Irs Schedule H Form 2015

What is the Irs Schedule H Form

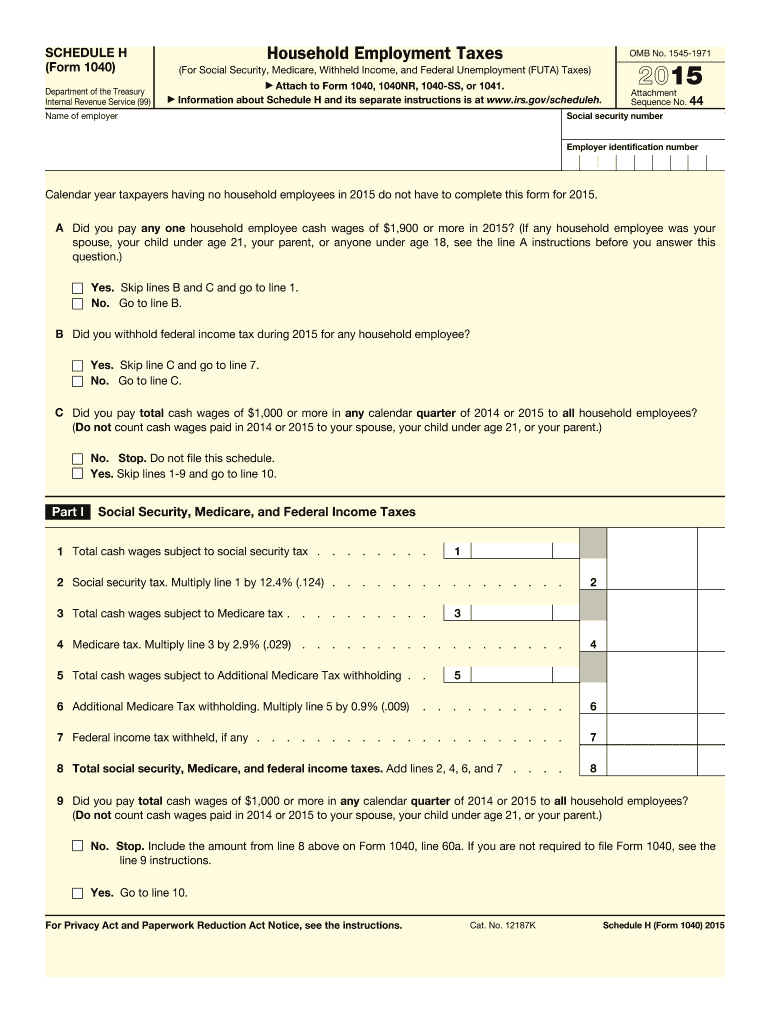

The Irs Schedule H Form is a tax document used by employers to report household employment taxes. This form is essential for individuals who employ household workers, such as nannies, caregivers, or housekeepers. By completing this form, employers can ensure compliance with federal tax regulations, including Social Security and Medicare taxes. The Schedule H is typically filed alongside the individual’s Form 1040 during tax season.

How to use the Irs Schedule H Form

To use the Irs Schedule H Form, employers must first determine if they are liable for household employment taxes. If they pay a worker $2,400 or more in a calendar year, they must fill out this form. The form requires details about the employer, the household employee, and the wages paid. Employers should accurately report the total wages and calculate the taxes owed. Once completed, the form is submitted with the employer's annual tax return.

Steps to complete the Irs Schedule H Form

Completing the Irs Schedule H Form involves several key steps:

- Gather necessary information, including the employer's and employee's names, addresses, and Social Security numbers.

- Calculate the total wages paid to the household employee during the year.

- Determine the applicable taxes, including Social Security and Medicare taxes.

- Fill out the form accurately, ensuring all information is correct.

- Attach the completed form to the employer's Form 1040 when filing taxes.

Legal use of the Irs Schedule H Form

The legal use of the Irs Schedule H Form is crucial for compliance with U.S. tax laws. Employers must file this form if they meet the wage threshold for household employees. Failure to file can result in penalties and interest on unpaid taxes. The form serves as a record of wages paid and taxes withheld, which can be important for both the employer and the employee in case of audits or disputes.

Filing Deadlines / Important Dates

The filing deadline for the Irs Schedule H Form coincides with the annual tax return deadline, typically April 15. Employers should ensure that they complete and submit the form by this date to avoid penalties. If an extension is filed for the tax return, the same extension applies to the Schedule H Form. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the Irs Schedule H Form, employers should have the following documents ready:

- Wage records for the household employee, including total payments made during the year.

- Social Security numbers for both the employer and the employee.

- Any previous tax forms relevant to household employment, such as W-2 forms.

Who Issues the Form

The Irs Schedule H Form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that employers understand their responsibilities regarding household employment taxes.

Quick guide on how to complete 2015 irs schedule h form

Effortlessly prepare Irs Schedule H Form on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow offers all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Irs Schedule H Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Irs Schedule H Form with ease

- Locate Irs Schedule H Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Schedule H Form and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs schedule h form

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs schedule h form

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the IRS Schedule H Form?

The IRS Schedule H Form is a tax form used by household employers to report wages paid to household employees and the associated payroll taxes. Using the airSlate SignNow platform, you can easily prepare and eSign the IRS Schedule H Form, ensuring compliance with tax regulations.

-

How can airSlate SignNow help me with the IRS Schedule H Form?

AirSlate SignNow simplifies the process of completing and eSigning the IRS Schedule H Form. With our user-friendly interface, you can quickly fill out the form, add signatures, and securely send it to the IRS, making tax season much less stressful.

-

Is there a cost associated with using airSlate SignNow for the IRS Schedule H Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes access to features that facilitate the completion and eSigning of the IRS Schedule H Form, making it a cost-effective solution for managing your tax documentation.

-

What features does airSlate SignNow include for managing the IRS Schedule H Form?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the process of completing the IRS Schedule H Form. These tools ensure that your forms are filled out correctly and submitted on time.

-

Can I integrate airSlate SignNow with other software to manage the IRS Schedule H Form?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when managing the IRS Schedule H Form. Whether you use accounting software or HR platforms, our integrations enhance efficiency and organization.

-

What are the benefits of using airSlate SignNow for the IRS Schedule H Form?

Using airSlate SignNow for the IRS Schedule H Form provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your forms are completed accurately and stored securely, allowing you to focus on other aspects of your business.

-

Is airSlate SignNow user-friendly for first-time users of the IRS Schedule H Form?

Absolutely! AirSlate SignNow is designed to be intuitive and user-friendly, making it easy for first-time users to navigate the IRS Schedule H Form. With clear instructions and helpful support, you can confidently complete your tax obligations.

Get more for Irs Schedule H Form

Find out other Irs Schedule H Form

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer