F1040sh PDF SCHEDULE H Form 1040 Department of the Treasury 2022

Understanding the 2018 Schedule H Form 1040

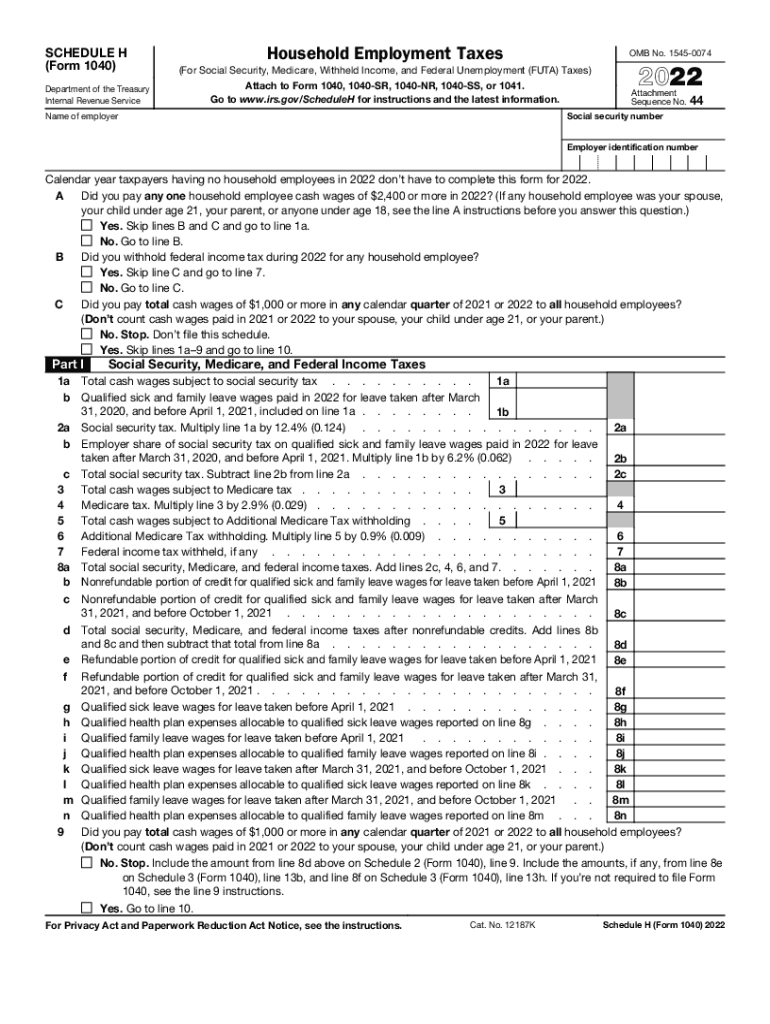

The 2018 Schedule H form, officially known as the "Household Employment Taxes," is a crucial document for taxpayers who employ household workers. This form is used to report and pay Social Security and Medicare taxes, as well as federal unemployment tax on wages paid to household employees. It is essential for compliance with IRS regulations, ensuring that household employers fulfill their tax obligations accurately.

Steps to Complete the 2018 Schedule H Form 1040

Completing the 2018 Schedule H form involves several key steps:

- Gather all necessary information about your household employees, including names, addresses, and Social Security numbers.

- Calculate the total wages paid to each employee during the year.

- Determine the applicable tax rates for Social Security, Medicare, and federal unemployment taxes.

- Fill out the form by entering the calculated amounts in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal Use of the 2018 Schedule H Form 1040

The 2018 Schedule H form is legally binding when filled out correctly and submitted to the IRS. It is important to understand that failing to file this form or underreporting wages can lead to penalties. Compliance with IRS regulations not only protects you as an employer but also ensures that your household employees receive the benefits they are entitled to, such as Social Security and Medicare.

Filing Deadlines for the 2018 Schedule H Form 1040

The deadline for filing the 2018 Schedule H form aligns with the due date for your federal income tax return. Typically, this means that the form must be submitted by April 15 of the following year. If you are unable to file by this date, you may request an extension, but it is crucial to pay any taxes owed to avoid penalties and interest.

IRS Guidelines for Completing the 2018 Schedule H Form 1040

The IRS provides specific guidelines for completing the Schedule H form. These include instructions on how to report wages, calculate taxes owed, and the process for submitting the form. It is advisable to refer to the official IRS instructions for the Schedule H to ensure compliance with all requirements and to avoid common mistakes.

Required Documents for the 2018 Schedule H Form 1040

To accurately complete the 2018 Schedule H form, you will need several documents, including:

- Wage records for each household employee.

- Any previous tax forms related to household employment.

- Documentation of any additional benefits provided to employees, such as health insurance.

Quick guide on how to complete f1040shpdf schedule h form 1040 department of the treasury

Complete F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely preserve it online. airSlate SignNow equips you with all the tools you need to produce, modify, and eSign your documents quickly without delays. Handle F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury seamlessly

- Locate F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to record your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1040shpdf schedule h form 1040 department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the f1040shpdf schedule h form 1040 department of the treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to h 2018?

airSlate SignNow is an eSignature platform that enables businesses to send and sign documents electronically with efficiency. It incorporates features that comply with h 2018 standards, ensuring your documents meet legal requirements while maintaining a modern workflow.

-

Is airSlate SignNow pricing competitive with other solutions in 2018?

Yes, airSlate SignNow offers competitive pricing tailored to your business needs in 2018. With scalable subscription plans, you can find an option that fits your budget while providing valuable features that enhance document management.

-

What key features does airSlate SignNow offer for h 2018?

In 2018, airSlate SignNow provides essential features such as customizable templates, advanced security measures, and real-time tracking of documents. These tools empower users to streamline their signing processes effectively.

-

How does airSlate SignNow ensure document security in compliance with h 2018 regulations?

airSlate SignNow employs advanced encryption and secure cloud storage to protect your documents. This security is crucial in 2018 as more businesses require compliance with h 2018 regulations to safeguard sensitive information.

-

Can airSlate SignNow integrate with other apps and services in 2018?

Absolutely! airSlate SignNow offers integration capabilities with popular apps like Google Drive and Salesforce in 2018, making it easier to manage your documents across different platforms. This enhances productivity and ensures seamless workflows.

-

What benefits can businesses expect when using airSlate SignNow in 2018?

Businesses can expect signNow time savings, reduced operational costs, and improved document turnaround times using airSlate SignNow in 2018. The platform's efficiency allows teams to focus on core activities while ensuring compliance with h 2018 standards.

-

Is there a mobile app for airSlate SignNow for use in 2018?

Yes, airSlate SignNow offers a mobile app that lets users sign and send documents on the go in 2018. This flexibility ensures that you can manage your eSigning needs from anywhere, fitting seamlessly into your busy schedule.

Get more for F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury

Find out other F1040sh pdf SCHEDULE H Form 1040 Department Of The Treasury

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple