Sc1065 Form 2017

What is the Sc1065 Form

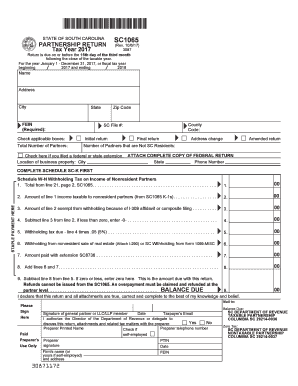

The Sc1065 Form is a tax document used by partnerships to report income, deductions, gains, losses, and other tax-related information to the Internal Revenue Service (IRS). This form is essential for partnerships operating in the United States, as it provides a clear overview of the partnership's financial activities for the tax year. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, enabling them to report this information on their individual tax returns.

How to use the Sc1065 Form

Using the Sc1065 Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation related to the partnership's activities. Next, fill out the form by entering the partnership's identifying information, including its name, address, and Employer Identification Number (EIN). Report all income and deductions accurately, ensuring that each partner's share is correctly calculated. Finally, review the completed form for accuracy before submitting it to the IRS.

Steps to complete the Sc1065 Form

Completing the Sc1065 Form requires attention to detail. Follow these steps:

- Gather financial records and documents related to the partnership.

- Enter the partnership's name, address, and EIN at the top of the form.

- Report total income earned by the partnership, including ordinary business income and other income sources.

- List all deductions, such as business expenses, salaries, and other allowable deductions.

- Calculate the partnership's taxable income by subtracting total deductions from total income.

- Complete the Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

- Review the form for accuracy and ensure all required signatures are present.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Sc1065 Form

The Sc1065 Form is legally recognized by the IRS for reporting partnership income and expenses. It must be completed accurately to comply with federal tax laws. Incorrect or incomplete submissions may lead to penalties or audits. Partnerships are required to file this form annually, ensuring transparency in their financial dealings. Additionally, partners must use the information from the Sc1065 Form and their respective K-1s to report income on their individual tax returns, which is crucial for maintaining compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Sc1065 Form are critical for compliance. Generally, partnerships must file the form by March 15 of the year following the tax year being reported. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension to file the Sc1065 Form, but it is essential to note that this extension does not apply to any taxes owed, which must be paid by the original due date to avoid penalties.

Who Issues the Form

The Sc1065 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that partnerships understand their reporting obligations. It is important for partnerships to refer to the IRS website or official publications for the most current version of the form and any updates regarding filing requirements.

Quick guide on how to complete sc1065 2017 form

Your assistance manual on how to prepare your Sc1065 Form

If you’re curious about how to finalize and submit your Sc1065 Form, here are a few straightforward guidelines to simplify tax declaration.

To start, you simply need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document management tool that allows you to edit, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Sc1065 Form in just a few minutes:

- Create your account and start working on PDFs almost immediately.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Sc1065 Form in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to append your legally-recognized eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this guide to file your taxes online with airSlate SignNow. Be aware that submitting on paper can lead to more errors and delays in refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc1065 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the sc1065 2017 form

How to create an electronic signature for your Sc1065 2017 Form in the online mode

How to make an electronic signature for the Sc1065 2017 Form in Chrome

How to generate an eSignature for putting it on the Sc1065 2017 Form in Gmail

How to make an electronic signature for the Sc1065 2017 Form right from your smart phone

How to make an eSignature for the Sc1065 2017 Form on iOS devices

How to generate an eSignature for the Sc1065 2017 Form on Android devices

People also ask

-

What is the SC1065 Form?

The SC1065 Form is a tax document used by partnerships operating in South Carolina to report income, deductions, and credits. It is essential for partnerships to complete this form accurately to ensure compliance with state tax regulations. airSlate SignNow simplifies the process of eSigning the SC1065 Form, making it easy for all partners to review and submit their information.

-

How can I eSign the SC1065 Form using airSlate SignNow?

You can easily eSign the SC1065 Form using airSlate SignNow by uploading the document to our platform and inviting your partners to sign electronically. Our user-friendly interface allows for quick navigation and seamless signing, ensuring that your form is completed promptly. With airSlate SignNow, you can track the signing process in real-time for added convenience.

-

Is airSlate SignNow suitable for filing the SC1065 Form?

Yes, airSlate SignNow is an excellent solution for filing the SC1065 Form. Our platform supports document management and eSigning, making it easier for partnerships to prepare and submit their tax forms electronically. With airSlate SignNow, you can ensure that your SC1065 Form is filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for the SC1065 Form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a small partnership or a larger organization, you can find a plan that suits your requirements for eSigning the SC1065 Form. Visit our pricing page to explore different options, which include monthly and annual subscriptions.

-

Can I integrate airSlate SignNow with other software for the SC1065 Form?

Absolutely! airSlate SignNow offers integrations with popular software such as Google Drive, Dropbox, and more. These integrations allow you to streamline your workflow for the SC1065 Form, ensuring that you can easily access and manage your documents across different platforms.

-

What benefits does airSlate SignNow provide for signing the SC1065 Form?

Using airSlate SignNow for the SC1065 Form offers numerous benefits, including enhanced security, ease of use, and faster turnaround times. By eSigning your documents online, you can reduce the need for paper, save time, and ensure that all signatures are legally binding. Our platform also provides audit trails for added transparency.

-

Is it safe to use airSlate SignNow for the SC1065 Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your SC1065 Form is handled safely. We use industry-standard encryption and adhere to legal regulations to protect your sensitive information. With airSlate SignNow, you can confidently eSign your tax documents without worrying about data bsignNowes.

Get more for Sc1065 Form

- Claim voucher form

- Mold remediation worker license applicationrenewal texas dshs state tx form

- Drying certificate form

- Nics appeals form

- Ayurvedic constitution quiz touchstone health touchstonehealth form

- Mavis mcmullen housing society form

- Planned death at home form

- School social studies assignment form

Find out other Sc1065 Form

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online