Individual Income Tax Forms SC Department of Revenue 2019

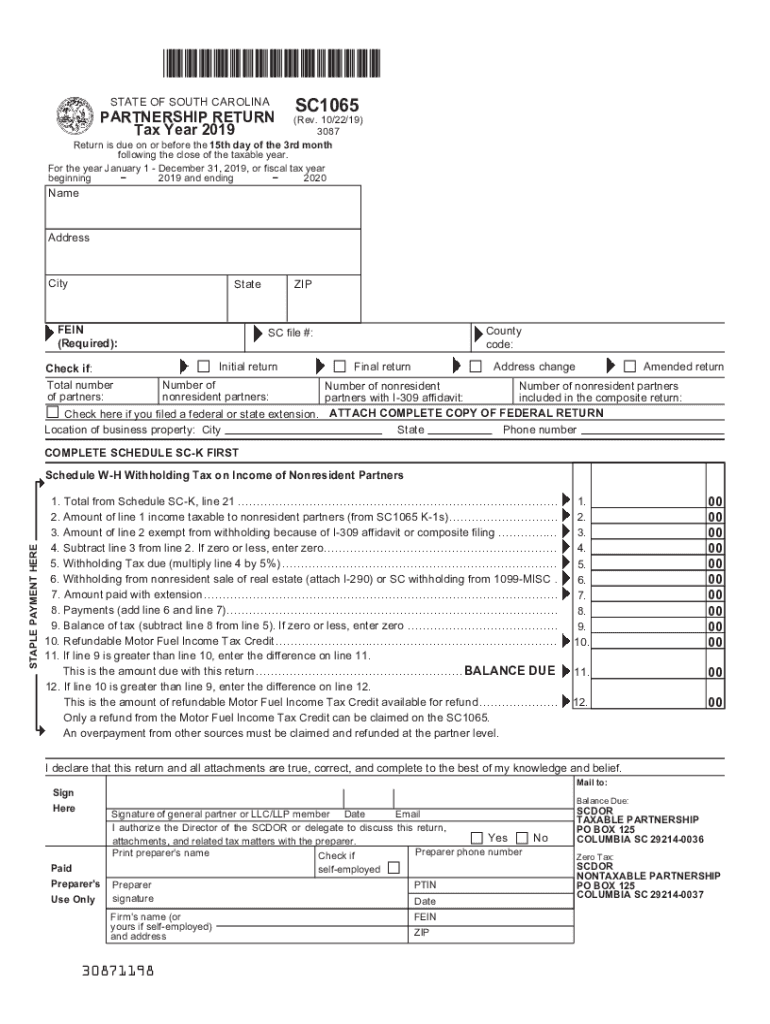

What is the SC 1065 Form?

The SC 1065 form is a state partnership return used by partnerships operating in South Carolina to report income, deductions, and credits. This form is essential for partnerships to comply with state tax regulations. It allows the partnership to report its income and allocate it among partners, who then report their respective shares on their individual tax returns. Understanding this form is crucial for ensuring accurate tax reporting and compliance with the South Carolina Department of Revenue.

Steps to Complete the SC 1065 Form

Completing the SC 1065 form involves several key steps:

- Gather necessary financial documents, including income statements, expense records, and partner information.

- Fill out the basic information section, including the partnership name, address, and federal employer identification number (EIN).

- Report the partnership's total income and allowable deductions on the form.

- Allocate income and deductions to each partner based on their ownership percentage.

- Complete any additional schedules or attachments required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Legal Use of the SC 1065 Form

The SC 1065 form serves a legal purpose by documenting the income and expenses of a partnership in South Carolina. Properly completing and filing this form is essential for compliance with state tax laws. Failure to file the SC 1065 can result in penalties and interest on unpaid taxes. Additionally, maintaining accurate records related to the SC 1065 form can support the partnership in case of an audit by the South Carolina Department of Revenue.

Filing Deadlines for the SC 1065 Form

Partnerships must file the SC 1065 form by the 15th day of the fourth month following the end of their tax year. For most partnerships operating on a calendar year, this means the form is due on April 15. It is important to be aware of these deadlines to avoid late filing penalties. Partnerships can apply for an extension if needed, but the extension must be filed before the original due date.

Required Documents for the SC 1065 Form

To complete the SC 1065 form accurately, partnerships should gather the following documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of expenses incurred, such as receipts and invoices.

- Information on each partner, including their ownership percentage and tax identification numbers.

Penalties for Non-Compliance with the SC 1065 Form

Failure to file the SC 1065 form or inaccuracies in the information provided can lead to significant penalties. These penalties may include fines imposed by the South Carolina Department of Revenue and interest on any unpaid taxes. It is crucial for partnerships to ensure that they file their returns accurately and on time to avoid these consequences.

Quick guide on how to complete individual income tax forms sc department of revenue

Complete Individual Income Tax Forms SC Department Of Revenue seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents rapidly without delays. Manage Individual Income Tax Forms SC Department Of Revenue on any platform using airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Individual Income Tax Forms SC Department Of Revenue effortlessly

- Locate Individual Income Tax Forms SC Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to store your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Individual Income Tax Forms SC Department Of Revenue and ensure exceptional communication at any stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax forms sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the individual income tax forms sc department of revenue

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the sc1065 2018 form and why is it important?

The sc1065 2018 form is a tax document used by partnerships to report income, deductions, and credits to the Internal Revenue Service. It is important because accurately completing and filing it can help avoid penalties and ensure compliance with tax regulations.

-

How does airSlate SignNow simplify the process of handling sc1065 2018 forms?

AirSlate SignNow simplifies the sc1065 2018 form process by offering an intuitive electronic signature solution that allows users to easily fill out, sign, and send documents online. This streamlines the workflow, reduces paper usage, and increases efficiency in completing tax-related tasks.

-

What features of airSlate SignNow are beneficial for managing sc1065 2018 forms?

AirSlate SignNow provides features such as customizable templates, in-app signing, and secure storage that specifically cater to the needs of managing sc1065 2018 forms. These features ensure that users can access their documents anytime, collaborate with partners, and maintain compliance effortlessly.

-

Is airSlate SignNow a cost-effective solution for filing sc1065 2018 forms?

Yes, airSlate SignNow is a cost-effective solution for filing sc1065 2018 forms, offering competitive pricing plans tailored to fit various business sizes. By reducing the need for physical paperwork and streamlining the signing process, users can save both time and money.

-

Can I integrate airSlate SignNow with other software for sc1065 2018 form management?

Absolutely! AirSlate SignNow can easily integrate with various applications like accounting software and document management systems, making it an ideal choice for streamlining the management of sc1065 2018 forms. This integration enhances productivity and helps keep all necessary information in one place.

-

What benefits does eSigning sc1065 2018 forms offer?

eSigning sc1065 2018 forms offers multiple benefits, such as faster turnaround times, improved accuracy, and enhanced security. By utilizing airSlate SignNow’s electronic signature capabilities, businesses can ensure timely submissions while eliminating the risks associated with traditional paper processes.

-

How does airSlate SignNow ensure the security of sc1065 2018 forms?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sc1065 2018 forms and sensitive data. This commitment to security helps businesses confidently manage their documentation without compromising privacy or compliance.

Get more for Individual Income Tax Forms SC Department Of Revenue

- Vermont tenant form

- Guaranty or guarantee of payment of rent vermont form

- Letter from landlord to tenant as notice of default on commercial lease vermont form

- Residential or rental lease extension agreement vermont form

- Commercial rental lease application questionnaire vermont form

- Rental application vermont form

- Residential rental lease application vermont form

- Salary verification form for potential lease vermont

Find out other Individual Income Tax Forms SC Department Of Revenue

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now