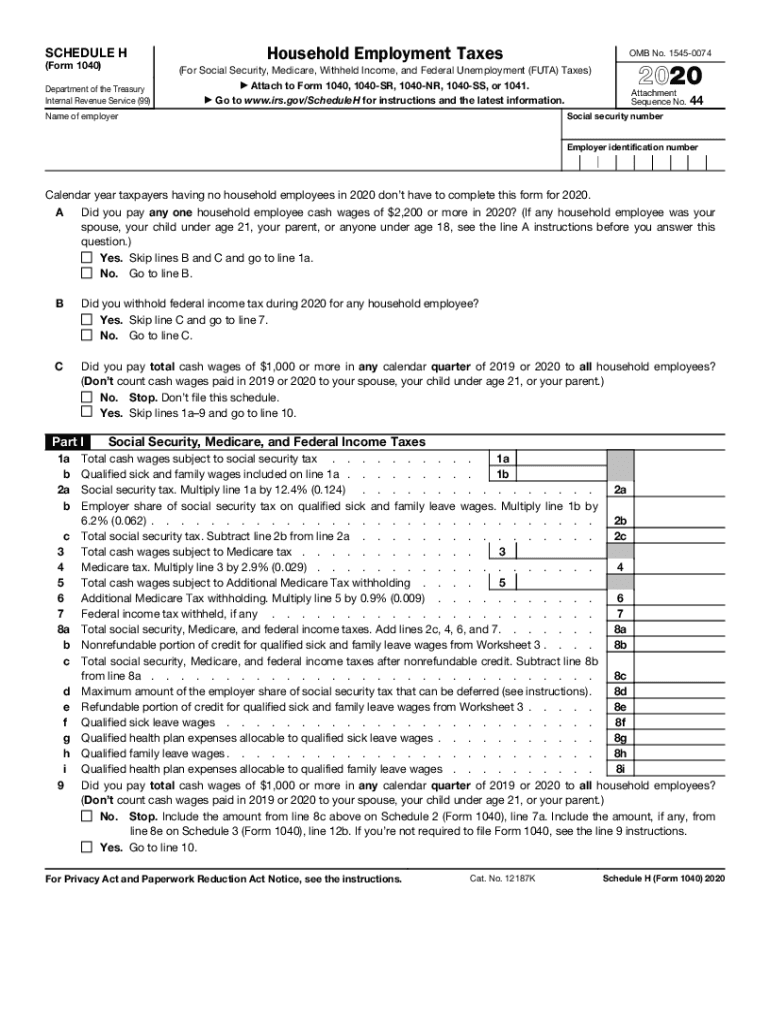

Schedule H Form 1040 Internal Revenue Service 2020

What is the Schedule H Form 1040?

The Schedule H form is a tax document used by employers to report household employment taxes to the Internal Revenue Service (IRS). Specifically, it is filed as part of Form 1040, the individual income tax return. This form is essential for individuals who employ domestic workers, such as nannies, housekeepers, or caregivers, and need to report wages paid and taxes withheld. The Schedule H allows taxpayers to calculate the Social Security and Medicare taxes owed on the wages they pay to their household employees.

Steps to complete the Schedule H Form 1040

Completing the Schedule H form involves several key steps:

- Gather Information: Collect all relevant details about your household employee, including their name, address, Social Security number, and total wages paid during the year.

- Calculate Taxes: Determine the total amount of Social Security and Medicare taxes owed based on the wages paid. The IRS provides specific rates for these calculations.

- Fill Out the Form: Enter the gathered information and calculated taxes into the Schedule H form. Ensure accuracy to avoid any issues with the IRS.

- Attach to Form 1040: Once completed, attach Schedule H to your Form 1040 when filing your tax return.

Legal use of the Schedule H Form 1040

The Schedule H form is legally required for taxpayers who employ household workers and pay them above a certain threshold. Failing to file this form can lead to penalties and interest on unpaid taxes. Additionally, accurate reporting is crucial for compliance with federal tax laws. By using Schedule H, taxpayers ensure they are fulfilling their obligations and protecting themselves from potential legal issues related to employment taxes.

Filing Deadlines / Important Dates

The Schedule H form must be filed by the same deadline as your Form 1040. Typically, this is April 15 of the following year, unless an extension is filed. If you owe taxes, they must be paid by this deadline to avoid penalties. It is essential to stay informed about any changes to tax deadlines, especially during tax season, as they can vary from year to year.

Required Documents

To complete the Schedule H form accurately, you will need several documents:

- Wage records for your household employee, including pay stubs or a summary of payments.

- Your employee's Social Security number for accurate reporting.

- Any previous tax forms related to household employment, if applicable.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule H form, including instructions on how to calculate taxes and report wages. It is important to refer to the most recent IRS publications or the official IRS website for detailed instructions, as these guidelines can change annually. Following these guidelines ensures compliance and helps avoid errors that could lead to audits or penalties.

Quick guide on how to complete 2020 schedule h form 1040 internal revenue service

Complete Schedule H Form 1040 Internal Revenue Service effortlessly on any device

Online document organization has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Schedule H Form 1040 Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Schedule H Form 1040 Internal Revenue Service without hassle

- Obtain Schedule H Form 1040 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Alter and eSign Schedule H Form 1040 Internal Revenue Service while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule h form 1040 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule h form 1040 internal revenue service

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the 2016 Schedule H instruction?

The 2016 Schedule H instruction details how to report household employment tax. It provides guidance for employers to accurately calculate and file employment taxes for household employees, ensuring compliance with IRS requirements related to wages and tax reporting.

-

How does airSlate SignNow help with the 2016 Schedule H instruction?

airSlate SignNow simplifies the process of managing documents related to the 2016 Schedule H instruction. With our platform, users can easily create, send, and eSign documents that are necessary for filing taxes on household employees, streamlining compliance and record-keeping.

-

What features does airSlate SignNow offer for managing 2016 Schedule H instruction documentation?

Our platform includes features like customizable templates, secure eSigning, and document tracking, which are particularly useful for handling 2016 Schedule H instruction documentation. These capabilities ensure that all necessary forms are filled out correctly and can be submitted with ease.

-

Are there any integrations available for handling 2016 Schedule H instruction with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various accounting and payroll software which can be beneficial when dealing with 2016 Schedule H instruction. This allows users to sync their documents and data seamlessly, making tax filing more efficient.

-

What pricing plans does airSlate SignNow have for businesses needing 2016 Schedule H instruction management?

AirSlate SignNow offers flexible pricing plans designed for businesses of all sizes. Each plan provides access to features that assist with managing the 2016 Schedule H instruction, making it a cost-effective solution for eSigning and document management.

-

Can airSlate SignNow help with the ongoing maintenance of 2016 Schedule H instruction records?

Absolutely! airSlate SignNow not only assists in creating and signing the necessary documents related to 2016 Schedule H instruction but also provides a secure cloud storage solution. This ensures that all records are maintained accurately and are easily accessible when needed.

-

Is airSlate SignNow user-friendly for those unfamiliar with 2016 Schedule H instruction?

Yes, airSlate SignNow is designed to be user-friendly even for those who may not be familiar with 2016 Schedule H instruction. Our intuitive interface and helpful resources assist users throughout the document preparation and signing process, making compliance easier.

Get more for Schedule H Form 1040 Internal Revenue Service

- Form packetsdomestic violence restraining order without

- Ok form ef 2019 2022 fill out tax template online

- Form it 212 investment credit tax year 2022

- 2022 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

- Hawaii income tax forms by tax year e file your taxes

- Form mo fpt food pantry homeless shelter or soup

- Form it 250 claim for credit for purchase of an automated

- Generating form it 3601 for nyc or yonkers part year

Find out other Schedule H Form 1040 Internal Revenue Service

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word