Hawaii Tax N 15 2015

What is the Hawaii Tax N 15

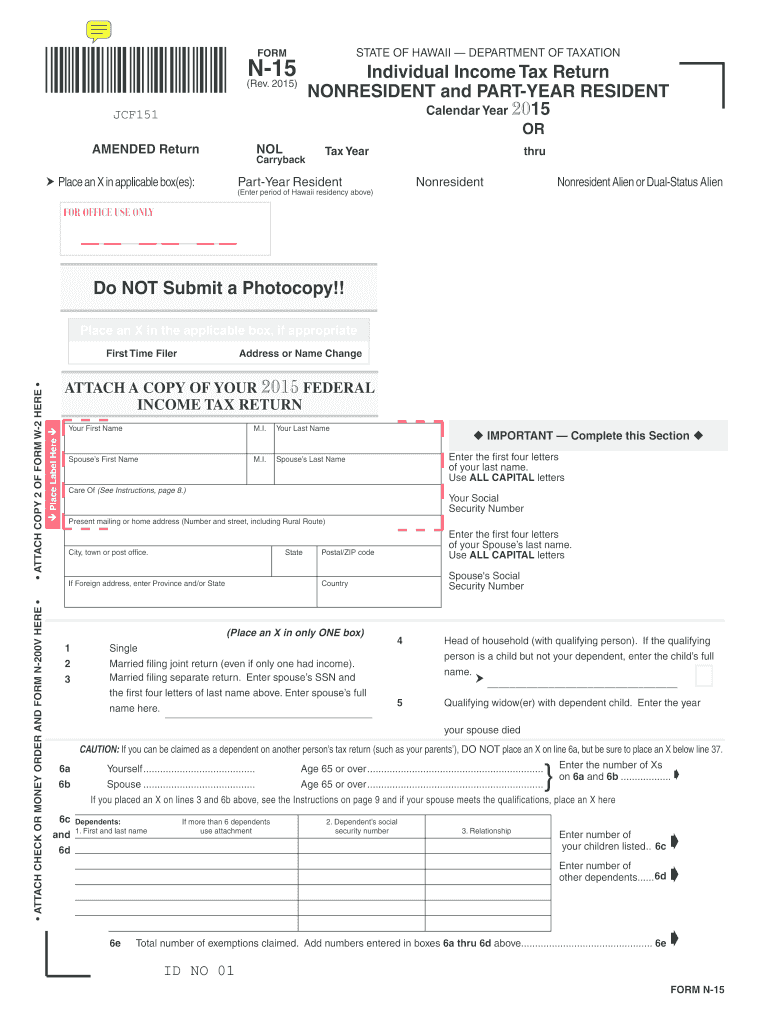

The Hawaii Tax N 15 is a state income tax form used by residents of Hawaii to report their income and calculate their tax liability. This form is specifically designed for individuals who have income that is not subject to federal withholding. The N 15 form allows taxpayers to detail their income sources, deductions, and credits, ultimately determining the amount of tax owed or the refund due. Understanding the purpose and requirements of the N 15 form is essential for accurate tax reporting and compliance with state regulations.

Steps to Complete the Hawaii Tax N 15

Completing the Hawaii Tax N 15 involves several key steps to ensure accuracy and compliance:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information at the top of the form, including your name, address, and Social Security number.

- Report your total income from various sources in the designated sections.

- Claim any deductions and credits for which you are eligible, following the instructions provided on the form.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before signing and dating it.

How to Obtain the Hawaii Tax N 15

The Hawaii Tax N 15 form can be obtained through several convenient methods. Taxpayers can download a fillable PDF version directly from the Hawaii Department of Taxation website. Additionally, physical copies of the form may be available at local tax offices or public libraries. For those who prefer digital solutions, using an eSignature platform can streamline the process of completing and submitting the form electronically.

Legal Use of the Hawaii Tax N 15

Using the Hawaii Tax N 15 form is legally required for residents who need to report specific types of income. It is important to ensure that the form is filled out accurately and submitted by the designated deadlines to avoid penalties. The form must be signed by the taxpayer, and electronic signatures are accepted under state law, provided they comply with the necessary regulations. Understanding the legal implications of using the N 15 form helps ensure that taxpayers remain compliant with state tax laws.

Form Submission Methods

Taxpayers have multiple options for submitting the Hawaii Tax N 15 form. The form can be filed electronically through approved e-filing services, which can expedite processing times. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate state tax office. In-person submissions are also possible at designated locations. It is essential to verify the submission method that aligns with personal preferences and compliance requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Tax N 15 are crucial for taxpayers to observe. Typically, the deadline for submitting the form is April fifteenth of the following year after the tax year ends. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, as well as the implications of late submissions, which can include penalties and interest on unpaid taxes.

Quick guide on how to complete hawaii n15 tax form 2015 2019

Your assistance manual on how to prepare your Hawaii Tax N 15

If you’re interested in understanding how to finalize and present your Hawaii Tax N 15, here are a few concise guidelines to facilitate tax submission.

To begin, you simply need to create your airSlate SignNow account to revolutionize your approach to managing documents online. airSlate SignNow is an extremely user-friendly and powerful document service that enables you to adjust, draft, and finalize your income tax forms with ease. With its editor, you can navigate between text, checkboxes, and eSignatures and return to modify answers as necessary. Streamline your tax administration with enhanced PDF editing, electronic signing, and user-friendly sharing.

Adhere to the steps below to achieve your Hawaii Tax N 15 in no time:

- Set up your account and start engaging with PDFs in just a few moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Hawaii Tax N 15 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper may lead to increased return errors and delayed refunds. Naturally, before electronically filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii n15 tax form 2015 2019

FAQs

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the hawaii n15 tax form 2015 2019

How to generate an eSignature for your Hawaii N15 Tax Form 2015 2019 in the online mode

How to make an eSignature for the Hawaii N15 Tax Form 2015 2019 in Chrome

How to generate an electronic signature for putting it on the Hawaii N15 Tax Form 2015 2019 in Gmail

How to create an electronic signature for the Hawaii N15 Tax Form 2015 2019 straight from your smartphone

How to make an electronic signature for the Hawaii N15 Tax Form 2015 2019 on iOS devices

How to create an eSignature for the Hawaii N15 Tax Form 2015 2019 on Android

People also ask

-

What is the fillable 2017 Hawaii tax form N-15?

The fillable 2017 Hawaii tax form N-15 is a state income tax form used by individuals who are part-year residents of Hawaii. It allows taxpayers to report their income accurately while benefiting from the state's tax credits. By using a fillable version, you can complete and submit your tax return electronically, which simplifies the process.

-

How can airSlate SignNow help me with the fillable 2017 Hawaii tax form N-15?

airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign your fillable 2017 Hawaii tax form N-15 effortlessly. Our solution ensures that your documents are secure and compliant with state regulations. Plus, you can easily share the form with tax professionals for a seamless filing experience.

-

Is there a cost associated with using the fillable 2017 Hawaii tax form N-15 on airSlate SignNow?

Yes, there is a minimal subscription fee for using airSlate SignNow's features, including the fillable 2017 Hawaii tax form N-15. This cost provides you with access to all the tools necessary for efficient document management and eSigning. We offer various pricing plans to suit different needs and budgets.

-

What features does airSlate SignNow offer for the fillable 2017 Hawaii tax form N-15?

With airSlate SignNow, you get features such as customizable templates for the fillable 2017 Hawaii tax form N-15, secure cloud storage, and the ability to eSign documents on any device. Our platform also allows for collaboration, letting multiple users work on the document. This enhances productivity and streamlines your tax filing process.

-

Can I access the fillable 2017 Hawaii tax form N-15 from any device?

Absolutely! The fillable 2017 Hawaii tax form N-15 can be accessed and completed from any device, including smartphones, tablets, and computers. airSlate SignNow's cloud-based solution ensures you can work on your tax filing anytime, anywhere. This flexibility is ideal for busy individuals looking to manage their finances on the go.

-

Are there any integrations available with airSlate SignNow for the fillable 2017 Hawaii tax form N-15?

Yes, airSlate SignNow integrates with various applications and platforms to enhance your workflow with the fillable 2017 Hawaii tax form N-15. You can connect it with cloud storage services, CRM systems, and productivity tools, making it easier to manage your documents. These integrations allow for a seamless transition between platforms and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the fillable 2017 Hawaii tax form N-15?

Using airSlate SignNow for the fillable 2017 Hawaii tax form N-15 offers several benefits, including increased efficiency, enhanced security, and reduced processing time. The platform simplifies document management and eSigning, making it easier for you to focus on your finances. Additionally, our customer support team is available to assist you if you need help.

Get more for Hawaii Tax N 15

Find out other Hawaii Tax N 15

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy