State Tax Form 2 Form of List 2022

Key elements of the SC 1065 instructions 2022

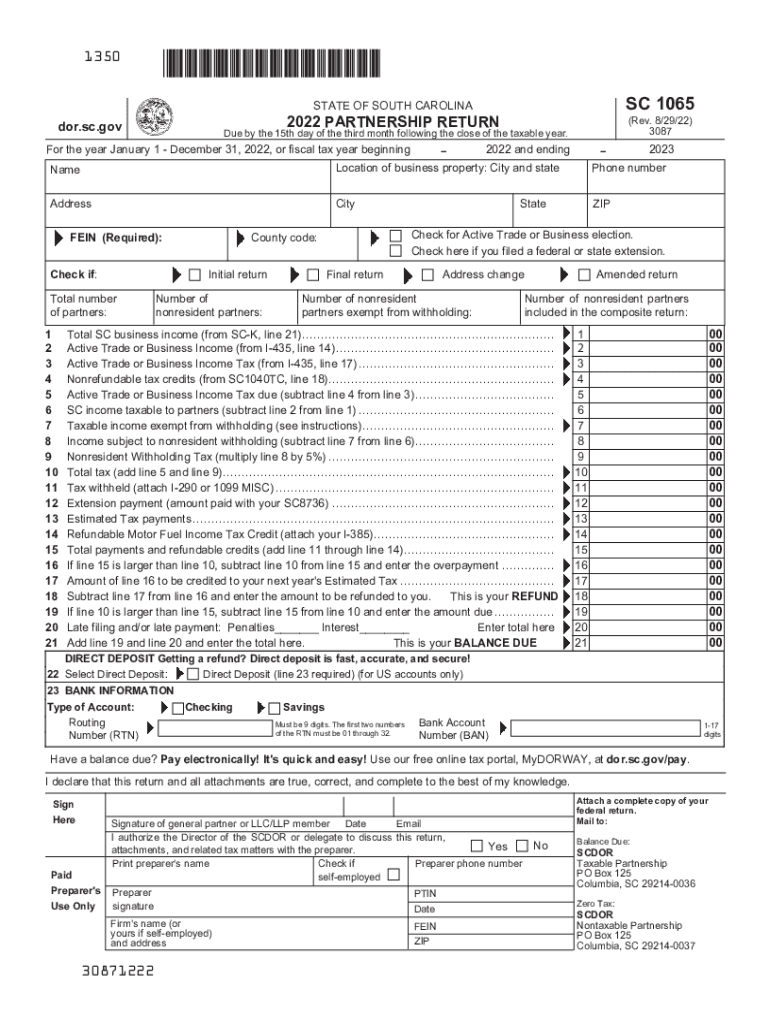

The SC 1065 instructions for 2022 provide essential guidance for partnerships operating in South Carolina. Understanding these key elements is crucial for accurate completion and compliance. The form captures vital information about the partnership's income, deductions, and credits, which are necessary for calculating the overall tax liability. Key elements include:

- Partnership Information: This section requires the partnership's name, address, and federal employer identification number (EIN).

- Income Reporting: Partnerships must report all sources of income, including sales, services, and other business activities.

- Deductions: Partnerships can deduct ordinary and necessary business expenses, which must be clearly itemized.

- Partner Information: Each partner's share of income, deductions, and credits must be reported accurately to ensure proper tax treatment.

Steps to complete the SC 1065 partnership return

Completing the SC 1065 partnership return involves several systematic steps to ensure accuracy and compliance. Follow these steps to navigate the process effectively:

- Gather Necessary Information: Collect all relevant financial documents, including income statements, expense records, and partner information.

- Fill Out the Form: Accurately complete each section of the SC 1065 form, ensuring all data is correct and corresponds with your records.

- Review for Accuracy: Double-check all entries for mathematical accuracy and completeness before submission.

- File the Return: Submit the completed SC 1065 form by the specified deadline, either electronically or by mail.

Filing deadlines for the SC 1065 return

Understanding the filing deadlines for the SC 1065 return is vital for compliance and avoiding penalties. The standard due date for filing the SC 1065 is typically the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the return is due by March 15. Extensions may be available, but it is essential to apply for them before the original due date.

Legal use of the SC 1065 partnership return

The SC 1065 partnership return is a legally binding document that must be completed accurately to comply with state tax laws. The information reported on this form is used to determine the partnership's tax obligations and the individual tax responsibilities of each partner. It is essential to maintain accurate records and ensure that all information is truthful and complete to avoid potential legal issues or audits.

Who issues the SC 1065 form?

The SC 1065 form is issued by the South Carolina Department of Revenue (SCDOR). This state agency oversees tax collection and compliance for partnerships operating within South Carolina. The SCDOR provides resources and guidance for completing the form and ensures that partnerships adhere to state tax regulations.

Required documents for the SC 1065 return

When preparing to file the SC 1065 return, certain documents are essential to ensure completeness and accuracy. Required documents include:

- Financial Statements: Income statements and balance sheets that detail the partnership's financial performance.

- Expense Records: Documentation of all business expenses incurred during the tax year.

- Partner Agreements: Any agreements that outline the terms of partnership and profit-sharing arrangements.

- Previous Tax Returns: Prior year tax returns may be necessary for reference and consistency.

Quick guide on how to complete state tax form 2 form of list

Prepare State Tax Form 2 Form Of List effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle State Tax Form 2 Form Of List on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign State Tax Form 2 Form Of List seamlessly

- Obtain State Tax Form 2 Form Of List and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign State Tax Form 2 Form Of List and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state tax form 2 form of list

Create this form in 5 minutes!

How to create an eSignature for the state tax form 2 form of list

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the SC 1065 instructions 2022?

The SC 1065 instructions 2022 provide detailed guidance on how to complete the South Carolina partnership income tax return. These instructions outline the necessary forms, required information, and key deadlines for filing accurately. Understanding these instructions is essential for partners to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with SC 1065 instructions 2022?

airSlate SignNow simplifies the process of sending and eSigning documents related to SC 1065 instructions 2022. Our user-friendly platform allows you to streamline document workflows, ensuring all partners can easily collaborate and submit the necessary forms. This efficiency helps reduce errors and accelerate the filing process.

-

Are there costs associated with using airSlate SignNow for SC 1065 instructions 2022?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs, including options for small businesses managing SC 1065 instructions 2022. Pricing is competitive and designed to provide excellent value given the features included, such as unlimited templates and seamless integrations. A free trial is also available to help you evaluate the service.

-

What features does airSlate SignNow provide for SC 1065 instructions 2022?

airSlate SignNow offers powerful features specifically designed to support your needs when working with SC 1065 instructions 2022. These include customizable templates, extensive eSigning options, document tracking, and secure cloud storage. These features enhance collaboration and ensure that all required documentation is properly managed and filed.

-

Is airSlate SignNow secure for handling SC 1065 instructions 2022?

Absolutely! airSlate SignNow prioritizes your security while handling SC 1065 instructions 2022. Our platform uses industry-standard encryption and complies with relevant regulations to protect your sensitive information. You can confidently manage and sign documents knowing that your data is secure.

-

What integrations does airSlate SignNow offer to support SC 1065 instructions 2022?

airSlate SignNow can integrate with various popular applications to enhance your workflow for SC 1065 instructions 2022. This includes CRMs, document management systems, and accounting software to ensure a seamless experience when accessing and sharing your documents. These integrations help streamline your processes and improve collaboration among team members.

-

Can I access airSlate SignNow from any device for SC 1065 instructions 2022?

Yes, airSlate SignNow is fully responsive and accessible from any device, making it perfect for handling SC 1065 instructions 2022 on the go. Whether you're using a desktop, tablet, or smartphone, you can send, sign, and manage your documents easily. This accessibility ensures you can stay productive regardless of your location.

Get more for State Tax Form 2 Form Of List

Find out other State Tax Form 2 Form Of List

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure