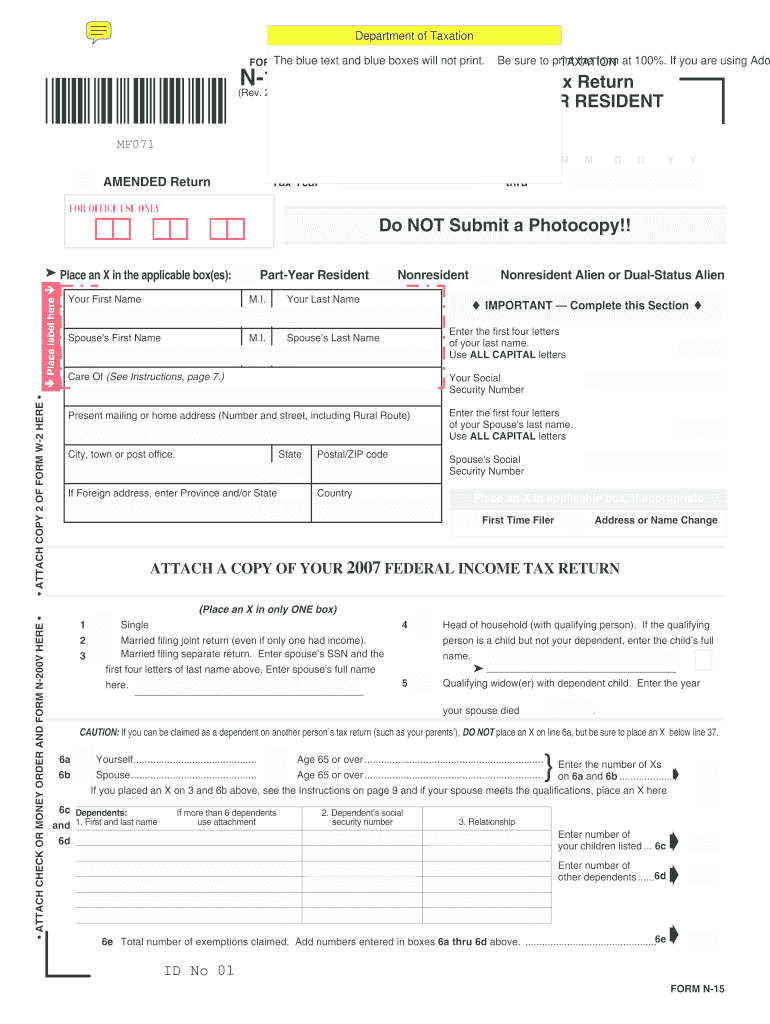

N 15 Rev NonResident and Part Year Resident Income Tax 2007

What is the N 15 Rev NonResident And Part Year Resident Income Tax

The N 15 Rev NonResident And Part Year Resident Income Tax form is a tax document used by individuals who are non-residents or part-year residents of a specific state. This form allows these taxpayers to report their income earned within the state during the tax year. It is essential for ensuring compliance with state tax laws and for accurately calculating the tax owed based on the income earned while residing or working in the state. The form is designed to accommodate various income types, ensuring that all relevant earnings are reported correctly.

Steps to complete the N 15 Rev NonResident And Part Year Resident Income Tax

Completing the N 15 Rev NonResident And Part Year Resident Income Tax involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the form accurately, ensuring that all income earned in the state is reported.

- Calculate the total tax owed based on the income reported and any applicable deductions or credits.

- Review the completed form for accuracy and completeness.

- Sign and date the form, ensuring compliance with signature requirements.

- Submit the form either electronically or via mail, following the specific submission guidelines provided by the state.

How to obtain the N 15 Rev NonResident And Part Year Resident Income Tax

The N 15 Rev NonResident And Part Year Resident Income Tax form can typically be obtained from the state’s department of revenue or taxation website. Many states provide downloadable PDF versions of the form, which can be filled out electronically or printed for manual completion. Additionally, some tax preparation software may include this form as part of their offerings, allowing for easier completion and submission.

Legal use of the N 15 Rev NonResident And Part Year Resident Income Tax

The legal use of the N 15 Rev NonResident And Part Year Resident Income Tax form is crucial for compliance with state tax regulations. Taxpayers must ensure that they use the correct version of the form for the specific tax year and that they adhere to all filing requirements. Failure to use the form appropriately can result in penalties, interest on unpaid taxes, or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the N 15 Rev NonResident And Part Year Resident Income Tax vary by state but typically align with the federal tax filing deadline. It is important for taxpayers to be aware of specific dates to avoid late fees and penalties. Some states may offer extensions, but these must be requested in advance, and taxpayers should remain informed about any changes in deadlines due to special circumstances, such as natural disasters or public health emergencies.

Required Documents

When completing the N 15 Rev NonResident And Part Year Resident Income Tax form, taxpayers should have the following documents ready:

- W-2 forms from employers for income earned.

- 1099 forms for any freelance or contract work.

- Documentation of any deductions or credits being claimed.

- Records of any state taxes withheld during the year.

Form Submission Methods (Online / Mail / In-Person)

The N 15 Rev NonResident And Part Year Resident Income Tax form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax portal, which may offer e-filing options for faster processing.

- Mailing a printed version of the completed form to the appropriate state tax office address.

- In-person submission at designated tax offices, which may be available in certain states for those who prefer face-to-face assistance.

Quick guide on how to complete n 15 rev 2007 nonresident and part year resident income tax

Your assistance manual on how to prepare your N 15 Rev NonResident And Part Year Resident Income Tax

If you’re curious about how to create and dispatch your N 15 Rev NonResident And Part Year Resident Income Tax, here are some straightforward guidelines to simplify tax processing.

To start, you simply need to sign up for your airSlate SignNow account to transform how you handle documentation online. airSlate SignNow is a user-friendly and robust document solution that allows you to modify, generate, and finalize your tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to change responses as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your N 15 Rev NonResident And Part Year Resident Income Tax in a matter of minutes:

- Create your account and begin working on PDFs in moments.

- Utilize our directory to access any IRS tax form; browse through different versions and schedules.

- Click Get form to launch your N 15 Rev NonResident And Part Year Resident Income Tax in our editor.

- Populate the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Finalize modifications, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes digitally with airSlate SignNow. Please be aware that filing on paper can lead to more mistakes and delays in reimbursements. Additionally, prior to e-filing your taxes, visit the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct n 15 rev 2007 nonresident and part year resident income tax

FAQs

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the n 15 rev 2007 nonresident and part year resident income tax

How to create an electronic signature for the N 15 Rev 2007 Nonresident And Part Year Resident Income Tax in the online mode

How to create an electronic signature for your N 15 Rev 2007 Nonresident And Part Year Resident Income Tax in Google Chrome

How to make an eSignature for putting it on the N 15 Rev 2007 Nonresident And Part Year Resident Income Tax in Gmail

How to generate an electronic signature for the N 15 Rev 2007 Nonresident And Part Year Resident Income Tax from your smart phone

How to generate an eSignature for the N 15 Rev 2007 Nonresident And Part Year Resident Income Tax on iOS devices

How to create an eSignature for the N 15 Rev 2007 Nonresident And Part Year Resident Income Tax on Android OS

People also ask

-

What is the N 15 Rev NonResident And Part Year Resident Income Tax form?

The N 15 Rev NonResident And Part Year Resident Income Tax form is designed for individuals who have earned income in Canada but do not reside there for the entire tax year. This form allows non-residents and part-year residents to report their income accurately and claim any applicable credits or deductions. Understanding this form is essential for ensuring compliance with Canadian tax regulations.

-

How can airSlate SignNow help with the N 15 Rev NonResident And Part Year Resident Income Tax form?

airSlate SignNow streamlines the process of completing and submitting the N 15 Rev NonResident And Part Year Resident Income Tax form by allowing users to fill out, sign, and send documents electronically. Our platform ensures that all necessary fields are completed accurately, reducing the likelihood of errors that could delay processing. With airSlate SignNow, managing your tax forms becomes easier and more efficient.

-

What features does airSlate SignNow offer for signing the N 15 Rev NonResident And Part Year Resident Income Tax form?

airSlate SignNow provides a range of features for signing the N 15 Rev NonResident And Part Year Resident Income Tax form, including customizable templates, secure electronic signatures, and real-time tracking. You can also integrate the platform with your existing document management systems, making it a seamless addition to your workflow. Our user-friendly interface ensures that signing tax documents is quick and hassle-free.

-

Is airSlate SignNow cost-effective for handling the N 15 Rev NonResident And Part Year Resident Income Tax?

Yes, airSlate SignNow is a cost-effective solution for handling the N 15 Rev NonResident And Part Year Resident Income Tax. We offer flexible pricing plans that cater to different business sizes and needs, ensuring that you only pay for what you use. By automating the signing process, you can save time and resources, ultimately reducing your overall expenses.

-

Can I store my N 15 Rev NonResident And Part Year Resident Income Tax documents securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the N 15 Rev NonResident And Part Year Resident Income Tax forms. All documents are stored in a secure cloud environment with encryption, ensuring that your sensitive information is protected. You can access your documents anytime, anywhere, with peace of mind.

-

What integrations does airSlate SignNow support for tax document management?

airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the N 15 Rev NonResident And Part Year Resident Income Tax forms. Popular integrations include Google Drive, Dropbox, and CRM systems, allowing you to streamline your workflow and keep all your documents organized. The flexibility of our integrations makes it easy to incorporate airSlate SignNow into your existing processes.

-

What are the benefits of using airSlate SignNow for the N 15 Rev NonResident And Part Year Resident Income Tax?

Using airSlate SignNow for the N 15 Rev NonResident And Part Year Resident Income Tax offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved accuracy. The platform simplifies the signing process, allowing for faster turnaround times on tax documents. Additionally, our customer support is available to assist you with any queries, ensuring a smooth experience.

Get more for N 15 Rev NonResident And Part Year Resident Income Tax

- Cpr and first aid training request form sds 361 1212

- Australian disability parking permit mobility impairment form

- The vehicle must be further than 200 miles away from the nearest dmv inspection lane to qualify form

- Icao flight plan equipment codes for aircraft with ifr gps form

- Certified public accountant form 4b verification of experience by supervisor

- New zealand superannuation applicationm12 use this application to apply for new zealand superannuation nz super if youre not form

- Solved irs letter from estonia intuit accountants community form

- Pdf notice cp2566 internal revenue service form

Find out other N 15 Rev NonResident And Part Year Resident Income Tax

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word