N 15 Rev NonResident and Part Year Resident Income Tax Return Forms Fillable 2019

What is the N-15 Rev NonResident And Part Year Resident Income Tax Return?

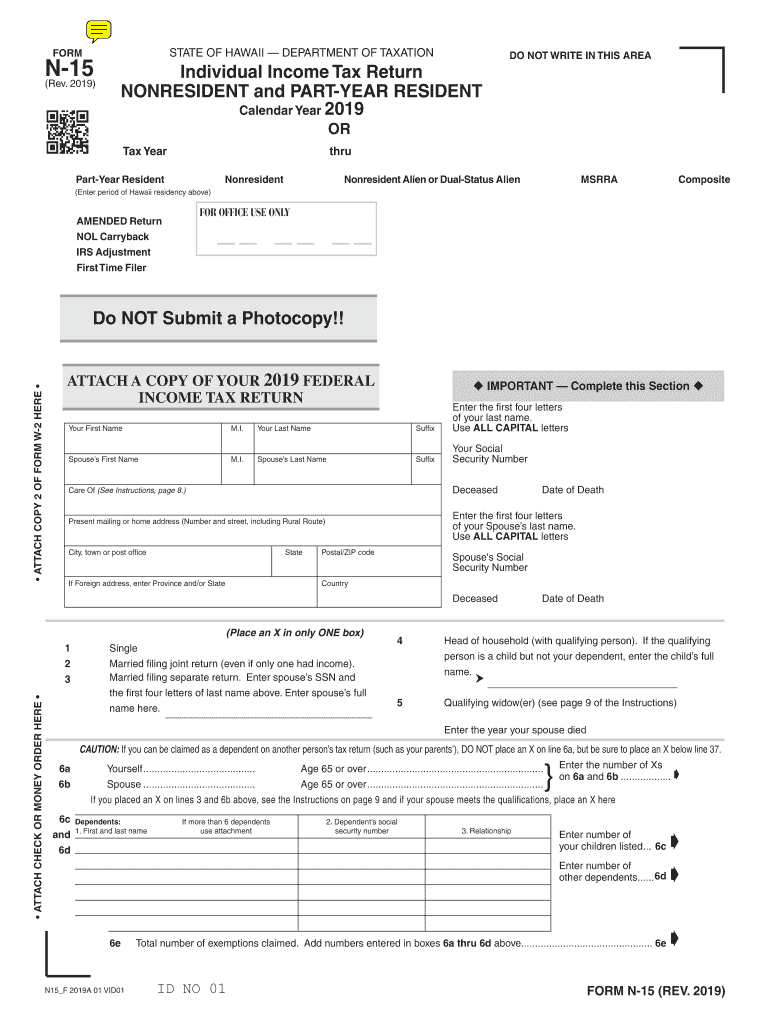

The N-15 Rev is a tax form specifically designed for non-residents and part-year residents of Hawaii. It is used to report income earned in Hawaii during the tax year. This form allows individuals who do not meet the residency requirements to file their state income tax, ensuring compliance with Hawaii's tax laws. The N-15 Rev is crucial for those who have income sourced from Hawaii but reside elsewhere, as it helps determine their tax obligations.

Steps to Complete the N-15 Rev NonResident And Part Year Resident Income Tax Return

Completing the N-15 Rev form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income earned in Hawaii, including wages, dividends, and rental income.

- Calculate your deductions and credits applicable to your situation.

- Determine your tax liability based on the Hawaii tax rates.

- Review the completed form for accuracy before submission.

Legal Use of the N-15 Rev NonResident And Part Year Resident Income Tax Return

The N-15 Rev form is legally binding when filled out correctly and submitted to the Hawaii Department of Taxation. It must be signed and dated by the taxpayer to validate the information provided. Compliance with state tax laws is essential, as failure to file or inaccuracies can lead to penalties. The form adheres to the legal requirements set forth by the state, ensuring that non-residents and part-year residents fulfill their tax obligations appropriately.

Filing Deadlines / Important Dates for the N-15 Rev

Filing deadlines for the N-15 Rev form are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available, which may allow additional time to file the form without incurring penalties.

Required Documents for the N-15 Rev NonResident And Part Year Resident Income Tax Return

To complete the N-15 Rev form accurately, several documents are required:

- W-2 forms from employers for income earned in Hawaii.

- 1099 forms for any additional income, such as freelance work or interest.

- Documentation for deductions, such as mortgage interest statements or property tax receipts.

- Any other relevant financial records that support the income and deductions claimed.

Who Issues the N-15 Rev NonResident And Part Year Resident Income Tax Return?

The N-15 Rev form is issued by the Hawaii Department of Taxation. This state agency is responsible for collecting taxes and ensuring compliance with Hawaii's tax laws. Taxpayers can obtain the form directly from the department's website or through authorized tax professionals. It is essential to use the most current version of the form to ensure compliance with any recent tax law changes.

Quick guide on how to complete n 15 rev 2019 nonresident and part year resident income tax return forms 2019 fillable

Effortlessly Prepare N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

Steps to Modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable with Ease

- Find N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n 15 rev 2019 nonresident and part year resident income tax return forms 2019 fillable

Create this form in 5 minutes!

How to create an eSignature for the n 15 rev 2019 nonresident and part year resident income tax return forms 2019 fillable

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the 15 form 2014 and how does it work with airSlate SignNow?

The 15 form 2014 is a specific document required in various business contexts. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your workflow. Our platform provides templates to help you fill out the 15 form 2014 quickly, enhancing efficiency.

-

Is airSlate SignNow suitable for businesses that need to manage the 15 form 2014?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes requiring the management of documents such as the 15 form 2014. By utilizing our platform, you can ensure that your documents are handled efficiently and securely.

-

What are the pricing plans for using airSlate SignNow for 15 form 2014?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users. You can find plans that suit individuals needing to file the 15 form 2014 and larger teams that require comprehensive document management solutions. Our cost-effective pricing makes it accessible for everyone.

-

Can I integrate airSlate SignNow with other tools for the 15 form 2014?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your document management process, including tools relevant to the 15 form 2014. This allows you to efficiently manage your workflow without jumping between different platforms.

-

What features does airSlate SignNow offer for managing the 15 form 2014?

airSlate SignNow provides numerous features that simplify the management of the 15 form 2014. These include customizable templates, easy eSigning options, and automated reminders, helping you manage deadlines effectively and keep your documents organized.

-

How does airSlate SignNow ensure the security of the 15 form 2014?

Security is a top priority at airSlate SignNow. When handling sensitive documents such as the 15 form 2014, our platform employs advanced encryption and secure access measures to protect your data and ensure compliance with relevant regulations.

-

Is it easy to train employees to use airSlate SignNow for the 15 form 2014?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for employees to learn how to use the platform for the 15 form 2014. With intuitive navigation and helpful resources, onboarding your team is quick and efficient.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Special or limited power of attorney for real estate sales transaction by seller utah form

- Special or limited power of attorney for real estate purchase transaction by purchaser utah form

- Limited power of attorney where you specify powers with sample powers included utah form

- Limited power of attorney for stock transactions and corporate powers utah form

- Special durable power of attorney for bank account matters utah form

- Utah small business startup package utah form

- Utah property management package utah form

- Utah minutes 497427820 form

Find out other N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online