Schedule H Form 1040 2018

What is the Schedule H Form 1040

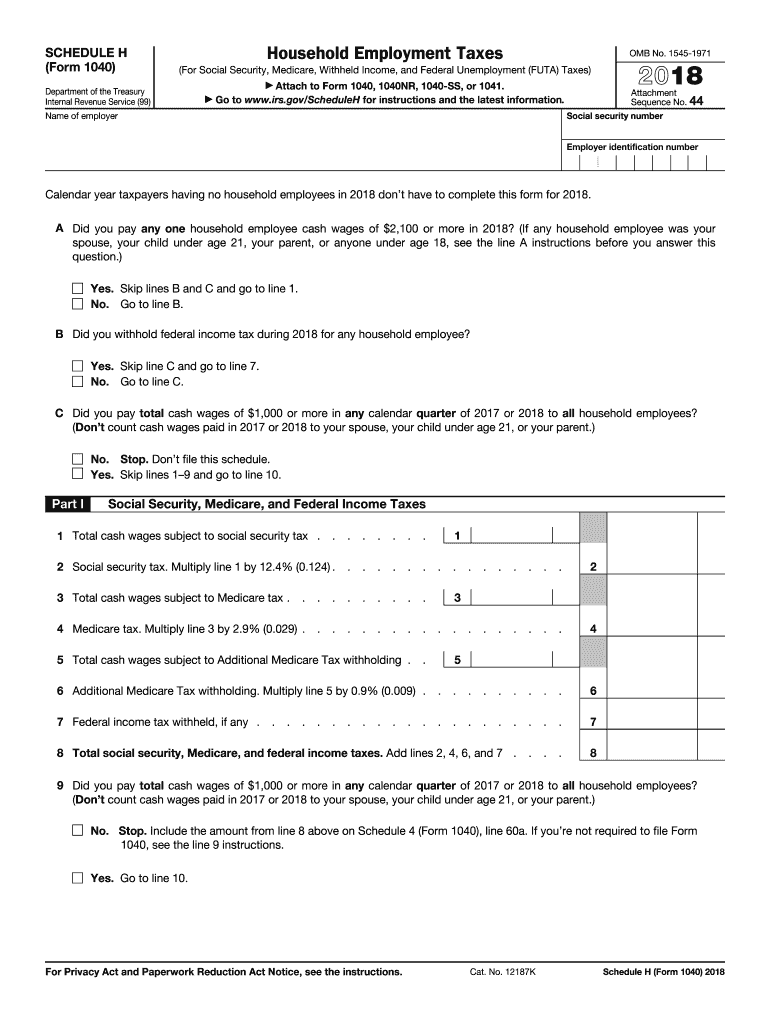

The Schedule H Form 1040 is a tax form used by individuals to report household employment taxes. This form is essential for anyone who employs household workers, such as nannies, housekeepers, or caregivers. It allows taxpayers to calculate and report the Social Security and Medicare taxes owed on wages paid to these employees. Additionally, the form helps determine if the taxpayer is eligible for any credits related to household employment.

How to use the Schedule H Form 1040

Using the Schedule H Form 1040 involves several steps. First, gather all necessary information about household employees, including their names, Social Security numbers, and total wages paid during the tax year. Next, complete the form by filling out the required sections, which include calculating the total wages, determining the amount of taxes owed, and reporting any applicable credits. Finally, attach the completed Schedule H to your Form 1040 when filing your federal income tax return.

Steps to complete the Schedule H Form 1040

Completing the Schedule H Form 1040 requires careful attention to detail. Begin by entering your personal information at the top of the form. Next, list each household employee and their respective wages in the designated sections. Calculate the total wages and the corresponding Social Security and Medicare taxes owed. Ensure that you check for any applicable tax credits that may reduce your overall tax liability. After verifying all entries for accuracy, sign and date the form before submitting it with your tax return.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Schedule H Form 1040. Typically, the deadline for submitting your federal income tax return, including Schedule H, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you owe taxes, they must be paid by this deadline to avoid penalties and interest.

Legal use of the Schedule H Form 1040

The Schedule H Form 1040 is legally required for taxpayers who have household employees and meet specific criteria set by the IRS. Failing to file this form when required can result in penalties and interest on unpaid taxes. It is important to understand the legal obligations regarding household employment, including the responsibility to withhold and pay Social Security and Medicare taxes. Compliance with these regulations ensures that taxpayers avoid potential legal issues and maintain good standing with the IRS.

Required Documents

To complete the Schedule H Form 1040 accurately, several documents are necessary. These include records of wages paid to household employees, their Social Security numbers, and any previous tax filings related to household employment. Additionally, taxpayers should have documentation of any tax credits they intend to claim. Keeping organized records throughout the year simplifies the process of filling out the form and ensures compliance with IRS requirements.

Quick guide on how to complete schedule h 2018 form

Uncover the simplest method to complete and endorse your Schedule H Form 1040

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior method to fill out and endorse your Schedule H Form 1040 and associated forms for public services. Our intelligent electronic signature solution equips you with all the tools required to process documents swiftly and in accordance with official standards - robust PDF editing, managing, securing, signing, and sharing features all readily available within an easy-to-use interface.

Only a few steps are required to fill out and endorse your Schedule H Form 1040:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to input in your Schedule H Form 1040.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross features to complete the sections with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Mask sections that are no longer relevant.

- Press Sign to produce a legally enforceable electronic signature using any method you prefer.

- Add the Date beside your signature and conclude your task with the Done button.

Store your completed Schedule H Form 1040 in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our service also offers adaptable form sharing. There's no need to print your forms when you can send them within the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your profile. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct schedule h 2018 form

FAQs

-

What's your GATE 2018 result and are you satisfied with it?

I am 2016 pass out from a private college in Mechanical engineering.During campus placements I got placed in TCS, but I didn’t join and opted for coaching from made easy Bhopal. I appeared for GATE 2017 as my first attempt and just cleared the cutoffs by TWO marks.My first attempt was mostly consumed mostly by the fear and some imaginary notion that my preparation is not up to the mark.Braced myself for the second attempt. ( But only doubt I had was “ Will I be able to make that big jump from 30’s to 80’s)Planned everything well this time: Collected all the standard books, studied from them, solved numerals, prepared short notes, formula sheets, took made easy (fully completed) and exergic (half completed) test series. I was constantly under 500 rank in full length test series of made easy. Exergic was a bit too hard to score.In short I did everything I could do.3rd Feb, 2018: Appeared for the morning session. Paper was very much moderate level compared to last year. Attempted 60 questions. ( My best attempt during test series was 55). I was hoping 75+ marks even after normalization.16th March, 2018: My world came crashing down. 63 marks AIR 5099. I was shattered beyond limits. I checked the answers and I found that I had lost 21 marks in silly mistakes. SIMPLE STRAIGHT CALCULATIONS. 16 marks NAT type out of range and rest MCQ. I never felt so hopeless in my entire life as I am feeling now. I am 26 and I have only few psus left I guess to apply even if I attempt gate again.I don’t know what to do and yes I am deeply UNSATISFIED.Suggestion and feedback's from people who has passed this phase in the past. Please!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

Create this form in 5 minutes!

How to create an eSignature for the schedule h 2018 form

How to generate an electronic signature for the Schedule H 2018 Form online

How to generate an eSignature for the Schedule H 2018 Form in Chrome

How to make an electronic signature for putting it on the Schedule H 2018 Form in Gmail

How to create an electronic signature for the Schedule H 2018 Form right from your smart phone

How to make an eSignature for the Schedule H 2018 Form on iOS devices

How to create an electronic signature for the Schedule H 2018 Form on Android devices

People also ask

-

What is the Schedule H Form 1040 and why do I need it?

The Schedule H Form 1040 is a tax form used by household employers to report wages paid to household employees and to calculate employment taxes. If you hire someone to work in your home, such as a nanny or housekeeper, you are required to file this form with your tax return. Properly completing the Schedule H Form 1040 ensures compliance with federal tax laws and helps you avoid potential penalties.

-

How can airSlate SignNow help me with my Schedule H Form 1040 submissions?

airSlate SignNow streamlines the process of preparing and eSigning your Schedule H Form 1040 by providing an easy-to-use platform for document management. With our digital signing solution, you can securely send, sign, and store your tax forms, including Schedule H Form 1040, all in one place. This reduces the hassle of paperwork and speeds up your submission process.

-

Is there a cost associated with using airSlate SignNow for the Schedule H Form 1040?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including those who need to manage their Schedule H Form 1040. Our plans are designed to be cost-effective, ensuring you get the best value for your document signing and management needs. You can choose a plan that fits your budget and usage requirements.

-

Can I integrate airSlate SignNow with other tools for filing my Schedule H Form 1040?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, making it easier to file your Schedule H Form 1040. By connecting with your preferred tools, you can automate workflows and ensure that your documents are always up-to-date and easily accessible.

-

What features does airSlate SignNow offer for managing the Schedule H Form 1040?

airSlate SignNow includes features such as customizable templates, advanced security measures, and real-time tracking for your Schedule H Form 1040. These tools simplify the eSigning process and ensure that your documents are signed and returned promptly, enhancing your overall efficiency.

-

How secure is my information when using airSlate SignNow for the Schedule H Form 1040?

Security is a top priority at airSlate SignNow. When you use our platform to manage your Schedule H Form 1040, your information is protected with bank-level encryption and secure cloud storage. We also comply with industry standards to ensure your data remains confidential and safe.

-

Can I access my Schedule H Form 1040 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access and manage your Schedule H Form 1040 from any device. Whether you're using a smartphone or tablet, you can easily send, sign, and track your tax documents on the go.

Get more for Schedule H Form 1040

Find out other Schedule H Form 1040

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later