Total from Line 21 Page 2 SC1065 2 Amount of Lin 2024-2026

Understanding the Total From Line 21 Page 2 SC1065

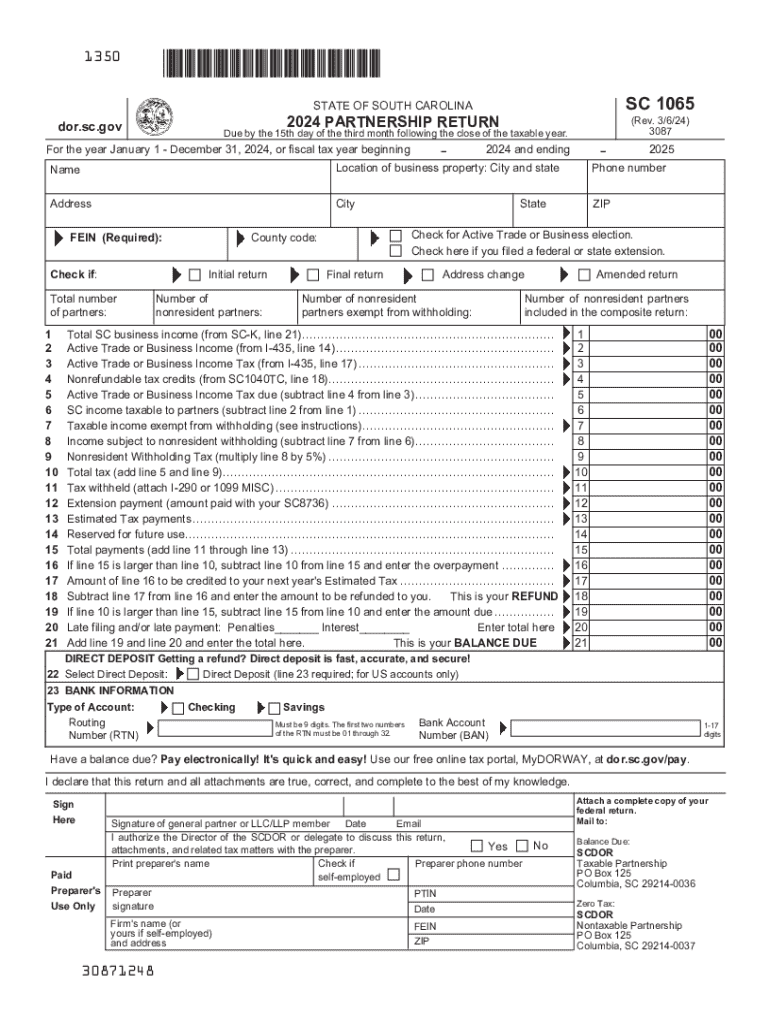

The Total From Line 21 on Page 2 of the SC1065 form represents the total income or loss for a partnership in South Carolina. This figure is crucial as it reflects the overall financial performance of the partnership for the tax year. It includes various income sources, deductions, and adjustments that have been calculated throughout the form. Understanding this total helps partners determine their share of income or loss, which is reported on their individual tax returns.

Steps to Complete the Total From Line 21 Page 2 SC1065

To accurately complete the Total From Line 21 on the SC1065 form, follow these steps:

- Begin by gathering all relevant financial documents, including income statements, expense reports, and prior year tax returns.

- Calculate total income from all sources, ensuring to include revenue from sales, services, and any other income streams.

- Deduct allowable business expenses, such as operating costs, salaries, and other deductions specified by the IRS and South Carolina tax regulations.

- Adjust for any special items or adjustments that may impact the total, such as depreciation or credits.

- Enter the final amount on Line 21 of Page 2 of the SC1065 form, ensuring accuracy to avoid issues with your filing.

Filing Deadlines and Important Dates

For the 2024 SC1065 return, it is essential to be aware of the filing deadlines to avoid penalties. The due date for filing the SC1065 is typically the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15, 2024. If additional time is needed, partnerships can file for an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Required Documents for the SC1065 Filing

When preparing to file the SC1065 form, certain documents are necessary to ensure a complete and accurate submission. These documents include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received by the partnership.

- Documentation of all business expenses incurred during the tax year.

- Partnership agreements that outline the distribution of income and losses among partners.

- Any prior year tax returns for reference and consistency in reporting.

Form Submission Methods for SC1065

The SC1065 form can be submitted through various methods, providing flexibility for partnerships. These methods include:

- Online Submission: Partnerships can file the SC1065 electronically through the South Carolina Department of Revenue's e-filing system, which offers a streamlined process.

- Mail: The form can also be printed and mailed to the appropriate address as specified by the South Carolina Department of Revenue.

- In-Person: Partnerships may choose to deliver the completed form in person to their local Department of Revenue office, ensuring it is received on time.

IRS Guidelines for Partnerships

Partnerships must adhere to specific IRS guidelines when filing the SC1065 form. These guidelines include maintaining accurate records of income and expenses, ensuring that all partners receive a Schedule K-1 detailing their share of the partnership's income, deductions, and credits. Additionally, partnerships should be aware of the different tax treatments for various types of income and ensure compliance with federal and state tax laws to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct total from line 21 page 2 sc1065 2 amount of lin

Create this form in 5 minutes!

How to create an eSignature for the total from line 21 page 2 sc1065 2 amount of lin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 SC return process with airSlate SignNow?

The 2024 SC return process with airSlate SignNow simplifies document management by allowing users to electronically sign and send necessary forms. This ensures that your 2024 SC return is filed accurately and on time, reducing the risk of errors. Our platform is designed to streamline the entire process, making it user-friendly for everyone.

-

How much does airSlate SignNow cost for managing the 2024 SC return?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those focused on the 2024 SC return. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow provide for the 2024 SC return?

For the 2024 SC return, airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document status. These features help ensure that your documents are processed efficiently and securely. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other tools for my 2024 SC return?

Yes, airSlate SignNow offers seamless integrations with various tools and applications that can assist in managing your 2024 SC return. This includes popular accounting software and document management systems. Integrating these tools can enhance your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the 2024 SC return?

Using airSlate SignNow for your 2024 SC return provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete your returns faster while ensuring compliance with legal standards. This means you can focus more on your business and less on administrative tasks.

-

Is airSlate SignNow secure for handling my 2024 SC return?

Absolutely! airSlate SignNow prioritizes security, especially when it comes to sensitive documents like the 2024 SC return. We utilize advanced encryption and security protocols to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

-

How can I get started with airSlate SignNow for my 2024 SC return?

Getting started with airSlate SignNow for your 2024 SC return is easy. Simply sign up for an account on our website, choose the plan that suits your needs, and start uploading your documents. Our user-friendly interface will guide you through the process of sending and signing documents in no time.

Get more for Total From Line 21 Page 2 SC1065 2 Amount Of Lin

- Change name form pdf

- Ak name change form

- Certificate of change of name minor name change alaska form

- Alaska secured promissory note alaska form

- Alaska unsecured installment payment promissory note for fixed rate alaska form

- Notice of option for recording alaska form

- Alaska documents form

- General durable power of attorney for property and finances or financial effective upon disability alaska form

Find out other Total From Line 21 Page 2 SC1065 2 Amount Of Lin

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple