Form W 12 2017

What is the Form W-12?

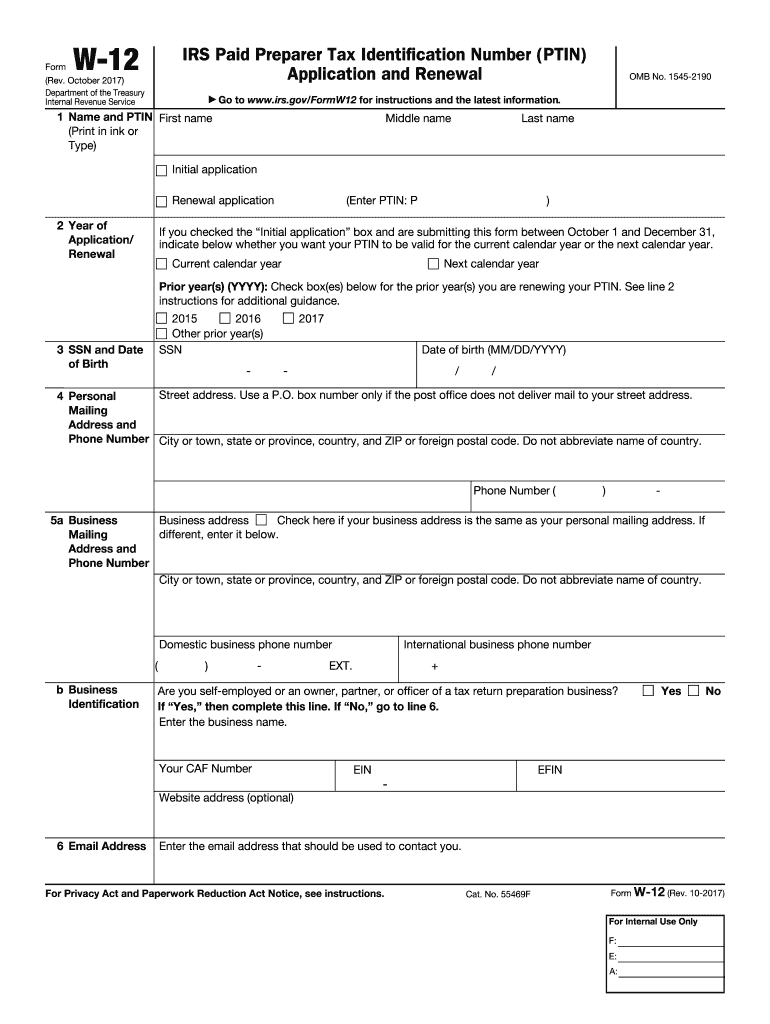

The Form W-12 is an application used by tax professionals to obtain a Preparer Tax Identification Number (PTIN) from the Internal Revenue Service (IRS). This form is essential for individuals who prepare tax returns for compensation. By completing the W-12, tax preparers ensure they are recognized by the IRS, allowing them to legally file tax returns on behalf of clients. The form collects necessary information about the applicant, including their name, address, and Social Security number.

How to use the Form W-12

Using the Form W-12 involves several straightforward steps. First, applicants must gather all required personal information, including their Social Security number and any relevant business details. Next, they need to fill out the form accurately, ensuring all sections are completed to avoid delays. Once the form is filled out, it can be submitted electronically or via mail to the IRS. It is important to retain a copy for personal records and to track the application status if submitted electronically.

Steps to complete the Form W-12

Completing the Form W-12 requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your Social Security number and contact details.

- Access the Form W-12 from the IRS website or a trusted source.

- Fill out the form, ensuring all fields are complete and accurate.

- Review the form for any errors or omissions.

- Submit the form electronically through the IRS e-Services or mail it to the designated address.

Legal use of the Form W-12

The Form W-12 is legally binding when completed and submitted according to IRS guidelines. It is crucial for tax professionals to understand that providing false information on the form can lead to penalties, including fines or revocation of the PTIN. Ensuring compliance with IRS regulations not only protects the preparer but also safeguards clients’ interests. The form must be used solely for its intended purpose of obtaining a PTIN and should be submitted in a timely manner to avoid any legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-12 are critical for tax professionals. Typically, the form should be submitted before the start of the tax season to ensure that the PTIN is received in time for client filings. The IRS usually sets specific deadlines for PTIN renewals, which occur annually. It is essential for preparers to stay informed about these dates to maintain compliance and avoid interruptions in their ability to file tax returns.

Who Issues the Form

The Form W-12 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides the form to streamline the process of obtaining a PTIN for tax professionals. It is important for applicants to ensure they are using the most current version of the form as provided by the IRS to avoid any issues with their application.

Quick guide on how to complete gov ptin 2017 2019 form 464471547

Complete Form W 12 effortlessly on any device

Online document management has become a favored choice among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Form W 12 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form W 12 effortlessly

- Find Form W 12 and click Get Form to start.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign Form W 12 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gov ptin 2017 2019 form 464471547

Create this form in 5 minutes!

How to create an eSignature for the gov ptin 2017 2019 form 464471547

How to make an electronic signature for your Gov Ptin 2017 2019 Form 464471547 in the online mode

How to create an electronic signature for the Gov Ptin 2017 2019 Form 464471547 in Chrome

How to generate an electronic signature for signing the Gov Ptin 2017 2019 Form 464471547 in Gmail

How to make an electronic signature for the Gov Ptin 2017 2019 Form 464471547 right from your smartphone

How to create an eSignature for the Gov Ptin 2017 2019 Form 464471547 on iOS devices

How to make an eSignature for the Gov Ptin 2017 2019 Form 464471547 on Android OS

People also ask

-

What is Form W 12 and how do I use it with airSlate SignNow?

Form W 12 is a document used by tax preparers to request a Preparer Tax Identification Number (PTIN). With airSlate SignNow, you can easily upload, sign, and send Form W 12 electronically, ensuring a streamlined process for your tax preparation needs.

-

Is there a cost associated with using airSlate SignNow for Form W 12?

Yes, airSlate SignNow offers several pricing plans, including a free trial to explore features for managing Form W 12. Each plan is designed to cater to different business needs, so you can choose the one that best fits your budget and usage.

-

What features does airSlate SignNow offer for managing Form W 12?

airSlate SignNow provides features such as eSignature, document templates, and automated workflows to simplify the management of Form W 12. These tools enhance efficiency and ensure compliance, making the process of gathering signatures quick and hassle-free.

-

Can I integrate airSlate SignNow with other applications for Form W 12?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRMs. This allows you to easily access and manage Form W 12 alongside your other business documents, improving your overall workflow.

-

How secure is airSlate SignNow when handling Form W 12?

airSlate SignNow prioritizes security, employing encryption and compliance with industry standards to protect your Form W 12 and other sensitive documents. You can trust that your data is safe while using our eSignature platform.

-

What benefits does airSlate SignNow provide for businesses using Form W 12?

By using airSlate SignNow for Form W 12, businesses can save time, reduce paperwork, and improve accuracy in the signing process. The platform streamlines document management, allowing for faster turnaround times and enhanced collaboration.

-

How do I track the status of my Form W 12 with airSlate SignNow?

AirSlate SignNow allows you to track the status of your Form W 12 in real-time. You can receive notifications when the document is viewed and signed, ensuring you stay updated throughout the entire process.

Get more for Form W 12

- Express scripts prior rx authorization form pdfprior authorization resourcesexpress scriptscontact usexpress scripts express

- Shift select atrium form

- Integrated health home marketing plan abc magellan of iowa form

- Ucare reimbursement form

- Pharmacy request form

- Sutton place behavioral health psychiatric review of intranet spbh form

- Oakland physical agility fitness examination registrationhealth screening form oakland physical agility fitness examination

- Www bostoncpg comstandard apartment leasestandard form apartment lease simplified fixed term

Find out other Form W 12

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template