for Calendar Year or Fiscal Year Beginning Mmdd 2017

What is the For Calendar Year Or Fiscal Year Beginning mmdd

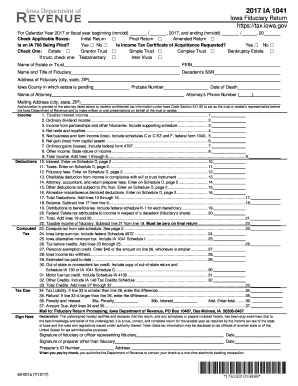

The form for calendar year or fiscal year beginning mmdd is a crucial document used by businesses and individuals to report financial information to the IRS. This form specifies the start date of the financial reporting period, which can either align with the calendar year or follow a fiscal year that begins on a specific date in the month. Understanding the distinction between these two types of reporting periods is essential for accurate financial planning and compliance with tax regulations.

Steps to complete the For Calendar Year Or Fiscal Year Beginning mmdd

Completing the for calendar year or fiscal year beginning mmdd form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary documents: Collect all financial records, including income statements, expense reports, and prior year tax returns.

- Determine your reporting period: Decide whether you will use the calendar year or a specific fiscal year starting date.

- Fill out the form: Enter the required information, ensuring accuracy in all figures and dates.

- Review for errors: Double-check all entries to avoid mistakes that could lead to penalties.

- Sign and date the form: Ensure that the form is signed by an authorized individual, confirming the accuracy of the information provided.

Legal use of the For Calendar Year Or Fiscal Year Beginning mmdd

The for calendar year or fiscal year beginning mmdd form is legally binding when filled out correctly and submitted in accordance with IRS guidelines. To ensure its legal validity, it must meet specific requirements, including proper signatures and adherence to deadlines. Additionally, using a reliable eSignature solution can enhance the form's legitimacy, as it provides a digital certificate that verifies the signer's identity and intention.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is critical for compliance. The due date for submitting the for calendar year or fiscal year beginning mmdd form typically aligns with the tax filing deadline for individuals or businesses. For calendar year filers, this is usually April fifteenth of the following year. Fiscal year filers should consult IRS guidelines to determine their specific deadlines based on their chosen reporting period.

Examples of using the For Calendar Year Or Fiscal Year Beginning mmdd

Understanding practical applications of the for calendar year or fiscal year beginning mmdd form can aid in its proper use. For instance, a small business using a fiscal year that begins on July first would complete the form to report financial results from July to June. Similarly, an individual may use this form to report income and expenses for the calendar year, ensuring that all financial activities are accurately captured for tax purposes.

Who Issues the Form

The for calendar year or fiscal year beginning mmdd form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. It is essential to use the most current version of the form provided by the IRS to ensure compliance with any recent changes in tax regulations.

Quick guide on how to complete for calendar year 2017 or fiscal year beginning mmdd

Effortlessly Prepare For Calendar Year Or Fiscal Year Beginning mmdd on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage For Calendar Year Or Fiscal Year Beginning mmdd on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and Electronically Sign For Calendar Year Or Fiscal Year Beginning mmdd

- Find For Calendar Year Or Fiscal Year Beginning mmdd and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign For Calendar Year Or Fiscal Year Beginning mmdd and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2017 or fiscal year beginning mmdd

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2017 or fiscal year beginning mmdd

How to generate an eSignature for the For Calendar Year 2017 Or Fiscal Year Beginning Mmdd in the online mode

How to make an eSignature for the For Calendar Year 2017 Or Fiscal Year Beginning Mmdd in Chrome

How to create an electronic signature for signing the For Calendar Year 2017 Or Fiscal Year Beginning Mmdd in Gmail

How to create an electronic signature for the For Calendar Year 2017 Or Fiscal Year Beginning Mmdd straight from your smartphone

How to make an electronic signature for the For Calendar Year 2017 Or Fiscal Year Beginning Mmdd on iOS

How to generate an electronic signature for the For Calendar Year 2017 Or Fiscal Year Beginning Mmdd on Android

People also ask

-

What is meant by 'For Calendar Year Or Fiscal Year Beginning mmdd' in airSlate SignNow?

The term 'For Calendar Year Or Fiscal Year Beginning mmdd' refers to the specific start date for document management and eSignature processes in your business's fiscal or calendar year. By setting this date, airSlate SignNow helps you streamline documentation and compliance related to your financial reporting.

-

How can airSlate SignNow help with document management for fiscal periods?

airSlate SignNow offers features that allow you to align document workflows with your financial cycles, including 'For Calendar Year Or Fiscal Year Beginning mmdd.' This ensures that all relevant documents are processed timely and securely, helping your business meet critical deadlines efficiently.

-

Are there any costs associated with customizing the 'For Calendar Year Or Fiscal Year Beginning mmdd' functionality?

airSlate SignNow offers a pricing structure that accommodates the needs of different businesses when implementing features like 'For Calendar Year Or Fiscal Year Beginning mmdd.' Most functionality is included in the standard packages, but premium features may incur additional fees, dependent on your specific requirements.

-

What integrations does airSlate SignNow support for syncing fiscal year data?

airSlate SignNow seamlessly integrates with various business tools like CRM and accounting software, which can help manage documents according to 'For Calendar Year Or Fiscal Year Beginning mmdd.' These integrations ensure all your financial information is aligned and accessible, streamlining your workflows.

-

Can multiple users collaborate on documents set for 'For Calendar Year Or Fiscal Year Beginning mmdd'?

Yes, airSlate SignNow allows multiple users to collaborate on documents related to 'For Calendar Year Or Fiscal Year Beginning mmdd.' This feature enhances teamwork and enables your organization to efficiently handle necessary changes ahead of fiscal deadlines.

-

Is it possible to automate reminders for documents due at 'For Calendar Year Or Fiscal Year Beginning mmdd'?

Absolutely! airSlate SignNow includes automation features that allow you to set reminders for documents due on 'For Calendar Year Or Fiscal Year Beginning mmdd.' This ensures that you never miss a critical deadline, keeping your organization's financial processes on track.

-

What benefits does using airSlate SignNow provide when aligning with 'For Calendar Year Or Fiscal Year Beginning mmdd'?

Using airSlate SignNow to manage your documentation in relation to 'For Calendar Year Or Fiscal Year Beginning mmdd' provides enhanced efficiency, compliance, and organization. Businesses can easily track and manage their documents, reducing risks associated with manual handling and ensuring timely completion of fiscal obligations.

Get more for For Calendar Year Or Fiscal Year Beginning mmdd

- Irb decision questionnaire form valparaiso university valpo

- Victory university transcript form

- Grabbe utley scholarship form

- Transcript request form virginia intermont college vic

- Viterbo university transcript form

- Washburn reinstatement petition form

- Fmla leave formpdffillercom

- Acknowledgement for lines form

Find out other For Calendar Year Or Fiscal Year Beginning mmdd

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF