation of your PTIN application or renewal. Alternatively, applicants may choose to print the form and submit it via mail to the designated IRS address. It is important to follow the instructions carefully for each submission method to ensure compliance and timely processing of the application.

Quick guide on how to complete form w 12 rev may 2021 irs paid preparer tax identification number ptin application and renewal

Effortlessly Prepare Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without unnecessary delays. Manage Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal across any platform using the airSlate SignNow mobile applications for Android or iOS, and streamline any document-focused process today.

The Easiest Method to Edit and eSign Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal Effortlessly

- Locate Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize critical sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering the form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, burdensome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and eSign Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal to guarantee exceptional communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 12 rev may 2021 irs paid preparer tax identification number ptin application and renewal

Create this form in 5 minutes!

How to create an eSignature for the form w 12 rev may 2021 irs paid preparer tax identification number ptin application and renewal

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is a PTIN and why do I need one?

A PTIN, or Preparer Tax Identification Number, is a unique identifier for tax preparers. If you prepare tax returns for compensation, you are required to have a PTIN by the IRS. Utilizing airSlate SignNow can streamline your document signing process, making it easier for you to manage your client documents while ensuring you comply with IRS regulations regarding PTIN usage.

-

How can airSlate SignNow help me with PTIN-related documents?

With airSlate SignNow, you can easily send and eSign PTIN-related documents efficiently. Our platform simplifies the process by allowing you to prepare important forms and securely collect signatures from your clients. This ensures that all necessary PTIN documentation is maintained in a compliant and organized manner.

-

Is there a cost associated with using airSlate SignNow for PTIN documentation?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling PTIN documentation. Our pricing is designed to be cost-effective, providing you with the tools necessary to manage your PTIN-related tasks without breaking the bank. Sign up today for a plan that fits your requirements.

-

Can I integrate airSlate SignNow with other software to manage PTIN documents?

Absolutely! airSlate SignNow supports integrations with various software solutions that can help you manage PTIN documents. This flexibility allows you to connect with your existing tax preparation tools, ensuring a seamless workflow that enhances your operations while focusing on PTIN compliance.

-

What features does airSlate SignNow offer for managing PTIN forms?

AirSlate SignNow includes features such as template creation, secure eSigning, and document tracking, which can signNowly enhance your management of PTIN forms. These functionalities ensure that your PTIN documents are handled efficiently while providing a user-friendly experience for both you and your clients.

-

How secure is airSlate SignNow for handling PTIN information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like PTINs. Our platform is equipped with robust encryption protocols and compliance with industry standards, ensuring that your PTIN-related documents are safe from unauthorized access and bsignNowes.

-

Can airSlate SignNow help me track my PTIN application status?

While airSlate SignNow primarily focuses on document signing and management, it can play a vital role in helping you organize and store your PTIN application status documents. By using our platform, you can maintain all related communications and updates in one place, making it easier to keep track of your PTIN application progress.

Get more for Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal

- Scholars rising form

- Csu ge breadth certification plan 2019 2020 cal state form

- Uco verification form

- Independent student jackson state community college form

- F 1 student financial statement northern virginia form

- Nursing program application nursing form

- Mcw department of radiology acgme neuroradiology brain form

- Change of advisermajor form west texas aampampampm university

Find out other Form W 12 Rev May IRS Paid Preparer Tax Identification Number PTIN Application And Renewal

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later