IA 1041 Iowa Fiduciary Return Revenue Iowa Go 2024-2026

Understanding the 2024 Iowa Fiduciary Return

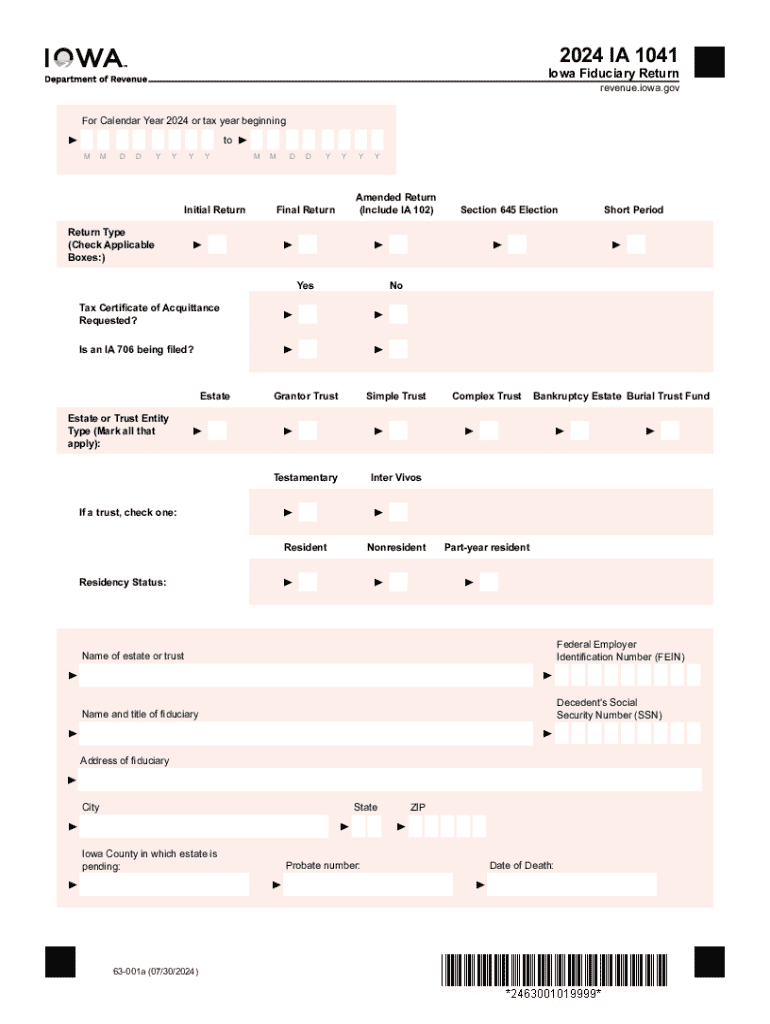

The 2024 Iowa 1041 form, also known as the Iowa Fiduciary Return, is designed for estates and trusts to report income and calculate the state tax owed. This form is essential for fiduciaries managing assets on behalf of beneficiaries. It ensures compliance with Iowa tax laws and provides a clear record of financial activities within the trust or estate. Understanding its purpose helps in fulfilling legal obligations and managing tax liabilities effectively.

Steps to Complete the 2024 Iowa 1041 Form

Filling out the 2024 Iowa 1041 form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Identify the beneficiaries and their respective shares of the income.

- Complete the required sections of the form, detailing income, deductions, and credits.

- Calculate the tax owed based on the net income reported.

- Review the completed form for accuracy before submission.

Key Elements of the 2024 Iowa 1041 Form

The 2024 Iowa 1041 form includes several critical components that must be accurately filled out:

- Income Reporting: All sources of income must be reported, including interest, dividends, and capital gains.

- Deductions: Eligible deductions can reduce taxable income, such as administrative expenses and distributions to beneficiaries.

- Tax Calculation: The form includes a section for calculating the state tax based on the net income.

- Signature Section: The fiduciary must sign the form, affirming the accuracy of the information provided.

Filing Deadlines for the 2024 Iowa 1041 Form

It is crucial to be aware of the filing deadlines for the 2024 Iowa 1041 form to avoid penalties:

- The form is typically due on the 15th day of the fourth month following the end of the tax year.

- Extensions may be available, but they must be filed before the original due date.

Required Documents for Submission

When preparing to file the 2024 Iowa 1041 form, gather the following documents:

- Income statements for the estate or trust.

- Records of expenses incurred during the tax year.

- Details of distributions made to beneficiaries.

- Any relevant tax documents, such as W-2s or 1099s.

Legal Use of the 2024 Iowa 1041 Form

The 2024 Iowa 1041 form serves a legal purpose in ensuring that estates and trusts comply with state tax regulations. Proper filing helps avoid legal issues and potential penalties associated with non-compliance. Fiduciaries must understand their responsibilities and the implications of the information reported on this form.

Create this form in 5 minutes or less

Find and fill out the correct ia 1041 iowa fiduciary return revenue iowa go

Create this form in 5 minutes!

How to create an eSignature for the ia 1041 iowa fiduciary return revenue iowa go

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Iowa 1041 form?

The 2024 Iowa 1041 form is a tax return form used by estates and trusts in Iowa to report income and calculate taxes owed. It is essential for fiduciaries to accurately complete this form to ensure compliance with state tax laws. Understanding the requirements of the 2024 Iowa 1041 form can help avoid penalties and ensure proper tax reporting.

-

How can airSlate SignNow help with the 2024 Iowa 1041 form?

airSlate SignNow provides a streamlined solution for electronically signing and sending the 2024 Iowa 1041 form. With its user-friendly interface, you can easily prepare, sign, and share your tax documents securely. This simplifies the process and saves time, allowing you to focus on other important tasks.

-

What are the pricing options for using airSlate SignNow for the 2024 Iowa 1041 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the 2024 Iowa 1041 form. You can choose from monthly or annual subscriptions, with options that include various features to enhance your document management experience. Check our website for the latest pricing details.

-

Are there any features specifically designed for the 2024 Iowa 1041 form?

Yes, airSlate SignNow includes features that are particularly beneficial for managing the 2024 Iowa 1041 form. These features include customizable templates, automated workflows, and secure eSignature capabilities. This ensures that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the 2024 Iowa 1041 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the 2024 Iowa 1041 form alongside your existing tools. Whether you use accounting software or document management systems, our integrations enhance your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the 2024 Iowa 1041 form?

Using airSlate SignNow for the 2024 Iowa 1041 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround and ensures that all signatures are legally binding. This can signNowly streamline your tax filing process.

-

Is airSlate SignNow secure for handling the 2024 Iowa 1041 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the 2024 Iowa 1041 form. Our platform uses advanced encryption and secure storage to protect your sensitive information. You can trust that your documents are safe while using our services.

Get more for IA 1041 Iowa Fiduciary Return Revenue iowa go

- You will be given an opportunity to cure this default form

- Residential lease for unit supreme court of florida form

- New york termination of lease lawlandlord tenant form

- Pims user manual registration menu form

- Power of attorney for minor arkansas legal services form

- Guardianship of a childminorwelcome to legal aid form

- Name street address city state ampampamp zip code title order no form

- Affidavit of financial means arkansas download printable form

Find out other IA 1041 Iowa Fiduciary Return Revenue iowa go

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document