Tax Iowa GovIowa Department of Revenue State of Iowa TaxesIowa 2021

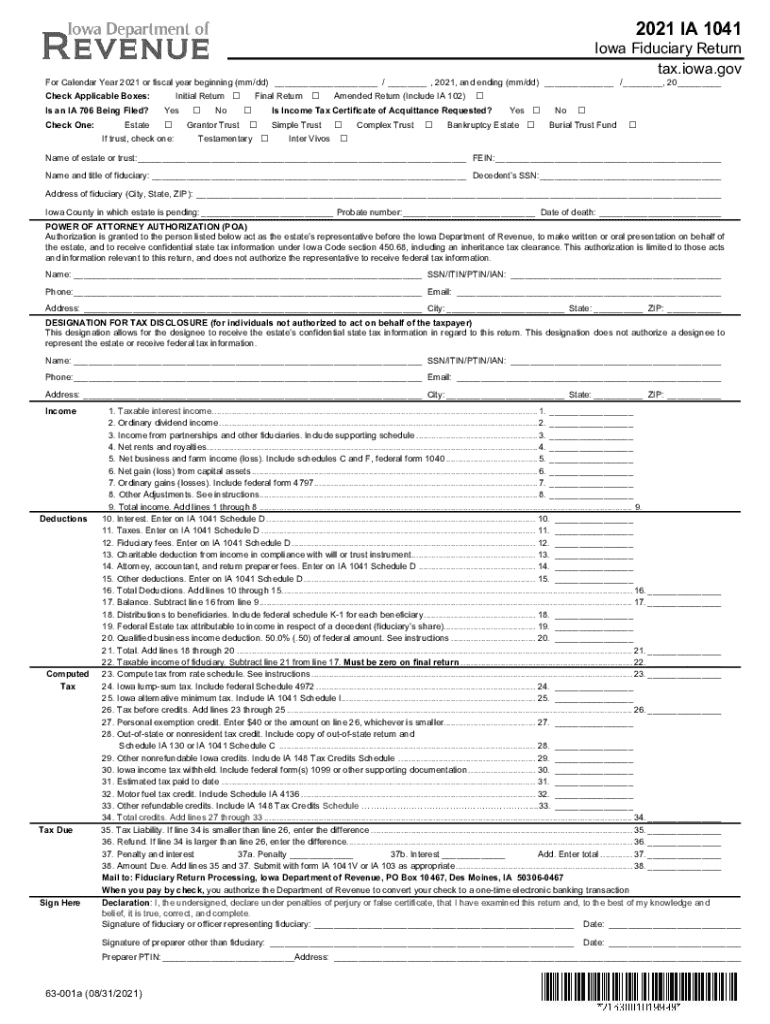

Understanding the Iowa 1041 Form

The Iowa 1041 form, also known as the Iowa fiduciary return, is a tax document specifically designed for estates and trusts in Iowa. This form is essential for reporting income generated by the fiduciary entity and ensuring compliance with state tax regulations. It is important for fiduciaries to accurately complete this form to avoid potential penalties and ensure that the estate or trust fulfills its tax obligations.

Steps to Complete the Iowa 1041 Form

Completing the Iowa 1041 form involves several key steps:

- Gather all necessary financial documents, including income statements, deductions, and any applicable credits.

- Fill out the form accurately, ensuring that all income and deductions are reported correctly.

- Review the completed form for accuracy and completeness before submission.

- Sign the form electronically or manually, depending on your submission method.

Filing Deadlines for the Iowa 1041 Form

It is crucial to be aware of the filing deadlines associated with the Iowa 1041 form. Generally, the form is due on the first day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means the form must be filed by April 30. Late submissions may result in penalties, so timely filing is essential.

Required Documents for Filing

When preparing to file the Iowa 1041 form, certain documents are required to ensure accurate reporting:

- Income statements from all sources, including interest, dividends, and rental income.

- Records of deductions, such as administrative expenses, taxes paid, and distributions to beneficiaries.

- Any supporting documentation that verifies the income and deductions reported on the form.

Legal Use of the Iowa 1041 Form

The Iowa 1041 form is legally binding when completed and submitted in accordance with state tax laws. It is essential for fiduciaries to ensure that the form is filled out accurately and submitted on time to avoid legal repercussions. Utilizing a reliable electronic signature solution can enhance the legitimacy of the submission, providing a secure and compliant method for signing and submitting the form.

Form Submission Methods

Fiduciaries have multiple options for submitting the Iowa 1041 form:

- Online submission through the Iowa Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate state tax office.

- In-person submission at designated tax offices, though this option may vary based on local regulations.

Quick guide on how to complete taxiowagoviowa department of revenue state of iowa taxesiowa

Effortlessly Prepare Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa on Any Device

Managing documents online has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to swiftly create, edit, and eSign your documents without delays. Handle Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa with Ease

- Locate Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxiowagoviowa department of revenue state of iowa taxesiowa

Create this form in 5 minutes!

How to create an eSignature for the taxiowagoviowa department of revenue state of iowa taxesiowa

The way to generate an e-signature for your PDF in the online mode

The way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is the Iowa 1041 form 2021?

The Iowa 1041 form 2021 is a tax form used by estates and trusts to report income, deductions, and credits that are taxable in the state of Iowa. It's essential for fiduciaries to understand how to complete this form accurately to ensure compliance with state tax laws.

-

How can I access the Iowa 1041 form 2021?

The Iowa 1041 form 2021 can typically be accessed through the Iowa Department of Revenue's website or through various tax preparation software. Using airSlate SignNow, you can easily send and sign this form electronically, streamlining your tax filing process.

-

What are the benefits of using airSlate SignNow for the Iowa 1041 form 2021?

Using airSlate SignNow for the Iowa 1041 form 2021 allows you to save time and reduce errors by eSigning documents electronically. Additionally, you can track the signing process and ensure all necessary signatures are obtained efficiently.

-

Is there a cost associated with eSigning the Iowa 1041 form 2021 on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow; however, it is considered a cost-effective solution compared to traditional methods. Pricing plans start at competitive rates, making it accessible for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for managing the Iowa 1041 form 2021?

Absolutely! airSlate SignNow offers various integrations with popular software, allowing you to manage the Iowa 1041 form 2021 seamlessly. By connecting with your existing tools, you can streamline your workflow and improve efficiency.

-

What features does airSlate SignNow offer for managing the Iowa 1041 form 2021?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and real-time tracking for managing the Iowa 1041 form 2021. These features help simplify the document management process and ensure compliance.

-

Is airSlate SignNow secure for eSigning the Iowa 1041 form 2021?

Yes, airSlate SignNow prioritizes security and uses industry-standard encryption to protect your sensitive information when eSigning the Iowa 1041 form 2021. You can trust that your documents are safe and compliant with regulations.

Get more for Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa

Find out other Tax iowa govIowa Department Of Revenue State Of Iowa TaxesIowa

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement