PartnershipForms SC Department of Revenue 2023

Understanding the South Carolina Partnership Form

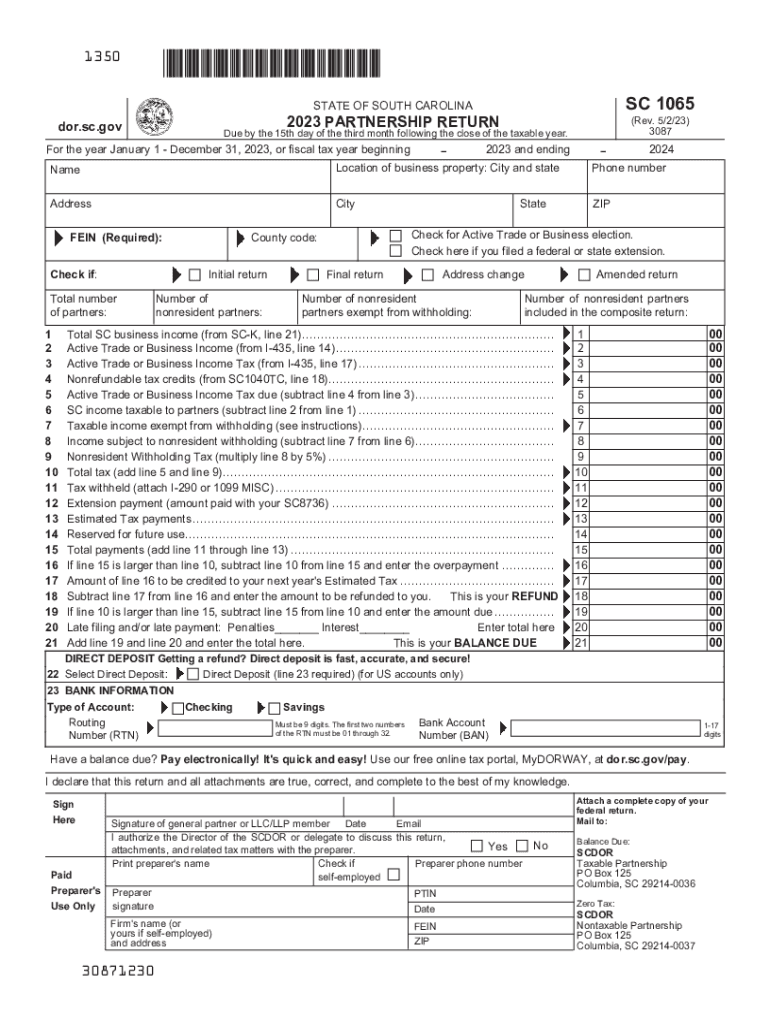

The South Carolina partnership form, specifically the SC-1065, is a crucial document for partnerships operating within the state. This form is used to report the income, deductions, and credits of a partnership. It is essential for ensuring compliance with state tax regulations, as partnerships themselves do not pay income tax; instead, the income is passed through to the partners, who report it on their individual tax returns.

Steps to Complete the SC-1065 Form

Completing the SC-1065 form involves several key steps:

- Gather necessary information about the partnership, including its name, address, and federal employer identification number (EIN).

- Compile financial data, including total income, deductions, and credits for the tax year.

- Complete the SC-1065 form, ensuring all sections are filled out accurately, including the income statement and balance sheet.

- Prepare the SC K-1 forms for each partner, detailing their share of income, deductions, and credits.

- Review the form for accuracy before submission.

Filing Deadlines for the SC-1065

The SC-1065 form must be filed annually, with the deadline typically aligning with the federal tax return deadline. For most partnerships, this means the form is due on the fifteenth day of the third month following the end of the tax year. For partnerships operating on a calendar year, the deadline is March 15. It is important to stay informed about any changes to these deadlines to avoid penalties.

Required Documents for Filing

When preparing to file the SC-1065, certain documents are essential:

- Financial statements, including profit and loss statements and balance sheets.

- Records of income and expenses incurred throughout the year.

- Partnership agreement detailing the distribution of profits and losses among partners.

- Previous year's tax return, if applicable, for reference.

Legal Use of the SC-1065 Form

The SC-1065 form is legally required for partnerships in South Carolina to report their income to the state. Failure to file this form can result in penalties and interest on unpaid taxes. It is important for partnerships to understand their legal obligations regarding this form to ensure compliance with state tax laws.

Digital vs. Paper Version of the SC-1065

Partnerships have the option to file the SC-1065 form either digitally or via paper submission. The digital version allows for a more streamlined process, often reducing the likelihood of errors and expediting the filing process. Paper submissions, while still accepted, may take longer to process. Choosing the digital route can enhance efficiency and ensure timely filing.

Quick guide on how to complete partnershipforms sc department of revenue

Complete PartnershipForms SC Department Of Revenue effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, since you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle PartnershipForms SC Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest way to alter and electronically sign PartnershipForms SC Department Of Revenue with ease

- Find PartnershipForms SC Department Of Revenue and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and electronically sign PartnershipForms SC Department Of Revenue and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnershipforms sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the partnershipforms sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a South Carolina partnership?

A South Carolina partnership is a business structure where two or more individuals share ownership and responsibilities. This arrangement allows partners to collaborate and pool resources for various business ventures while enjoying certain tax benefits. Understanding the specifics of a South Carolina partnership can help you legally establish and manage your business effectively.

-

How can airSlate SignNow assist with South Carolina partnership agreements?

AirSlate SignNow simplifies the process of creating and signing partnership agreements for your South Carolina partnership. Our platform allows users to easily draft, send, and eSign essential documents, ensuring that every partner's responsibilities and shares are clearly defined. With airSlate SignNow, you'll streamline communication and reduce paperwork hassles.

-

What are the benefits of using airSlate SignNow for my South Carolina partnership?

Using airSlate SignNow for your South Carolina partnership offers numerous benefits, including enhanced efficiency and cost savings. Our easy-to-use platform allows for quick document turnaround and eSigning, increasing productivity within your organization. Additionally, your partnership will maintain compliance and security, as all documents are safely stored within our system.

-

What pricing plans does airSlate SignNow offer for businesses in South Carolina?

AirSlate SignNow provides flexible pricing plans tailored for businesses in South Carolina, making it easy to find the right fit for your partnership's needs. Whether you're a small startup or a larger enterprise, we offer various subscription tiers designed to accommodate different levels of usage. This ensures that your South Carolina partnership can leverage our tools without exceeding budget constraints.

-

Are there any integrations available for airSlate SignNow to help manage my South Carolina partnership?

Yes, airSlate SignNow integrates seamlessly with several popular software solutions, making it easier to manage your South Carolina partnership. Integrations include CRM platforms, cloud storage services, and project management tools, ensuring that all aspects of your business operate smoothly. These connections enhance workflow efficiency and keep relevant documents organized.

-

Is airSlate SignNow compliant with South Carolina laws for partnerships?

Absolutely! AirSlate SignNow is designed to comply with the relevant laws governing South Carolina partnerships. Our platform ensures that your digital documents, including partnership agreements and contracts, meet legal standards. This compliance helps build trust among partners and ensures that your business operates within legal parameters.

-

Can I customize documents for my South Carolina partnership using airSlate SignNow?

Yes, airSlate SignNow allows you to customize documents conveniently for your South Carolina partnership. You can easily modify templates to include specific terms, partner roles, and various clauses necessary for your agreements. This customization ensures that all partnership documents are tailored to your unique business needs.

Get more for PartnershipForms SC Department Of Revenue

- Counterfeit uttering 18 usc 472 form

- 18 us code473 dealing in counterfeit obligations or form

- 1462 forged endorsements charged under 18 usc 495 or form

- Jury instruction uttering a forged endorsementus legal forms

- 18 us code545 smuggling goods into the united states form

- 839 theft of government money or propertymodel jury form

- 18 us code chapter 31 embezzlement and theftus code form

- Charleston sc bankruptcy fraud attorneys criminal defense form

Find out other PartnershipForms SC Department Of Revenue

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template