South Carolina Partnership Return SC1065 TaxFormFinder 2021

Understanding the South Carolina Partnership Return SC1065

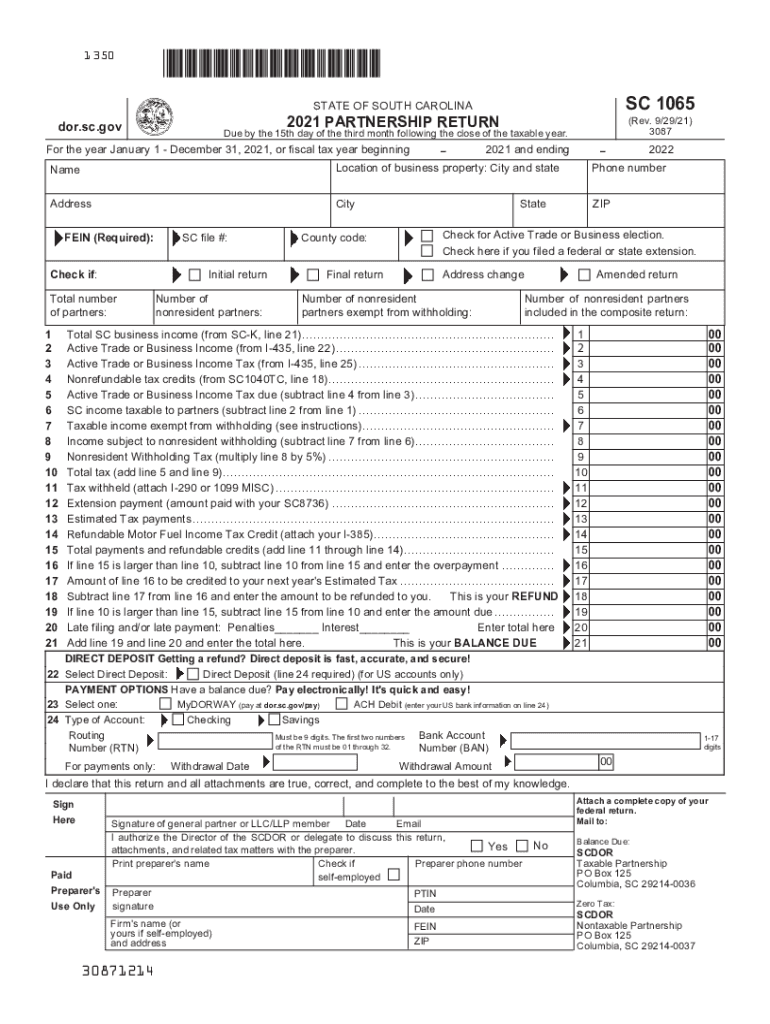

The South Carolina Partnership Return, known as SC1065, is a tax form that partnerships use to report income, deductions, and credits to the state of South Carolina. This form is essential for partnerships operating within the state, as it ensures compliance with state tax regulations. The SC1065 is specifically designed for partnerships, including limited liability companies (LLCs) that are treated as partnerships for tax purposes. Each partner must also report their share of the partnership's income on their individual tax returns.

Steps to Complete the South Carolina Partnership Return SC1065

Completing the SC1065 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements and expense reports. Next, fill out the form by providing information about the partnership, such as its name, address, and federal employer identification number (EIN). Report the total income, deductions, and credits as required. Finally, ensure that all partners sign the return before submission. It is important to review the completed form for any errors or omissions before filing.

Filing Deadlines and Important Dates for SC1065

The filing deadline for the SC1065 typically aligns with the federal tax return due date, which is usually on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Partners should be aware of any extensions that may apply and ensure timely submission to avoid penalties.

Required Documents for the SC1065

To successfully complete the SC1065, several documents are required. These include the partnership's financial statements, such as profit and loss statements, balance sheets, and any relevant supporting documentation for deductions and credits claimed. Partners should also have their Social Security numbers or EINs ready, as this information is necessary for proper identification on the form. Ensuring all documents are accurate and complete will facilitate a smoother filing process.

Legal Use of the South Carolina Partnership Return SC1065

The SC1065 is legally recognized as the official document for reporting partnership income to the state of South Carolina. It must be completed in accordance with state tax laws and regulations. Filing this form not only fulfills legal obligations but also ensures that the partnership is in good standing with the state. Moreover, accurate reporting can prevent potential audits or penalties associated with non-compliance.

Examples of Using the South Carolina Partnership Return SC1065

Partnerships in various industries, such as real estate, consulting, and retail, utilize the SC1065 to report their income and expenses. For instance, a real estate partnership may report rental income and associated expenses, while a consulting partnership might report earnings from client contracts. Each partner's share of the income and deductions must be accurately reflected on their individual tax returns, illustrating the importance of the SC1065 in the overall tax reporting process.

Quick guide on how to complete south carolina partnership return sc1065 taxformfinder

Prepare South Carolina Partnership Return SC1065 TaxFormFinder effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents promptly without interruptions. Manage South Carolina Partnership Return SC1065 TaxFormFinder on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign South Carolina Partnership Return SC1065 TaxFormFinder with minimal effort

- Locate South Carolina Partnership Return SC1065 TaxFormFinder and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and eSign South Carolina Partnership Return SC1065 TaxFormFinder and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina partnership return sc1065 taxformfinder

Create this form in 5 minutes!

People also ask

-

What is the SC1065 instructions form?

The SC1065 instructions form provides detailed guidelines on how to complete the SC1065 form, essential for partnerships in California. It outlines the necessary steps and requirements to ensure accurate reporting of income, deductions, and credits for partnerships.

-

How can I access the SC1065 instructions form?

You can easily access the SC1065 instructions form through the California Franchise Tax Board’s official website. It's available as a downloadable PDF, ensuring you have the latest guidance for your partnership tax filings.

-

Are there any costs associated with using airSlate SignNow for signing the SC1065 instructions form?

Using airSlate SignNow to eSign the SC1065 instructions form is cost-effective, with various pricing plans available based on your business needs. You can choose the plan that best fits your requirements, making document signing efficient without breaking the bank.

-

What features does airSlate SignNow offer for the SC1065 instructions form?

AirSlate SignNow offers robust features for managing and signing the SC1065 instructions form, including templates, reusable fields, and real-time tracking. These features streamline the signing process, making it easy to manage multiple documents efficiently.

-

What are the benefits of using airSlate SignNow for the SC1065 instructions form?

Using airSlate SignNow for the SC1065 instructions form enhances your workflow by speeding up document turnaround times and reducing paper usage. The secure electronic signature process ensures compliance and offers peace of mind for both individuals and businesses.

-

Can I integrate airSlate SignNow with other software while completing the SC1065 instructions form?

Yes, airSlate SignNow provides seamless integrations with various software applications, allowing you to enhance your document management processes. Whether you're using accounting software or CRM tools, you can easily integrate these systems when working on the SC1065 instructions form.

-

Is it safe to eSign the SC1065 instructions form with airSlate SignNow?

Absolutely! AirSlate SignNow employs top-notch security measures to protect your data when eSigning the SC1065 instructions form. With encrypted storage and secure authentication processes, you can trust that your sensitive information remains safe.

Get more for South Carolina Partnership Return SC1065 TaxFormFinder

- Quitclaim deed from an individual to a husband wife and an individual oregon form

- Oregon corporation form

- Oregon deed 497323597 form

- Oregon disclaimer form

- Response to demand for list of services individual oregon form

- Quitclaim deed by two individuals to husband and wife oregon form

- Warranty deed from two individuals to husband and wife oregon form

- Deed husband wife 497323603 form

Find out other South Carolina Partnership Return SC1065 TaxFormFinder

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free