Iowa 1040 Form 2018

What is the Iowa 1040 Form

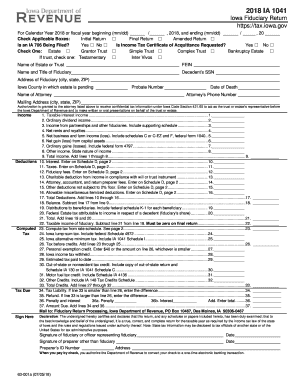

The Iowa 1040 Form, also known as the Iowa Individual Income Tax Return, is a state-specific tax form used by residents of Iowa to report their income and calculate their state tax liability. This form is essential for individuals who earn income, including wages, salaries, and other sources of revenue, and it must be filed annually with the Iowa Department of Revenue. The form captures various types of income, deductions, and credits that may apply to the taxpayer's situation, ensuring compliance with state tax laws.

Steps to Complete the Iowa 1040 Form

Completing the Iowa 1040 Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, fill out personal information such as your name, address, and Social Security number. Then, report your total income by entering amounts from your income statements. After that, apply any deductions and credits you qualify for to determine your taxable income. Finally, calculate your tax liability and determine if you owe taxes or are due a refund. Ensure you review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Iowa 1040 Form to avoid penalties and interest. Typically, the deadline for filing your Iowa state tax return is April 30 of the year following the tax year. For instance, for the 2018 tax year, the deadline would be April 30, 2019. In some cases, taxpayers may qualify for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties. Always check for any updates or changes to deadlines that may occur due to state regulations.

Required Documents

When preparing to file the Iowa 1040 Form, it is essential to have all required documents on hand. These documents typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

- Bank statements and receipts for itemized deductions

Having these documents readily available will streamline the process of completing the form and ensure that all income and deductions are accurately reported.

Form Submission Methods

The Iowa 1040 Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file electronically using approved e-filing software, which often provides a more efficient and faster processing time. Alternatively, individuals can print the completed form and mail it to the Iowa Department of Revenue. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own advantages, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to file the Iowa 1040 Form by the deadline or inaccurately reporting income can result in penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential legal consequences. The Iowa Department of Revenue may impose a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. To avoid these penalties, it is advisable to file on time and ensure that all information reported is accurate and complete.

Quick guide on how to complete ia1041 fidicuary income tax return 63001 iowa department of

Effortlessly manage Iowa 1040 Form on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Iowa 1040 Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to edit and electronically sign Iowa 1040 Form with ease

- Find Iowa 1040 Form and click Get Form to begin.

- Use the tools available to complete your document.

- Mark important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and has the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Iowa 1040 Form to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia1041 fidicuary income tax return 63001 iowa department of

Create this form in 5 minutes!

How to create an eSignature for the ia1041 fidicuary income tax return 63001 iowa department of

How to make an eSignature for your Ia1041 Fidicuary Income Tax Return 63001 Iowa Department Of in the online mode

How to generate an eSignature for your Ia1041 Fidicuary Income Tax Return 63001 Iowa Department Of in Chrome

How to generate an electronic signature for signing the Ia1041 Fidicuary Income Tax Return 63001 Iowa Department Of in Gmail

How to generate an eSignature for the Ia1041 Fidicuary Income Tax Return 63001 Iowa Department Of right from your smartphone

How to make an electronic signature for the Ia1041 Fidicuary Income Tax Return 63001 Iowa Department Of on iOS devices

How to generate an eSignature for the Ia1041 Fidicuary Income Tax Return 63001 Iowa Department Of on Android devices

People also ask

-

What is the 2018 IA 1041 form used for?

The 2018 IA 1041 form is primarily used for reporting income, deductions, and tax liability for estates and trusts in Iowa. It allows fiduciaries to file taxes on behalf of these entities. Understanding this form is crucial for proper tax compliance and efficient management of estate or trust funds.

-

How can airSlate SignNow help with completing the 2018 IA 1041?

airSlate SignNow provides a streamlined way to manage and electronically sign documents like the 2018 IA 1041 form. Our platform allows users to collaborate in real-time, ensuring that all information is correct before submission. By using airSlate SignNow, you can enhance efficiency and accuracy in tax document handling.

-

Is there a cost associated with using airSlate SignNow for the 2018 IA 1041?

Yes, there is a subscription fee for using airSlate SignNow, but it offers a cost-effective solution compared to traditional paper methods. The pricing is designed to fit businesses of all sizes, providing access to advanced features for managing the 2018 IA 1041 form. Consider our plans to find one that best suits your needs.

-

What features does airSlate SignNow offer for electronic signatures on the 2018 IA 1041?

With airSlate SignNow, you gain access to features like customizable templates, real-time tracking, and secure cloud storage. These features help streamline the process of signing the 2018 IA 1041 form digitally. The user-friendly interface ensures that you can manage these tasks efficiently.

-

Can I integrate airSlate SignNow with other tools for managing the 2018 IA 1041 documentation?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRMs, document management systems, and cloud storage solutions. This means you can easily incorporate our platform into your existing workflow for managing the 2018 IA 1041 and other important documents.

-

What are the benefits of using airSlate SignNow for tax-related documents like the 2018 IA 1041?

Using airSlate SignNow for tax documents like the 2018 IA 1041 can save you time and reduce paperwork. The platform enhances collaboration among stakeholders, facilitates quick document routing, and improves compliance with electronic signatures. This ensures that your tax filings are handled efficiently and accurately.

-

Is airSlate SignNow secure for submitting 2018 IA 1041 forms?

Yes, airSlate SignNow prioritizes security with advanced encryption standards and secure access controls. This means you can confidently handle sensitive information related to the 2018 IA 1041 form and other tax documents. Rest assured that your data will be protected while using our platform.

Get more for Iowa 1040 Form

- Northeast texas treatment center nttcruskorg form

- Divorce petitioner verification clark county nevada form

- Navmc 118 11 form

- Assisted living application for licensure dhmh dhmh maryland form

- Vr 091 form

- State of maryland department of health and mental hygiene dhmh maryland form

- What is request for appointment consideration form

- Dentaquest provider login form

Find out other Iowa 1040 Form

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile