How to File Schedule H for Household Employment Taxes 2024-2026

What is the Schedule H for Household Employment Taxes?

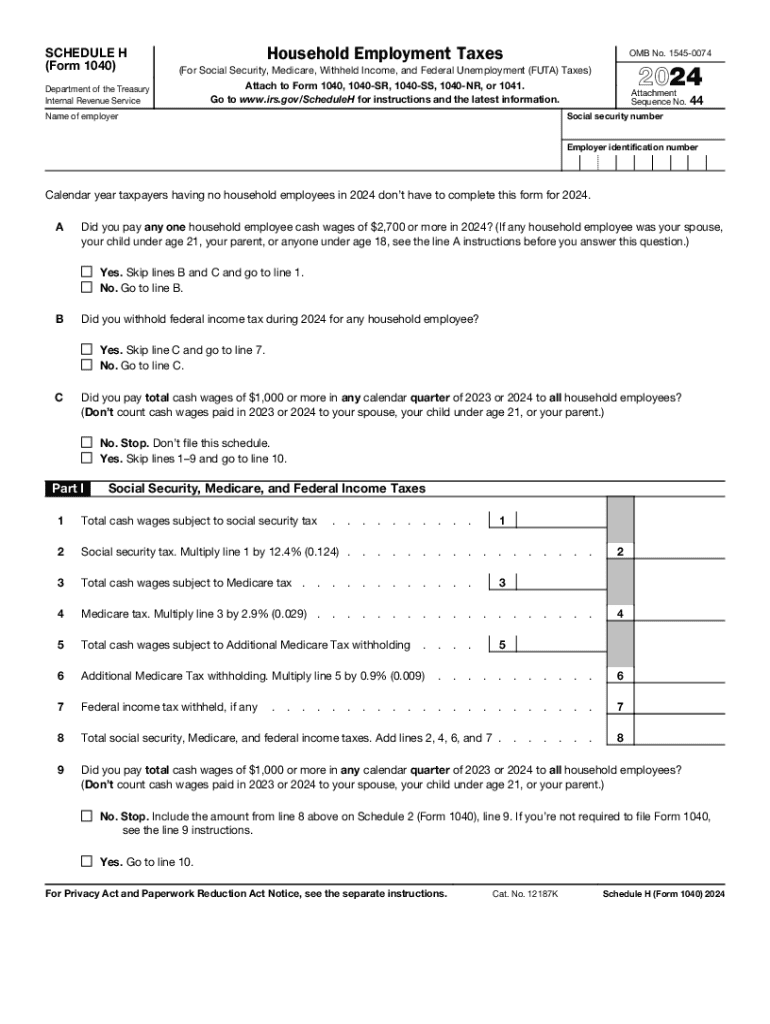

The Schedule H is a tax form used by individuals who employ household workers, such as nannies, housekeepers, or caregivers. This form allows employers to report wages paid to these employees and calculate the associated employment taxes. It is essential for ensuring compliance with IRS regulations regarding household employees. Understanding the Schedule H is crucial for anyone who hires domestic help, as it outlines the employer's responsibilities and tax obligations.

Steps to Complete the Schedule H for Household Employment Taxes

Completing the Schedule H involves several key steps:

- Gather necessary information about your household employee, including their name, address, and Social Security number.

- Determine the total wages paid to the employee during the year.

- Calculate the required employment taxes, including Social Security and Medicare taxes, based on the wages paid.

- Fill out the Schedule H form accurately, ensuring all information is complete and correct.

- Attach the completed Schedule H to your Form 1040 when filing your annual tax return.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Schedule H. Typically, the form must be submitted by the same deadline as your federal income tax return, which is usually April 15. If you need additional time, you can file for an extension, but keep in mind that any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines for Schedule H

The IRS provides specific guidelines for completing and filing the Schedule H. These guidelines include instructions on who qualifies as a household employee, how to calculate wages, and the types of taxes that must be withheld. It is advisable to review the IRS instructions thoroughly to ensure compliance and avoid any potential issues with your tax filings.

Required Documents for Filing Schedule H

To complete the Schedule H, you will need several documents, including:

- Your household employee's Social Security number.

- Total wages paid to the employee during the tax year.

- Records of any federal income tax withheld.

- Documentation of any other benefits provided to the employee, such as health insurance or retirement contributions.

Penalties for Non-Compliance with Schedule H

Failing to file the Schedule H or inaccurately reporting information can result in penalties from the IRS. These may include fines for late filing or failure to pay employment taxes. Additionally, if you do not report household employees correctly, you may face back taxes and interest on unpaid amounts. It is essential to stay informed and compliant to avoid these potential issues.

Create this form in 5 minutes or less

Find and fill out the correct how to file schedule h for household employment taxes

Create this form in 5 minutes!

How to create an eSignature for the how to file schedule h for household employment taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to schedule h instructions 2021?

airSlate SignNow offers a range of features that simplify the process of managing schedule h instructions 2021. Users can easily create, send, and eSign documents, ensuring compliance and accuracy. The platform also includes templates specifically designed for schedule h instructions 2021, making it easier for businesses to stay organized.

-

How does airSlate SignNow help with compliance for schedule h instructions 2021?

Compliance is crucial when dealing with schedule h instructions 2021, and airSlate SignNow provides tools to ensure that all documents meet regulatory standards. The platform allows for secure eSigning and document tracking, which helps businesses maintain compliance. Additionally, users can access audit trails to verify that all steps in the process are documented.

-

What pricing plans are available for airSlate SignNow for schedule h instructions 2021?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling schedule h instructions 2021. Plans range from basic to advanced, allowing users to choose the features that best suit their requirements. Each plan provides access to essential tools for managing documents efficiently.

-

Can airSlate SignNow integrate with other software for schedule h instructions 2021?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance the management of schedule h instructions 2021. This includes popular CRM systems, cloud storage solutions, and productivity tools. These integrations streamline workflows and improve overall efficiency.

-

What benefits does airSlate SignNow provide for managing schedule h instructions 2021?

Using airSlate SignNow for schedule h instructions 2021 offers numerous benefits, including increased efficiency and reduced turnaround times for document processing. The platform's user-friendly interface allows for quick navigation and easy document management. Additionally, businesses can save costs by eliminating the need for paper-based processes.

-

Is airSlate SignNow suitable for small businesses handling schedule h instructions 2021?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing schedule h instructions 2021. Its cost-effective solutions and scalable features make it an ideal choice for small enterprises looking to streamline their document workflows without breaking the bank.

-

How secure is airSlate SignNow when dealing with schedule h instructions 2021?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like schedule h instructions 2021. The platform employs advanced encryption and security protocols to protect user data. Additionally, users can set permissions and access controls to ensure that only authorized personnel can view or edit documents.

Get more for How To File Schedule H For Household Employment Taxes

- Prettyboy reservoir boat permit form

- Ca 7a form

- University of greenwich grading system form

- French passport application form pdf

- Doterra invoice form

- Rc form 302 4 texas department of state health services dshs state tx

- City of mercer island rfp response form doc image mercergov

- Ltp reg form doc community services department sportscenter escondido

Find out other How To File Schedule H For Household Employment Taxes

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure