Hawaii Form N 15 Individual Income Tax Return 2023

What is the Hawaii Form N-15 Individual Income Tax Return

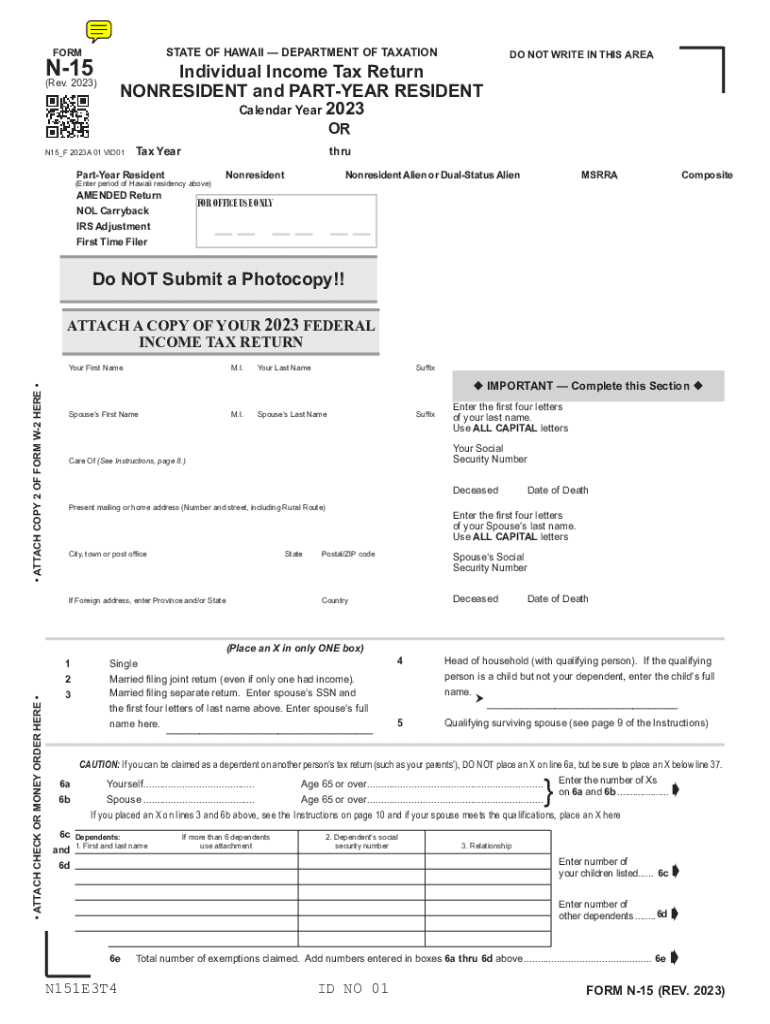

The Hawaii Form N-15 is the Individual Income Tax Return specifically designed for nonresidents of Hawaii. This form is utilized by individuals who earned income from sources within Hawaii but do not qualify as residents. The N-15 allows nonresidents to report their income, claim deductions, and calculate their tax liability based on Hawaii's tax laws.

By filing the N-15, nonresidents can ensure compliance with state tax regulations while accurately reflecting their income earned in Hawaii. It is essential for individuals to understand the specific requirements and guidelines associated with this form to avoid penalties and ensure proper filing.

Steps to complete the Hawaii Form N-15 Individual Income Tax Return

Completing the Hawaii Form N-15 involves several key steps to ensure accurate reporting of income and deductions. Here are the steps to follow:

- Gather necessary documents: Collect all relevant income statements, such as W-2s or 1099s, and any documentation for deductions.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income earned in Hawaii in the designated section of the form.

- Claim deductions: Identify and claim any applicable deductions that reduce your taxable income.

- Calculate tax liability: Use the tax tables provided to determine your tax owed based on your reported income.

- Review and sign: Double-check all entries for accuracy and sign the form before submission.

How to obtain the Hawaii Form N-15 Individual Income Tax Return

The Hawaii Form N-15 can be obtained through several convenient methods. Individuals can access the form online through the Hawaii Department of Taxation's official website, where it is available for download in PDF format. Additionally, physical copies of the form can often be found at local libraries, post offices, and state tax offices.

It is advisable to ensure that you are using the correct version of the form for the tax year in question, as forms may be updated periodically. Always check for the most current version to avoid any issues during filing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Hawaii Form N-15 is crucial for compliance. Typically, the deadline for filing the N-15 is the same as the federal tax return deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

For those who require additional time, an automatic extension can be requested, allowing for an extension of up to six months. It is important to note that while an extension to file is granted, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Key elements of the Hawaii Form N-15 Individual Income Tax Return

The Hawaii Form N-15 includes several key elements that are essential for accurate tax reporting. These elements consist of:

- Personal Information: This section requires basic details such as your name, address, and Social Security number.

- Income Reporting: Nonresidents must report all income earned from Hawaii sources, including wages, rental income, and business earnings.

- Deductions: The form allows for various deductions that can reduce taxable income, such as certain expenses related to earning income in Hawaii.

- Tax Calculation: A section for calculating the total tax owed based on the reported income and applicable tax rates.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate and complete.

Quick guide on how to complete hawaii form n 15 individual income tax return

Complete Hawaii Form N 15 Individual Income Tax Return effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Hawaii Form N 15 Individual Income Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Hawaii Form N 15 Individual Income Tax Return without hassle

- Find Hawaii Form N 15 Individual Income Tax Return and click Get Form to initiate.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your choice. Modify and eSign Hawaii Form N 15 Individual Income Tax Return and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 15 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 15 individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2014 Hawaii nonresident tax filing requirement?

The 2014 Hawaii nonresident tax filing requirement mandates that nonresidents must file a Hawaii tax return if they earned income from sources within the state. This filing helps ensure compliance with State tax laws and prevents potential penalties for non-filing.

-

How can airSlate SignNow assist with 2014 Hawaii nonresident tax documents?

airSlate SignNow offers an efficient platform for managing and electronically signing 2014 Hawaii nonresident tax documents. With our easy-to-use features, you can ensure that your tax forms are completed quickly and securely, helping you streamline your filing process.

-

Are there any specific features for managing 2014 Hawaii nonresident tax forms?

Yes, airSlate SignNow provides specialized features such as customizable templates and seamless document sharing that cater specifically to 2014 Hawaii nonresident tax forms. These features help in maintaining organization and ensuring compliance as you prepare your documents.

-

What are the pricing options for using airSlate SignNow for 2014 Hawaii nonresident documentation?

airSlate SignNow offers competitive pricing plans that cater to businesses needing to manage 2014 Hawaii nonresident documentation. Our flexible subscription models ensure you only pay for what you need, providing a cost-effective solution for your documentation needs.

-

Can airSlate SignNow integrate with tax software for 2014 Hawaii nonresident filing?

Absolutely! airSlate SignNow supports integration with various tax software tools, facilitating the seamless transfer of information for 2014 Hawaii nonresident filing. This integration enhances efficiency, allowing for smoother workflows in managing your tax documentation.

-

What benefits does eSigning provide for 2014 Hawaii nonresident tax documents?

eSigning provides multiple benefits for 2014 Hawaii nonresident tax documents, including enhanced security, reduced processing time, and the ability to sign from anywhere. This convenience allows you to meet filing deadlines more efficiently while ensuring your documents remain secure.

-

Is airSlate SignNow user-friendly for those unfamiliar with 2014 Hawaii nonresident tax processes?

Yes, airSlate SignNow is designed with a user-friendly interface that simplifies the experience, even for those unfamiliar with 2014 Hawaii nonresident tax processes. Our platform features intuitive navigation and helpful tools, making tax documentation accessible to everyone.

Get more for Hawaii Form N 15 Individual Income Tax Return

Find out other Hawaii Form N 15 Individual Income Tax Return

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document