Form 1040 U S Individual Income Tax Return 20 2021

What is the IRS Form 1040 Schedule H?

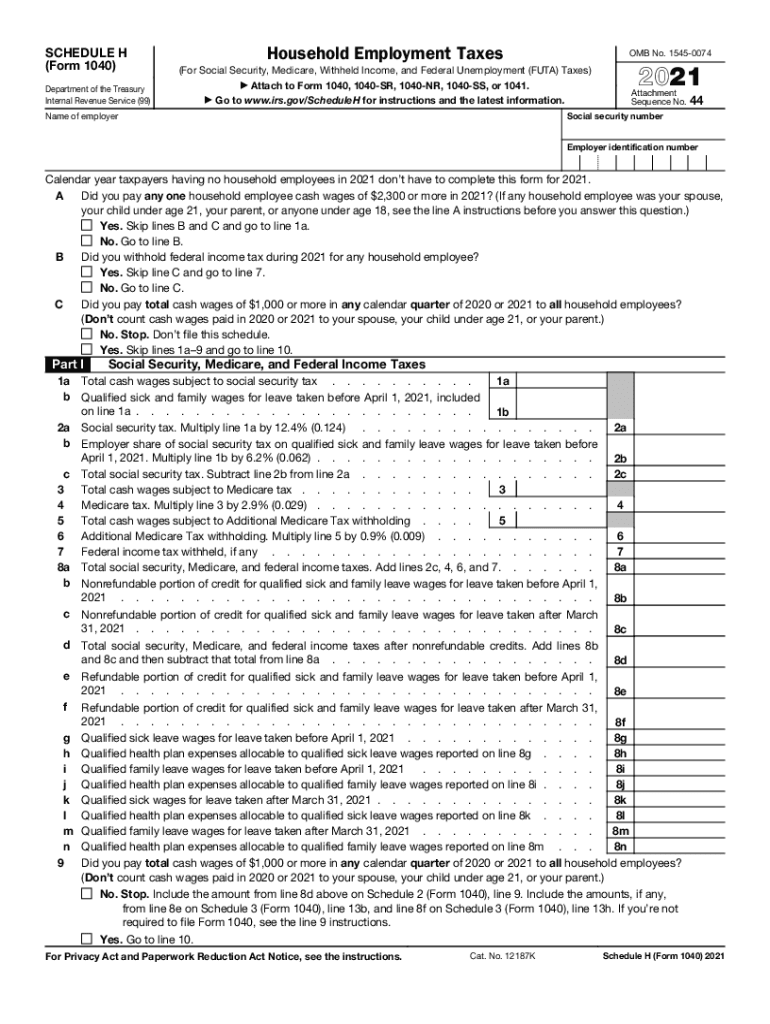

The IRS Form 1040 Schedule H is specifically designed for reporting household employment taxes. It is used by employers of household workers, such as nannies, housekeepers, or caregivers, to report wages paid and taxes owed. This form is an essential part of the U.S. tax system, ensuring that household employers comply with federal tax obligations. By using Schedule H, employers can accurately report Social Security and Medicare taxes, as well as federal unemployment tax (FUTA) for their household employees.

Steps to Complete the IRS Form 1040 Schedule H

Completing the IRS Form 1040 Schedule H involves several key steps. First, gather all necessary information about your household employee, including their name, address, and Social Security number. Next, calculate the total wages paid during the year. This includes any bonuses or additional compensation. After determining the total wages, calculate the applicable taxes, including Social Security, Medicare, and FUTA taxes. Finally, ensure that you sign and date the form before submitting it along with your Form 1040.

IRS Guidelines for Filing Schedule H

The IRS provides specific guidelines for filing Schedule H, which must be adhered to for compliance. Employers are required to file the form if they pay a household employee cash wages of $2,400 or more in a calendar year. Additionally, the form must be submitted along with your annual Form 1040 tax return. It is crucial to keep accurate records of all payments made to household employees, as these records may be needed for verification by the IRS.

Required Documents for Schedule H

To successfully complete the IRS Form 1040 Schedule H, certain documents are necessary. These include your household employee's Social Security number, records of wages paid throughout the year, and any tax identification numbers if applicable. Keeping detailed records of hours worked and payments made is essential for accurate reporting and compliance with tax laws. Having these documents organized will facilitate a smoother filing process.

Penalties for Non-Compliance with Schedule H

Failure to comply with the requirements of the IRS Form 1040 Schedule H can result in significant penalties. Employers who do not report household employment taxes may face fines and interest on unpaid taxes. Additionally, if the IRS determines that an employer has willfully failed to report or pay these taxes, they could be subject to further legal action. It is crucial for employers to understand their responsibilities to avoid these penalties.

Filing Deadlines for Schedule H

The filing deadline for the IRS Form 1040 Schedule H aligns with the annual tax return deadline. Typically, this means that the form must be filed by April 15 of the following year. If you require additional time to file your taxes, you may request an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 1040 us individual income tax return 20

Effortlessly Prepare Form 1040 U S Individual Income Tax Return 20 on Any Device

The management of online documents has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed forms, as you can access the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1040 U S Individual Income Tax Return 20 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form 1040 U S Individual Income Tax Return 20 Effortlessly

- Locate Form 1040 U S Individual Income Tax Return 20 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or conceal sensitive information using tools specially designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all entered information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your preference. Alter and eSign Form 1040 U S Individual Income Tax Return 20 and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 us individual income tax return 20

Create this form in 5 minutes!

How to create an eSignature for the form 1040 us individual income tax return 20

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an e-signature for a PDF file on Android OS

People also ask

-

What is the primary benefit of using airSlate SignNow to schedule h?

Using airSlate SignNow to schedule h allows businesses to streamline their document signing processes. It enhances productivity by providing an easy-to-use platform for sending and eSigning important documents quickly and efficiently.

-

How does airSlate SignNow improve the scheduling of documents?

airSlate SignNow improves the scheduling of documents by offering automated reminders and tracking. This ensures that all parties are notified when it's time to sign, helping you stay organized and on top of critical deadlines related to your schedule h.

-

What are the pricing options for airSlate SignNow's schedule h features?

airSlate SignNow offers various pricing plans to accommodate different business needs, ranging from basic to more advanced features. These plans include options that ensure you can effectively manage the scheduling of documents without overspending.

-

Can I integrate airSlate SignNow with other tools for scheduling?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications and tools related to scheduling. This allows users to synchronize their workflows and manage all aspects of scheduling h efficiently.

-

Is it easy to use airSlate SignNow for scheduling documents?

Absolutely! airSlate SignNow features an intuitive interface that makes it simple for users to schedule h documents. Whether you're tech-savvy or new to electronic signatures, you'll find the platform easy to navigate.

-

What security measures does airSlate SignNow have for scheduled documents?

airSlate SignNow prioritizes security with advanced encryption and authentication protocols. This ensures that all documents scheduled for signing are secure and confidential, giving you peace of mind while managing your schedule h.

-

How does airSlate SignNow support mobile scheduling?

airSlate SignNow provides a mobile-friendly app that allows you to schedule h on the go. Whether you're using a smartphone or tablet, you can send and receive signed documents at your convenience.

Get more for Form 1040 U S Individual Income Tax Return 20

- Electrical contract for contractor district of columbia form

- Sheetrock drywall contract for contractor district of columbia form

- Flooring contract for contractor district of columbia form

- Dc contract real estate form

- Notice of intent to enforce forfeiture provisions of contact for deed district of columbia form

- Final notice of forfeiture and request to vacate property under contract for deed district of columbia form

- Buyers request for accounting from seller under contract for deed district of columbia form

- District columbia property form

Find out other Form 1040 U S Individual Income Tax Return 20

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free