SC 1065 2020

What is the SC 1065

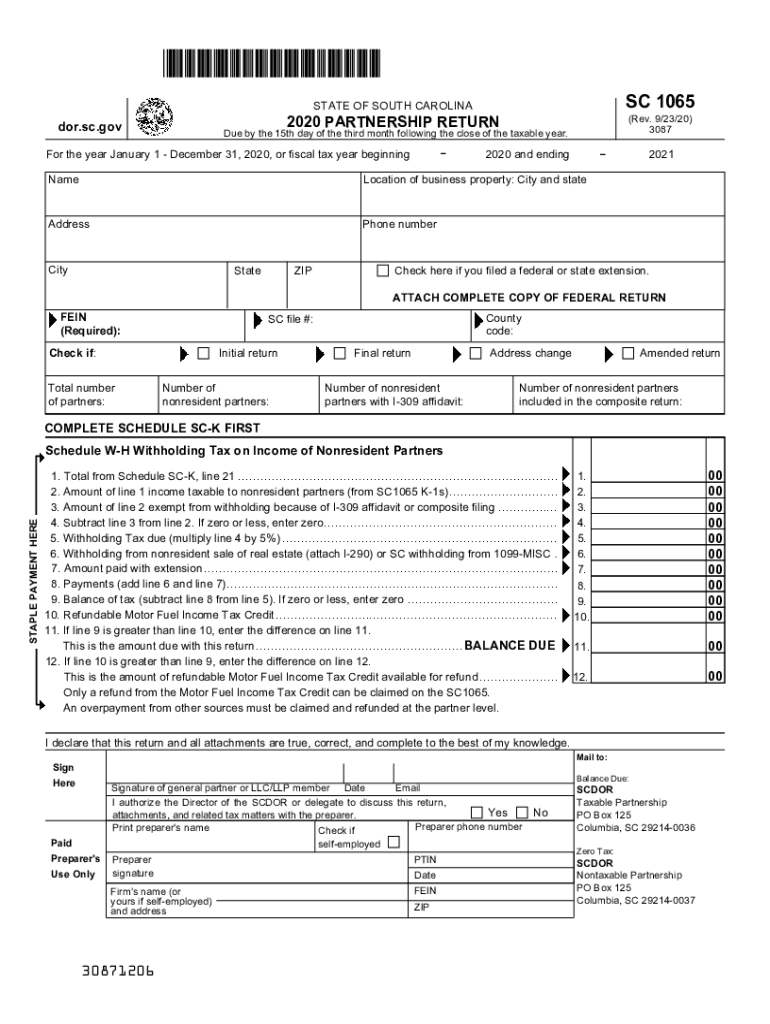

The SC 1065 is the South Carolina Partnership Return, a crucial tax form used by partnerships operating within the state. This form is designed to report the income, deductions, and credits of partnerships to the South Carolina Department of Revenue. It serves as a means for partnerships to fulfill their tax obligations while providing the necessary information for the state to assess the partnership's tax liability accurately. Understanding the SC 1065 is essential for compliance and ensuring that all partners receive their appropriate K-1 forms for individual tax reporting.

Steps to complete the SC 1065

Completing the SC 1065 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense records, and prior year tax returns. Next, fill out the SC 1065 form with details about the partnership, including the names and addresses of all partners, as well as the partnership's federal employer identification number (EIN).

Once the basic information is entered, report the partnership's income and deductions. This includes any income generated from business operations, as well as allowable deductions such as operating expenses and depreciation. After completing the income and deductions sections, calculate the partnership's total income and any applicable tax credits. Finally, ensure that all partners' information is accurately reflected, as this will be crucial for their individual K-1 forms.

Legal use of the SC 1065

The SC 1065 is legally binding when completed and submitted according to South Carolina tax laws. To ensure its legal standing, partnerships must adhere to the requirements set forth by the South Carolina Department of Revenue. This includes providing accurate and truthful information on the form, as well as obtaining the necessary signatures from all partners. Electronic signatures, when used in conjunction with a compliant eSignature solution, can also be legally valid, provided they meet the standards outlined in federal and state laws.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the SC 1065 to avoid penalties. Typically, the SC 1065 is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. If a partnership requires additional time, it can file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the SC 1065 accurately, several documents are necessary. Partnerships should gather:

- Financial statements, including profit and loss statements

- Records of all income and expenses

- Prior year SC 1065 returns, if applicable

- Partners' Social Security numbers or EINs

- Documentation for any tax credits being claimed

Having these documents ready can streamline the completion process and help ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The SC 1065 can be submitted through various methods, providing flexibility for partnerships. Electronic filing is available through the South Carolina Department of Revenue's online portal, which allows for quick processing and confirmation of submission. Alternatively, partnerships can choose to mail the completed form to the appropriate address provided by the state. In-person submissions are also an option, although they may require an appointment. Regardless of the method chosen, it is important to keep copies of the submitted form and any supporting documents for future reference.

Quick guide on how to complete sc 1065

Easily Prepare SC 1065 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle SC 1065 on any device through the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The Simplest Way to Modify and Electronically Sign SC 1065 Effortlessly

- Locate SC 1065 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign SC 1065 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1065

Create this form in 5 minutes!

How to create an eSignature for the sc 1065

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is sc1065 in the context of airSlate SignNow?

The term sc1065 refers to a specific functionality within airSlate SignNow that streamlines document workflows. It allows users to easily send and eSign documents, ensuring both security and efficiency. By utilizing sc1065, businesses can manage their documents more effectively.

-

How does airSlate SignNow pricing work for sc1065 users?

airSlate SignNow offers flexible pricing plans for users interested in utilizing sc1065 features. Plans vary based on the number of users and specific functionalities required. Businesses can sign up for a free trial to explore how sc1065 can benefit their operations without immediate commitment.

-

What are the key features of sc1065 in airSlate SignNow?

Key features of sc1065 include automatic document tracking, advanced security measures, and user-friendly eSigning capabilities. This ensures that every document sent is monitored, secure, and easy to sign for all parties involved. The sc1065 feature set is designed to enhance productivity in any business environment.

-

How can sc1065 improve my business workflow?

Integrating sc1065 into your business workflow can signNowly streamline document management processes. By automating signatures and reminders, you can reduce turnaround times and improve team collaboration. This leads to increased efficiency and allows your team to focus on more strategic tasks.

-

What benefits does sc1065 provide for remote teams?

sc1065 is especially beneficial for remote teams as it enables seamless communication and document sharing regardless of location. Teams can easily eSign documents from anywhere, which speeds up the approval process and keeps projects moving forward. This flexibility fosters collaboration and enhances overall productivity for remote workers.

-

Can sc1065 be integrated with other software solutions?

Yes, sc1065 can be integrated with various software solutions to enhance its functionality. Whether you use CRM systems, accounting software, or project management tools, sc1065's integration capabilities allow for a smooth flow of information across platforms. This interoperability ensures that your document management system works in harmony with your existing tools.

-

Is sc1065 compliant with legal standards?

Absolutely! sc1065 adheres to all necessary legal standards and regulations for electronic signatures, making it a reliable choice for businesses. It ensures that all eSigned documents maintained in the airSlate SignNow platform are legally binding and securely stored. Compliance with these standards gives users peace of mind.

Get more for SC 1065

Find out other SC 1065

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself