About Form 56, Notice Concerning Fiduciary RelationshipInternal 2022-2026

Understanding Form 56: Notice Concerning Fiduciary Relationship

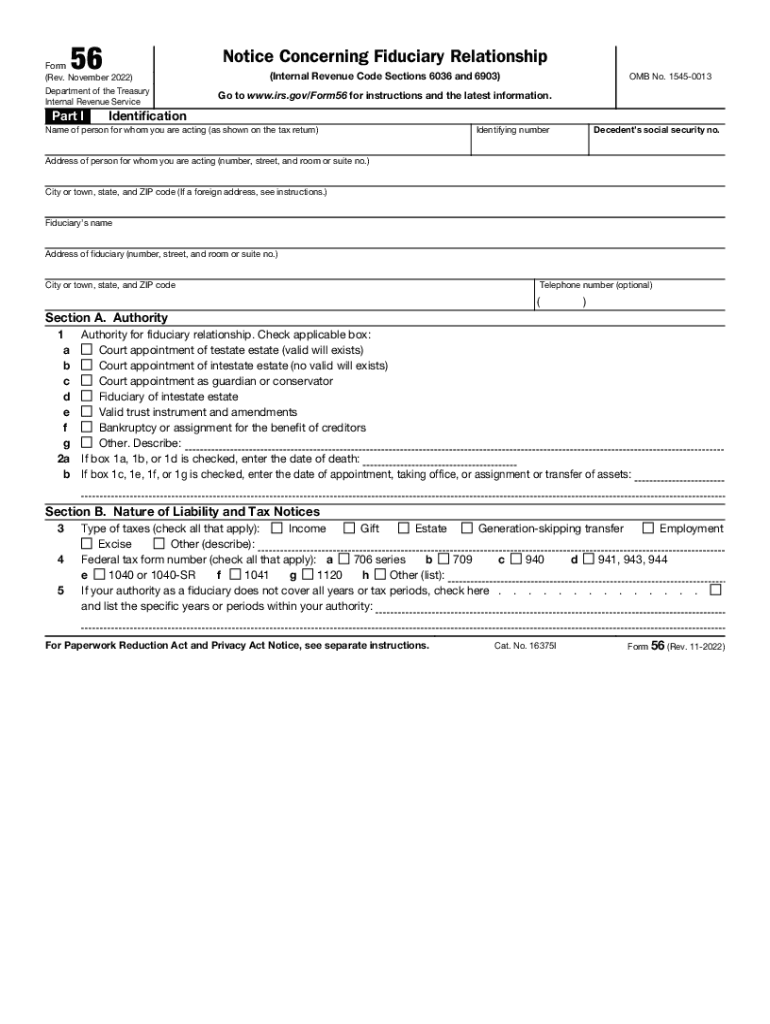

Form 56, officially known as the Notice Concerning Fiduciary Relationship, is a crucial document used in the United States to notify the IRS of a fiduciary relationship. This form is typically utilized by individuals or entities acting on behalf of another party, such as executors, administrators, or guardians. By filing this form, fiduciaries can ensure that the IRS is aware of their role and can direct any tax-related correspondence to them. This is particularly important for managing the tax obligations of estates or trusts.

Steps to Complete Form 56

Completing Form 56 involves several key steps to ensure accurate submission. Start by providing the name and address of the fiduciary, followed by the name and address of the person or entity for whom you are acting. Be sure to include the taxpayer identification number (TIN) of the individual or entity involved. Next, indicate the type of fiduciary relationship, such as executor or trustee. After filling out the form, review it for accuracy, sign it, and date it. Finally, submit the form to the IRS, ensuring that you retain a copy for your records.

Legal Use of Form 56

The legal use of Form 56 is essential for establishing a recognized fiduciary relationship with the IRS. Filing this form allows fiduciaries to manage tax matters effectively on behalf of another party. It also protects the fiduciary by ensuring that they receive all relevant tax information and correspondence. Compliance with IRS guidelines regarding the use of Form 56 is critical to avoid penalties and ensure smooth communication with the tax authority.

Filing Deadlines for Form 56

Understanding the filing deadlines for Form 56 is vital for fiduciaries. Generally, the form should be filed as soon as the fiduciary relationship is established. It is advisable to submit Form 56 before filing any tax returns related to the estate or trust. This ensures that the IRS recognizes the fiduciary's authority and can direct any necessary communications appropriately. Keeping track of these dates helps prevent potential issues with tax filings.

Form Submission Methods

Form 56 can be submitted to the IRS through various methods. Fiduciaries have the option to file the form by mail or electronically, depending on their preference and the specific circumstances. When mailing, ensure that the form is sent to the appropriate IRS address based on the state of residence. For electronic submissions, using a reliable eSignature solution can streamline the process, making it easier to submit and manage documentation securely.

Key Elements of Form 56

Several key elements must be included when completing Form 56. These include the fiduciary's name, address, and TIN, as well as the name and address of the individual or entity represented. It is also important to specify the nature of the fiduciary relationship and to provide any additional information that may be required. Ensuring that all relevant details are accurately filled out helps in maintaining compliance and facilitates effective communication with the IRS.

IRS Guidelines for Form 56

The IRS provides specific guidelines for the completion and submission of Form 56. These guidelines outline the required information, filing procedures, and any additional documentation that may be necessary. Adhering to these guidelines is crucial for ensuring that the form is processed correctly and that the fiduciary relationship is recognized. Regularly reviewing IRS updates regarding Form 56 can help fiduciaries stay informed about any changes in requirements or procedures.

Quick guide on how to complete about form 56 notice concerning fiduciary relationshipinternal

Prepare About Form 56, Notice Concerning Fiduciary RelationshipInternal effortlessly on any device

Managing documents online has gained traction among both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle About Form 56, Notice Concerning Fiduciary RelationshipInternal on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign About Form 56, Notice Concerning Fiduciary RelationshipInternal with ease

- Obtain About Form 56, Notice Concerning Fiduciary RelationshipInternal and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign function, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and eSign About Form 56, Notice Concerning Fiduciary RelationshipInternal and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 56 notice concerning fiduciary relationshipinternal

Create this form in 5 minutes!

People also ask

-

What is Form 56 and how does it work with airSlate SignNow?

Form 56 is a crucial document for tax purposes, specifically designed for notifying the IRS about the appointment of a representative. With airSlate SignNow, you can easily create, send, and eSign Form 56, ensuring a smooth and efficient filing process.

-

How much does it cost to use airSlate SignNow for Form 56?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from a cost-effective option for small businesses. Pricing includes features for eSigning Form 56 documents and other essential functionalities, providing excellent value for your investment.

-

What features does airSlate SignNow provide for managing Form 56?

AirSlate SignNow includes features like customizable templates, easy drag-and-drop editing, and secure eSignature capabilities specifically for Form 56. This allows users to streamline their document processes while maintaining compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other applications for Form 56?

Yes, airSlate SignNow offers integrations with various popular applications, including Google Drive, Dropbox, and CRM systems, making it simple to manage Form 56 alongside your other business tools. This enhances your workflow efficiency and keeps your documents organized.

-

Is airSlate SignNow compliant with legal eSignature regulations for Form 56?

Absolutely! airSlate SignNow complies with all major legal eSignature regulations, including the ESIGN Act and UETA, ensuring that your eSigned Form 56 is legally binding and recognized. This compliance gives you peace of mind while handling important tax documents.

-

What are the benefits of using airSlate SignNow for Form 56?

Using airSlate SignNow for Form 56 expedites the eSigning process, reduces paperwork, and minimizes delays in filing. Additionally, its user-friendly interface and automated notifications help you track the status of your document effortlessly, improving overall productivity.

-

Can I track the status of my Form 56 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Form 56, allowing you to monitor when the document is viewed, signed, and completed. This transparency improves communication with your clients or colleagues and ensures timely compliance with tax filing deadlines.

Get more for About Form 56, Notice Concerning Fiduciary RelationshipInternal

Find out other About Form 56, Notice Concerning Fiduciary RelationshipInternal

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT