N 15 Rev NonResident and Part Year Resident Income Tax Return Forms Fillable 2021

What is the N-15 Rev NonResident and Part Year Resident Income Tax Return?

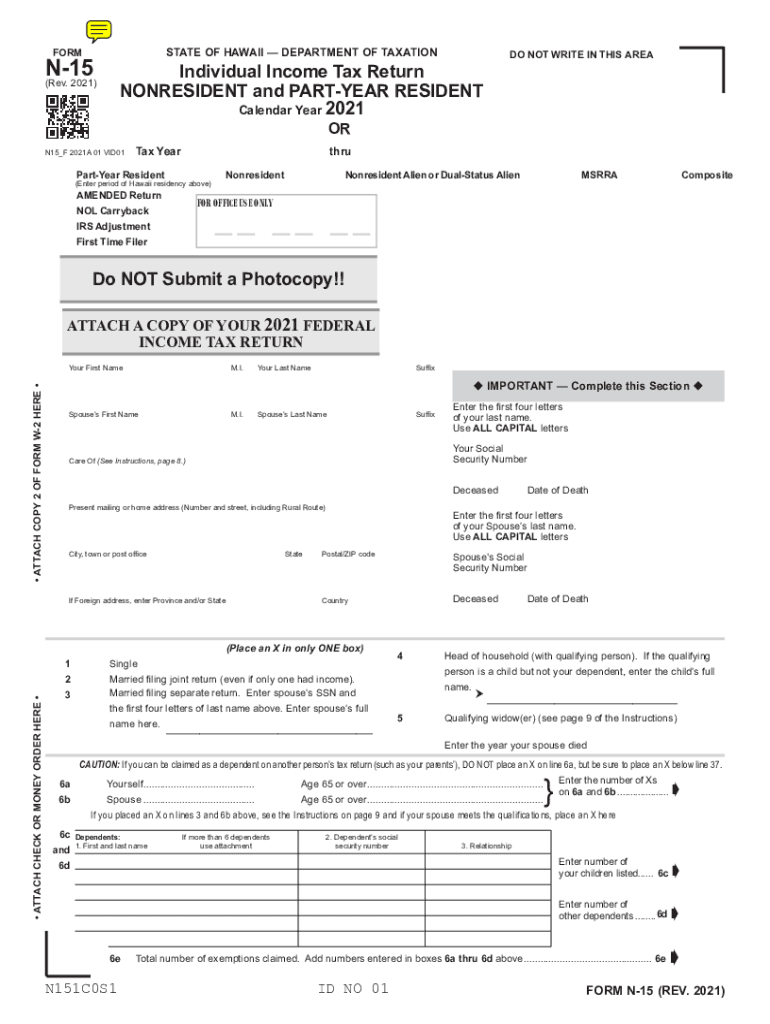

The N-15 Rev NonResident and Part Year Resident Income Tax Return is a specific tax form used by individuals who earn income in Hawaii but are not residents of the state for the entire year. This form is essential for reporting income earned in Hawaii, ensuring compliance with state tax laws. It is designed for nonresidents and part-year residents who need to file taxes on income sourced from Hawaii, allowing them to accurately report their earnings and calculate any tax liabilities.

Steps to Complete the N-15 Rev NonResident and Part Year Resident Income Tax Return

Completing the N-15 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s and 1099s that reflect income earned in Hawaii. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income earned in Hawaii, including wages, salaries, and other sources.

- Deduct any applicable exemptions and credits to determine your taxable income.

- Calculate the tax owed based on the state tax rates for nonresidents.

- Sign and date the form before submitting it to the appropriate tax authority.

How to Obtain the N-15 Rev NonResident and Part Year Resident Income Tax Return

The N-15 form can be obtained through the official Hawaii Department of Taxation website. It is available for download in a fillable PDF format, making it easy to complete digitally. Additionally, physical copies of the form can be requested from local tax offices or obtained at designated state agency locations. Ensure you have the most recent version of the form to comply with current tax regulations.

Legal Use of the N-15 Rev NonResident and Part Year Resident Income Tax Return

To ensure the legal validity of the N-15 form, it must be completed accurately and submitted by the specified deadlines. The form must include all required information, and any supporting documents should be attached as necessary. Filing the N-15 correctly not only fulfills legal obligations but also protects taxpayers from potential penalties or audits by the state tax authority.

Filing Deadlines and Important Dates for the N-15 Rev NonResident and Part Year Resident Income Tax Return

Filing deadlines for the N-15 form typically align with the federal tax filing deadlines. For most taxpayers, this means the form should be submitted by April fifteenth of the following year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents for the N-15 Rev NonResident and Part Year Resident Income Tax Return

When completing the N-15 form, specific documents are necessary to support your income claims and deductions. Required documents may include:

- W-2 forms from employers reporting wages earned in Hawaii.

- 1099 forms for any freelance or contract work performed in the state.

- Records of any other income sources, such as rental income or investments.

- Documentation for any deductions or credits claimed on the form.

Quick guide on how to complete n 15 rev 2021 nonresident and part year resident income tax return forms 2021 fillable

Complete N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable without any hassle

- Find N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n 15 rev 2021 nonresident and part year resident income tax return forms 2021 fillable

Create this form in 5 minutes!

People also ask

-

What is the Hawaii state form N 15?

The Hawaii state form N 15 is a tax form required for certain residents of Hawaii to report their income and determine their state tax obligations. It is essential for ensuring compliance with state tax laws and can be easily managed using online tools like airSlate SignNow.

-

How can airSlate SignNow help with the Hawaii state form N 15?

airSlate SignNow streamlines the process of completing and eSigning the Hawaii state form N 15. With its user-friendly interface, users can quickly fill out the necessary details and send the form securely, enhancing efficiency and accuracy.

-

Is there a cost associated with using airSlate SignNow for the Hawaii state form N 15?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Users can enjoy the cost-effective solution for managing documents, including the Hawaii state form N 15, with various features to choose from.

-

What features does airSlate SignNow offer for the Hawaii state form N 15?

airSlate SignNow provides multiple features for handling the Hawaii state form N 15, such as customizable templates, electronic signatures, and secure cloud storage. These tools make it easier for users to complete their forms accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for filing the Hawaii state form N 15?

Absolutely, airSlate SignNow offers integrations with various software platforms that can facilitate filing the Hawaii state form N 15. This allows users to connect their favorite apps and enhance their workflow without any hassle.

-

How does using airSlate SignNow benefit my business while preparing the Hawaii state form N 15?

Using airSlate SignNow to prepare the Hawaii state form N 15 enhances productivity by simplifying the documentation process. Businesses can save time, reduce errors, and ensure compliance with state tax requirements efficiently.

-

Is airSlate SignNow secure for sending the Hawaii state form N 15?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Hawaii state form N 15 is sent and stored safely. With advanced encryption and authentication measures, you can trust that your sensitive information is protected.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- Site work contractor package north dakota form

- Siding contractor package north dakota form

- Refrigeration contractor package north dakota form

- Drainage contractor package north dakota form

- Tax free exchange package north dakota form

- North dakota tenant 497317818 form

- Buy sell agreement package north dakota form

- Option to purchase package north dakota form

Find out other N 15 Rev NonResident And Part Year Resident Income Tax Return Forms Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors