Sc1065 2018

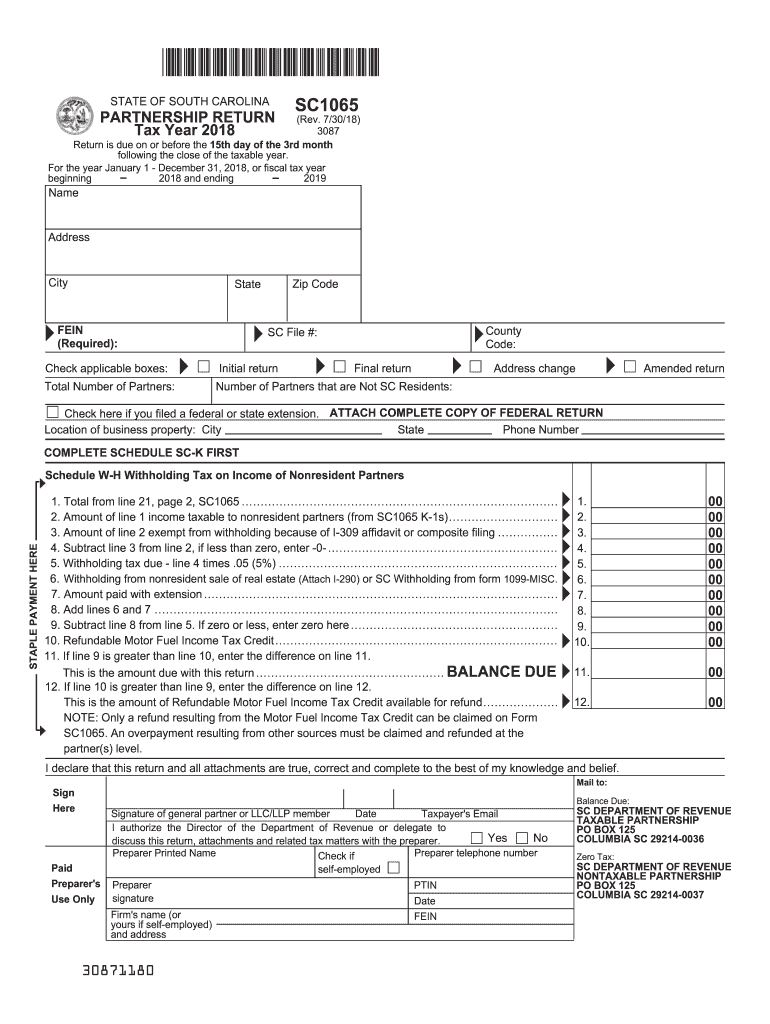

What is the SC1065?

The SC1065 is a tax form used by partnerships in South Carolina to report income, deductions, and credits. This form is essential for partnerships that operate within the state, as it provides a comprehensive overview of the partnership's financial activities for the tax year. The SC1065 must be filed annually, and it captures the necessary details to ensure compliance with state tax regulations. Each partner in the partnership receives a Schedule K-1, which outlines their share of the partnership's income, deductions, and credits, allowing them to report this information on their individual tax returns.

Steps to Complete the SC1065

Completing the SC1065 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements, expense reports, and prior year tax returns. Follow these steps:

- Fill out the basic information section, including the partnership's name, address, and federal employer identification number (EIN).

- Report the total income generated by the partnership during the tax year, including all revenue streams.

- Detail the deductions the partnership is eligible for, such as business expenses and depreciation.

- Calculate the net income or loss by subtracting total deductions from total income.

- Distribute the income or loss to each partner using Schedule K-1, ensuring that each partner's share aligns with the partnership agreement.

- Review the completed form for accuracy and ensure all required signatures are obtained.

Legal Use of the SC1065

The SC1065 is legally recognized by the South Carolina Department of Revenue as the official document for reporting partnership income. To ensure legal compliance, partnerships must adhere to the guidelines set forth by the IRS and state tax authorities. This includes accurate reporting of income, deductions, and ensuring that all partners receive their appropriate K-1 forms. Failure to file the SC1065 correctly can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

The filing deadline for the SC1065 typically aligns with the federal tax deadline, which is usually April fifteenth. However, partnerships may request an extension, allowing them to file by September fifteenth. It is crucial for partnerships to be aware of these dates to avoid late filing penalties. Additionally, any payments due should be submitted by the original deadline to prevent interest accrual.

Required Documents

To successfully complete the SC1065, partnerships need to gather several key documents, including:

- Financial statements detailing income and expenses for the tax year.

- Previous year’s tax returns for reference.

- Partnership agreement outlining profit and loss distribution among partners.

- Records of any credits or deductions the partnership intends to claim.

Form Submission Methods

The SC1065 can be submitted through various methods, ensuring flexibility for partnerships. Options include:

- Online filing through the South Carolina Department of Revenue's e-filing system, which offers a secure and efficient way to submit the form.

- Mailing a paper copy of the completed SC1065 to the appropriate address provided by the state.

- In-person submission at designated tax offices, allowing for direct interaction with tax officials if needed.

Penalties for Non-Compliance

Failure to file the SC1065 accurately and on time can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential audits by the South Carolina Department of Revenue. Partnerships should prioritize compliance to avoid these issues, ensuring all required forms are submitted correctly and within the designated timeframes.

Quick guide on how to complete sc1065 2018 2019 form

Your assistance manual on how to prepare your Sc1065

If you’re wondering how to generate and submit your Sc1065, here are a few brief instructions on how to simplify tax processing.

To begin, simply create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, produce, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and easily revert to revise answers as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Sc1065 in just a few minutes:

- Sign up for your account and start editing PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Sc1065 in our editor.

- Complete the necessary fillable fields with your information (text entries, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if required).

- Review your document and rectify any inaccuracies.

- Save changes, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Remember that submitting hard copies may lead to return mistakes and delay refunds. Of course, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc1065 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the sc1065 2018 2019 form

How to generate an electronic signature for the Sc1065 2018 2019 Form online

How to create an eSignature for your Sc1065 2018 2019 Form in Chrome

How to create an eSignature for signing the Sc1065 2018 2019 Form in Gmail

How to make an eSignature for the Sc1065 2018 2019 Form from your smartphone

How to create an electronic signature for the Sc1065 2018 2019 Form on iOS devices

How to generate an eSignature for the Sc1065 2018 2019 Form on Android devices

People also ask

-

What is Sc1065 in relation to airSlate SignNow?

Sc1065 refers to a specific feature set within airSlate SignNow that streamlines document signing processes. This functionality is designed to enhance user experience by providing intuitive tools for eSigning and document management, making it easier for businesses to manage their signing workflows.

-

How much does it cost to use airSlate SignNow with Sc1065 features?

Pricing for airSlate SignNow varies based on the plan selected, which includes access to the Sc1065 features. Businesses can choose from different tiers depending on their needs, with the most cost-effective option designed to provide essential eSigning capabilities without compromising on quality.

-

What benefits does Sc1065 offer for document management?

Using Sc1065 within airSlate SignNow provides numerous benefits for document management, including enhanced security and compliance. This feature empowers businesses to send, track, and manage documents seamlessly, ensuring that all signatures are legally binding and securely stored.

-

Is Sc1065 easy to integrate with other tools?

Yes, Sc1065 is designed for easy integration with a variety of business tools and software. Whether you use CRM systems, cloud storage services, or other productivity applications, airSlate SignNow makes it simple to connect and streamline your document signing processes.

-

Can I customize templates using Sc1065 in airSlate SignNow?

Absolutely! Sc1065 allows users to create and customize document templates to suit their specific needs. This feature ensures that businesses can maintain brand consistency while simplifying the document preparation process.

-

What types of documents can I sign using Sc1065?

With Sc1065, you can sign a wide range of documents, including contracts, agreements, and forms. airSlate SignNow supports various file formats, allowing you to manage all your signing needs in one convenient platform.

-

Does Sc1065 support mobile signing?

Yes, Sc1065 in airSlate SignNow supports mobile signing, enabling users to eSign documents from their smartphones or tablets. This flexibility ensures that you can get documents signed quickly, no matter where you are.

Get more for Sc1065

- Certificado de estudio primaria 281272268 form

- Fda form 3636

- Medically necessary contact lens benefit eyemed addendum form benefits mt

- Self transportation form aacps

- Notice of employee separation soiportal soi com form

- Duxbury assessor form

- Sample oral moderate sedation recordchart nopatie form

- Boxing canada medical form

Find out other Sc1065

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form