Irs Form 56 Where to Email 1992

What is the IRS Form 56 Where to Email

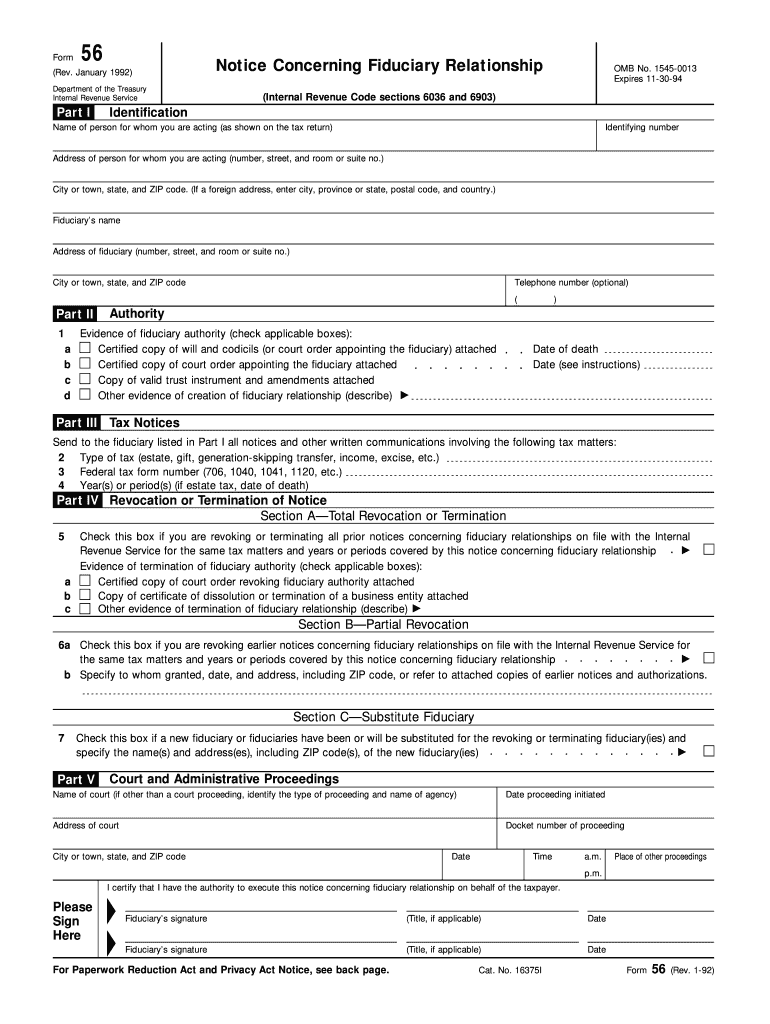

The IRS Form 56 is a document used to notify the Internal Revenue Service of the appointment of a fiduciary, such as an executor, administrator, or trustee. This form is essential for ensuring that the IRS recognizes the fiduciary's authority to act on behalf of an estate or trust. Proper completion and submission of this form help facilitate the management of tax obligations related to the estate or trust.

Steps to Complete the IRS Form 56 Where to Email

Completing the IRS Form 56 involves several key steps:

- Obtain the form from the IRS website or through tax professionals.

- Fill in the required information, including the name and address of the fiduciary, the taxpayer's name, and the relevant tax identification numbers.

- Ensure that all details are accurate and complete to avoid delays.

- Sign and date the form, confirming the appointment of the fiduciary.

How to Use the IRS Form 56 Where to Email

Once the IRS Form 56 is completed, it can be submitted electronically. To do this, you should email the form to the appropriate IRS office, which is typically indicated in the IRS instructions for the form. This electronic submission helps streamline the process, ensuring that the IRS receives the notification promptly.

Legal Use of the IRS Form 56 Where to Email

The legal use of the IRS Form 56 is crucial for establishing the fiduciary's authority. The form must be filed in accordance with IRS guidelines to ensure its validity. This includes adhering to any specific requirements related to the type of fiduciary and the nature of the estate or trust being managed. Proper use of the form can prevent legal complications and ensure compliance with tax obligations.

Filing Deadlines / Important Dates

While the IRS Form 56 does not have a specific filing deadline, it is advisable to submit it as soon as the fiduciary is appointed. Timely submission helps prevent any potential issues with tax filings and ensures that the IRS is aware of the fiduciary's authority to act on behalf of the estate or trust.

Required Documents

When submitting the IRS Form 56, it is important to include any supporting documents that may be necessary to validate the fiduciary's appointment. This may include a copy of the will, court documents, or other legal papers that establish the fiduciary's authority. Ensuring that all required documents are included can help facilitate the processing of the form by the IRS.

Quick guide on how to complete irs form 56 where to email 1992

Effortlessly Prepare Irs Form 56 Where To Email on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed materials, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents swiftly without holdups. Manage Irs Form 56 Where To Email on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Alter and Electronically Sign Irs Form 56 Where To Email with Ease

- Find Irs Form 56 Where To Email and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiresome form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Irs Form 56 Where To Email and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 56 where to email 1992

Create this form in 5 minutes!

How to create an eSignature for the irs form 56 where to email 1992

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is IRS Form 56 and why do I need to email it?

IRS Form 56 is a notice concerning fiduciary relationship, essential for notifying the IRS of any fiduciary appointments. Knowing 'IRS Form 56 where to email' is crucial because timely submission ensures compliance and avoids penalties. Using airSlate SignNow simplifies this process by allowing you to eSign and send documents directly to the IRS.

-

Where do I email IRS Form 56?

You can find the proper email addresses for sending IRS Form 56 depending on your location and type of entity. It's important to check the IRS website for the most current information. airSlate SignNow helps streamline the process of preparing and sending IRS Form 56, ensuring you send it to the right place.

-

How does airSlate SignNow facilitate emailing IRS Form 56?

airSlate SignNow allows you to prepare, eSign, and send IRS Form 56 directly from your device. With user-friendly features, you can easily upload the form, add your signature, and email it to the IRS in moments. Understanding 'IRS Form 56 where to email' becomes hassle-free with our integrated solution.

-

Is there a cost associated with using airSlate SignNow for IRS Form 56?

airSlate SignNow offers several pricing plans, including a free trial, making it an affordable option for individuals and businesses. Understanding the cost versus the benefits of using airSlate SignNow for IRS Form 56 is valuable, as it promotes efficiency and saves time when managing documents electronically.

-

What benefits does airSlate SignNow provide for IRS Form 56 submissions?

Using airSlate SignNow for IRS Form 56 submission enhances security and compliance. Our platform ensures your documents are encrypted and provides a digital audit trail, making it easier to track submissions. This guarantees that your forms are sent timely and correctly, addressing the concern of 'IRS Form 56 where to email' effectively.

-

Can I integrate airSlate SignNow with other applications for IRS Form 56?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Dropbox, and more. This means you can manage your IRS Form 56 within your existing workflow without hassle. Leveraging these integrations can help you understand more about 'IRS Form 56 where to email' by keeping your documents organized.

-

Is it easy to track my IRS Form 56 after emailing it?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor your sent documents, including IRS Form 56. You’ll receive notifications when the document is opened or signed, helping you stay informed. This tracking capability answers the concern of 'IRS Form 56 where to email' effectively, ensuring accountability.

Get more for Irs Form 56 Where To Email

- Full text of ampquoteric ed117739 back to the basics in english form

- Generic medical release formdocx

- Participant release formdocx

- Girl health history form girl scouts western pa

- Bchp dental reimbursement form

- Abc voucher application form sc

- Click here to email completed form

- Epayment enrollment authorization form providers select health of south carolina epayment enrollment authorization form

Find out other Irs Form 56 Where To Email

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple