W 12 Form 2012

What is the W-12 Form

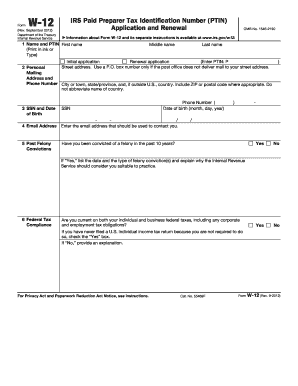

The W-12 Form, officially known as the "IRS e-file Signature Authorization," is a crucial document for tax professionals and businesses that allows for electronic filing of tax returns. This form is specifically designed for tax preparers who need to obtain authorization from their clients to file their tax returns electronically. The W-12 Form ensures that the taxpayer's consent is documented, facilitating a smoother e-filing process.

How to obtain the W-12 Form

To obtain the W-12 Form, individuals can visit the official IRS website where the form is available for download. The form can be accessed in a PDF format, allowing for easy printing and filling. Additionally, tax professionals may have access to the form through their accounting software or tax preparation tools, which often include the latest IRS forms for convenience.

Steps to complete the W-12 Form

Completing the W-12 Form involves several straightforward steps:

- Begin by entering the taxpayer's name and Social Security number.

- Provide the name of the tax preparer and their Preparer Tax Identification Number (PTIN).

- Indicate the type of tax return being filed.

- Ensure that the taxpayer signs and dates the form to authorize the electronic filing.

After filling out the form, it should be securely stored and provided to the tax preparer for submission during the e-filing process.

Legal use of the W-12 Form

The W-12 Form is legally binding when completed correctly and signed by the taxpayer. It complies with IRS regulations regarding electronic filing, ensuring that the tax preparer's submission is authorized. Utilizing this form protects both the taxpayer and the preparer by documenting consent and establishing a clear record of the agreement to file electronically.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-12 Form. Tax preparers must ensure they are using the most current version of the form, as updates may occur annually. Additionally, the IRS emphasizes the importance of maintaining the confidentiality of taxpayer information, which includes securely storing signed W-12 Forms. Tax professionals should also be aware of the requirements for e-filing and ensure compliance with all IRS regulations.

Form Submission Methods

The W-12 Form does not need to be submitted to the IRS directly. Instead, it is retained by the tax preparer as part of the e-filing process. The form serves as authorization for the preparer to file the taxpayer's return electronically. Taxpayers should ensure that the signed form is kept in a secure location, as it may be needed for future reference or audits.

Penalties for Non-Compliance

Failure to properly complete and retain the W-12 Form can result in penalties for tax preparers. If a tax return is filed without the necessary authorization, the IRS may impose fines or sanctions against the preparer. Additionally, taxpayers may face complications with their returns if proper documentation is not maintained. It is essential for both parties to adhere to the requirements set forth by the IRS to avoid potential legal issues.

Quick guide on how to complete 2012 w 12 form

Complete W 12 Form effortlessly on any device

Digital document management has gained increasing popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle W 12 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign W 12 Form without hassle

- Find W 12 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign W 12 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 w 12 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 w 12 form

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is a W 12 Form and why is it important?

The W 12 Form is a critical document used by businesses to authorize a third-party to prepare or file tax returns on their behalf. Understanding the W 12 Form is essential for ensuring compliance with IRS regulations. By using airSlate SignNow, you can quickly and securely eSign your W 12 Form, streamlining your tax preparation process.

-

How does airSlate SignNow simplify the W 12 Form signing process?

airSlate SignNow simplifies the W 12 Form signing process by providing an intuitive platform that allows users to send and eSign documents effortlessly. With features like templates and automated reminders, you can ensure that your W 12 Form is completed and submitted on time. This ease of use saves time and reduces the hassle often associated with paperwork.

-

Is there a cost associated with using airSlate SignNow for W 12 Form eSigning?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that best suits your requirements for managing documents like the W 12 Form. The cost is competitive, especially considering the time and resources saved by using our efficient eSigning solution.

-

Can airSlate SignNow integrate with accounting software for W 12 Form handling?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, allowing you to manage your W 12 Form alongside your financial documents. This integration enhances workflow efficiency and ensures that your tax documentation is always up to date.

-

What security measures does airSlate SignNow employ for W 12 Form documents?

airSlate SignNow prioritizes the security of your documents, including the W 12 Form, by utilizing advanced encryption and secure cloud storage. This means your sensitive tax information is protected from unauthorized access. You can trust that your eSigned W 12 Form is safe and compliant with industry standards.

-

Are there any limits on the number of W 12 Forms I can send with airSlate SignNow?

Depending on your chosen pricing plan, there may be limits on the number of documents, including the W 12 Form, you can send each month. However, our higher-tier plans offer unlimited document sending, ensuring that you can manage all your signing needs without restrictions.

-

Can I customize the W 12 Form templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize W 12 Form templates to fit your specific needs. You can add your branding, adjust fields, and include instructions, making the signing experience more personalized for your clients or employees. This feature enhances professionalism and clarity in your document handling.

Get more for W 12 Form

Find out other W 12 Form

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement