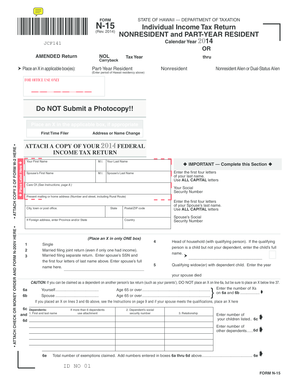

Hawaii N 15 Form 2014

What is the Hawaii N-15 Form

The Hawaii N-15 Form is a state tax form used by individuals who are not residents of Hawaii but earn income within the state. This form is essential for reporting income and calculating the appropriate tax liability for non-residents. It allows taxpayers to accurately report their earnings and claim any applicable deductions or credits. Understanding the purpose of the Hawaii N-15 Form is crucial for ensuring compliance with state tax laws.

How to use the Hawaii N-15 Form

Using the Hawaii N-15 Form involves several key steps. First, gather all necessary income documentation, including W-2s and 1099s that reflect earnings from Hawaii sources. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the income section, as this will determine your tax liability. After completing the form, review it for any errors before submitting it to the appropriate state tax authority.

Steps to complete the Hawaii N-15 Form

Completing the Hawaii N-15 Form requires a methodical approach:

- Gather your income documents, including any forms that report earnings from Hawaii.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned in Hawaii, ensuring you include all relevant sources.

- Claim any deductions or credits you are eligible for, as these can reduce your taxable income.

- Calculate your total tax due based on the instructions provided with the form.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Hawaii N-15 Form

The Hawaii N-15 Form is legally recognized for tax reporting purposes in the state of Hawaii. It is important for taxpayers to use this form correctly to avoid potential penalties or legal issues. The form must be submitted by the designated filing deadline to ensure compliance with state tax regulations. Additionally, utilizing an eSignature for the form can streamline the submission process while maintaining legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii N-15 Form typically align with the federal tax filing schedule. Taxpayers should be aware of the specific due dates to avoid late fees. Generally, the form must be filed by April 20 of the year following the tax year in question. It is advisable to verify any changes to deadlines annually, as state regulations can evolve.

Form Submission Methods

The Hawaii N-15 Form can be submitted through several methods, providing flexibility for taxpayers. Options include:

- Online submission via the state tax department's website, which may offer a streamlined process.

- Mailing a paper version of the completed form to the appropriate state tax office.

- In-person submission at designated tax offices, allowing for direct interaction with tax officials.

Quick guide on how to complete hawaii n 15 form 2014

Your assistance manual on how to prepare your Hawaii N 15 Form

If you’re curious about how to produce and transmit your Hawaii N 15 Form, here are some brief guidelines to simplify tax processing.

To begin, you only need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document platform that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, allowing for adjustments where necessary. Enhance your tax administration with advanced PDF manipulation, eSigning, and easy sharing capabilities.

Complete the following steps to finalize your Hawaii N 15 Form in no time:

- Create your account and start editing PDFs in moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Hawaii N 15 Form in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding electronic signature (if needed).

- Examine your document and correct any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Keep in mind that paper filing may lead to return errors and prolonged refunds. Certainly, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii n 15 form 2014

FAQs

-

How can I fill the improvement form for class 12th, CBSE 2014-15?

The forms are available in November or December only. You can't apply for an improvement now!And worse? You can't apply even for next session; it has to be in the year just after you graduated from your high school.

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

What is the procedure to fill out a 15G form?

Form 15G is the form which you give to Bank requesting them not to deduct tax as the liability is on you to state the interest as your income in returns, now a days banks are deducting TDS directly and hence Form 15G may be void now a days.

Create this form in 5 minutes!

How to create an eSignature for the hawaii n 15 form 2014

How to generate an electronic signature for the Hawaii N 15 Form 2014 online

How to make an eSignature for your Hawaii N 15 Form 2014 in Google Chrome

How to generate an eSignature for signing the Hawaii N 15 Form 2014 in Gmail

How to make an electronic signature for the Hawaii N 15 Form 2014 from your mobile device

How to create an electronic signature for the Hawaii N 15 Form 2014 on iOS devices

How to generate an eSignature for the Hawaii N 15 Form 2014 on Android

People also ask

-

What is the Hawaii N 15 Form and why do I need it?

The Hawaii N 15 Form is a tax form used by individuals who are not residents of Hawaii but have earned income in the state. Completing this form is essential for ensuring the correct tax amount is calculated and maintained. Using airSlate SignNow, you can easily eSign and submit your Hawaii N 15 Form without any hassle.

-

How does airSlate SignNow simplify the process of eSigning the Hawaii N 15 Form?

AirSlate SignNow provides a user-friendly interface that allows you to upload, fill, and eSign the Hawaii N 15 Form quickly. Our platform ensures your documents are securely stored and easily accessible. With features like templates and reminders, completing your form has never been easier.

-

Is there a cost associated with using airSlate SignNow for the Hawaii N 15 Form?

AirSlate SignNow offers competitive pricing for individuals and businesses looking to manage their documentation efficiently. While basic eSigning features are available for free, premium plans offering additional functionality for handling the Hawaii N 15 Form start at an affordable monthly rate, providing great value.

-

Can I integrate airSlate SignNow with other applications for filing the Hawaii N 15 Form?

Yes, airSlate SignNow supports integrations with various applications, making it easy to file the Hawaii N 15 Form. You can connect it with cloud storage services, CRMs, and project management tools to streamline your document workflow. This integration capability enhances your filing process and saves valuable time.

-

What are the benefits of using airSlate SignNow for the Hawaii N 15 Form?

Using airSlate SignNow for the Hawaii N 15 Form provides multiple benefits, including enhanced security for your sensitive information and faster turnaround times. The platform allows you to track the status of your documents and receive timely notifications, eliminating uncertainty in the filing process. You can complete your form with confidence and ease.

-

Is airSlate SignNow compliant with legal standards for the Hawaii N 15 Form?

Absolutely! AirSlate SignNow adheres to legal standards and regulations for electronic signatures, ensuring that your Hawaii N 15 Form is compliant and valid. Our platform uses advanced encryption technology to protect your data while meeting all necessary legal requirements for eSigning documents.

-

What types of documents can I create and manage with airSlate SignNow besides the Hawaii N 15 Form?

AirSlate SignNow is versatile and allows you to create and manage various types of documents beyond the Hawaii N 15 Form. You can handle contracts, agreements, and other essential forms all within the same platform. This versatility makes airSlate SignNow a comprehensive solution for all your document signing needs.

Get more for Hawaii N 15 Form

- Hahira honeybee dog show registration form

- Toothpickase lab pdf form

- City of roseville police department form

- Anthem subscriber terminationpcp change form louisville

- B8ab cover letter to defendant re acknowledgment of service chplnj form

- Research license agreement template form

- Research and development agreement template form

- Reseller partner agreement template form

Find out other Hawaii N 15 Form

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online