56 Irs Form 2015

What is the 56 IRS Form

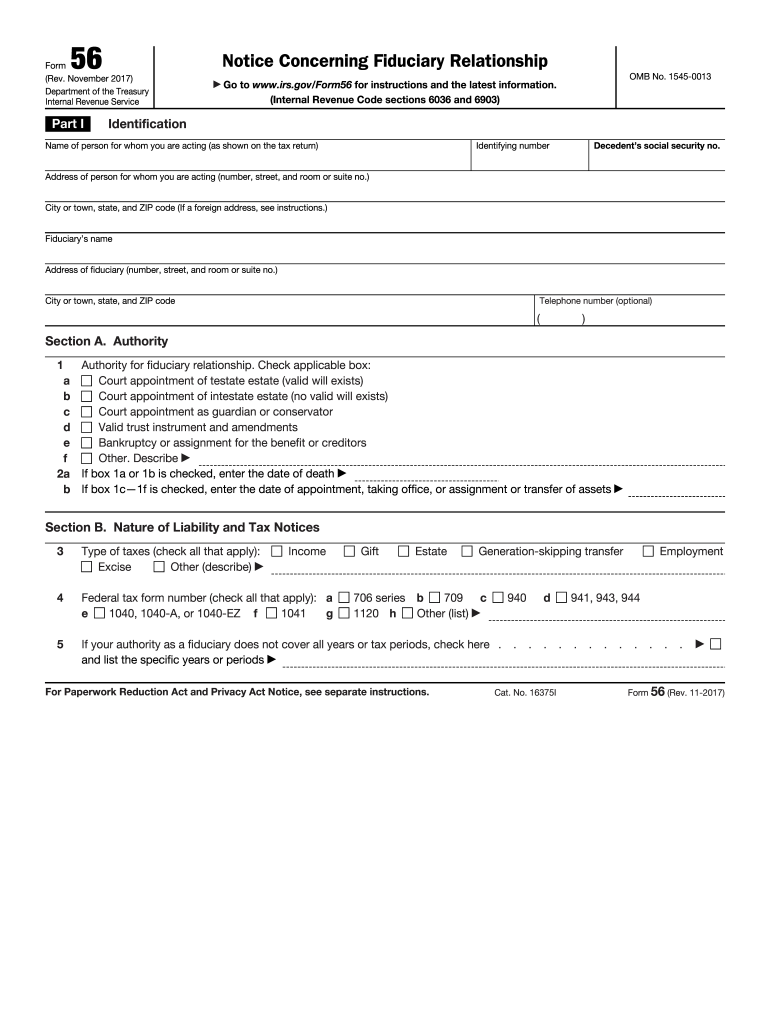

The 56 IRS Form, officially known as Form 56, is a document used to notify the Internal Revenue Service (IRS) of the creation of a fiduciary relationship. This form is essential for individuals or entities acting on behalf of another person, such as executors, administrators, or trustees. By filing this form, the fiduciary informs the IRS that they are responsible for tax matters concerning the taxpayer's estate or trust. This ensures proper communication and compliance with tax obligations.

How to use the 56 IRS Form

Using the 56 IRS Form involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website. Next, fill out the form with accurate information, including the name and taxpayer identification number of both the fiduciary and the individual or entity they represent. Once completed, the form must be submitted to the IRS to officially establish the fiduciary relationship. It is crucial to keep a copy for your records as well.

Steps to complete the 56 IRS Form

Completing the 56 IRS Form requires careful attention to detail. Follow these steps:

- Obtain the most recent version of Form 56 from the IRS website.

- Fill in your name, address, and taxpayer identification number as the fiduciary.

- Provide the name and taxpayer identification number of the individual or entity you are representing.

- Indicate the type of fiduciary relationship, such as executor or trustee.

- Sign and date the form to certify the information is accurate.

- Submit the completed form to the IRS, either by mail or electronically if applicable.

Legal use of the 56 IRS Form

The legal use of the 56 IRS Form is critical for establishing a fiduciary relationship recognized by the IRS. This form must be filed to ensure that the fiduciary can manage tax matters on behalf of the taxpayer. It is important to understand that failing to file this form may lead to complications in tax reporting and compliance. The form serves as a formal declaration of the fiduciary's authority, which is essential for legal and tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for the 56 IRS Form can vary based on the specific circumstances surrounding the fiduciary relationship. Generally, it is advisable to submit the form as soon as the fiduciary relationship is established. For estates, this may coincide with the filing of the estate tax return. It is important to stay informed about any relevant deadlines to avoid penalties or complications with the IRS.

Required Documents

When completing the 56 IRS Form, certain documents may be necessary to support the filing. These can include:

- Proof of the fiduciary relationship, such as a will or trust document.

- Identification documents for both the fiduciary and the taxpayer.

- Any prior correspondence with the IRS regarding the taxpayer's account.

Having these documents ready can facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete 56 irs 2015 form

Effortlessly prepare 56 Irs Form on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides you with all the essentials to create, edit, and electronically sign your documents rapidly without any hold-ups. Manage 56 Irs Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to modify and electronically sign 56 Irs Form effortlessly

- Find 56 Irs Form and click on Get Form to initiate the process.

- Employ the tools provided to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for such purposes.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, or invitation link; or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your preference. Edit and electronically sign 56 Irs Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 56 irs 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 56 irs 2015 form

How to create an electronic signature for the 56 Irs 2015 Form in the online mode

How to generate an electronic signature for the 56 Irs 2015 Form in Google Chrome

How to make an eSignature for signing the 56 Irs 2015 Form in Gmail

How to create an eSignature for the 56 Irs 2015 Form from your smartphone

How to create an eSignature for the 56 Irs 2015 Form on iOS devices

How to make an electronic signature for the 56 Irs 2015 Form on Android OS

People also ask

-

What is the 56 IRS Form and how is it used?

The 56 IRS Form, also known as the Notice Concerning Fiduciary Relationship, is used to notify the IRS about the appointment of a fiduciary. This form is essential for ensuring that the IRS is informed about any individuals who will be acting on behalf of another party in tax matters. Using airSlate SignNow, businesses can easily eSign and send the 56 IRS Form securely and efficiently.

-

How can airSlate SignNow help with the 56 IRS Form?

airSlate SignNow provides a streamlined way to prepare and eSign the 56 IRS Form online. With its user-friendly interface, you can quickly fill out the form, gather signatures, and send it directly to the IRS, reducing paperwork and saving time. This solution helps you manage your tax documents with ease and reliability.

-

Is there a cost associated with using airSlate SignNow for the 56 IRS Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to choose the best option for electronically signing the 56 IRS Form. Each plan provides access to essential features for document management and eSignature, ensuring that you get a cost-effective solution for all your signing needs.

-

Can I integrate airSlate SignNow with other applications for handling documents like the 56 IRS Form?

Absolutely! airSlate SignNow supports integrations with a wide range of applications, making it easy to manage your documents, including the 56 IRS Form. Whether you're using CRM systems, cloud storage, or other productivity tools, you can seamlessly connect them to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the 56 IRS Form?

Using airSlate SignNow for the 56 IRS Form offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, ensuring that your tax-related forms are processed promptly and securely, making it easier for you to manage your fiduciary responsibilities.

-

Is airSlate SignNow secure for signing sensitive documents like the 56 IRS Form?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect sensitive documents, including the 56 IRS Form. This ensures that your data remains confidential and secure throughout the signing process, giving you peace of mind when managing important tax documents.

-

Do I need any special training to use airSlate SignNow for the 56 IRS Form?

No special training is required to use airSlate SignNow for the 56 IRS Form. The platform is designed to be intuitive and user-friendly, allowing anyone to easily navigate through the process of preparing and signing documents. With basic computer skills, you can efficiently manage your forms.

Get more for 56 Irs Form

Find out other 56 Irs Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors