SC Issues Tax Relief Due to Hurricane Ian, Encourages Filing by 2022

Understanding the SC Issues Tax Relief Due to Hurricane Ian

The SC Issues Tax Relief due to Hurricane Ian provides essential support to taxpayers affected by the disaster. This relief includes extensions for filing returns and making payments, ensuring that individuals and businesses can manage their financial obligations without added stress during recovery. The South Carolina Department of Revenue (SCDOR) has outlined specific provisions to assist those impacted, making it crucial for taxpayers to stay informed about their eligibility and the benefits available to them.

Steps to Complete the SC Issues Tax Relief Due to Hurricane Ian

To effectively complete the necessary forms for the SC Issues Tax Relief, follow these steps:

- Gather all relevant documentation, including income statements and any records of damages incurred due to Hurricane Ian.

- Review the eligibility criteria set forth by the SCDOR to ensure you qualify for the relief.

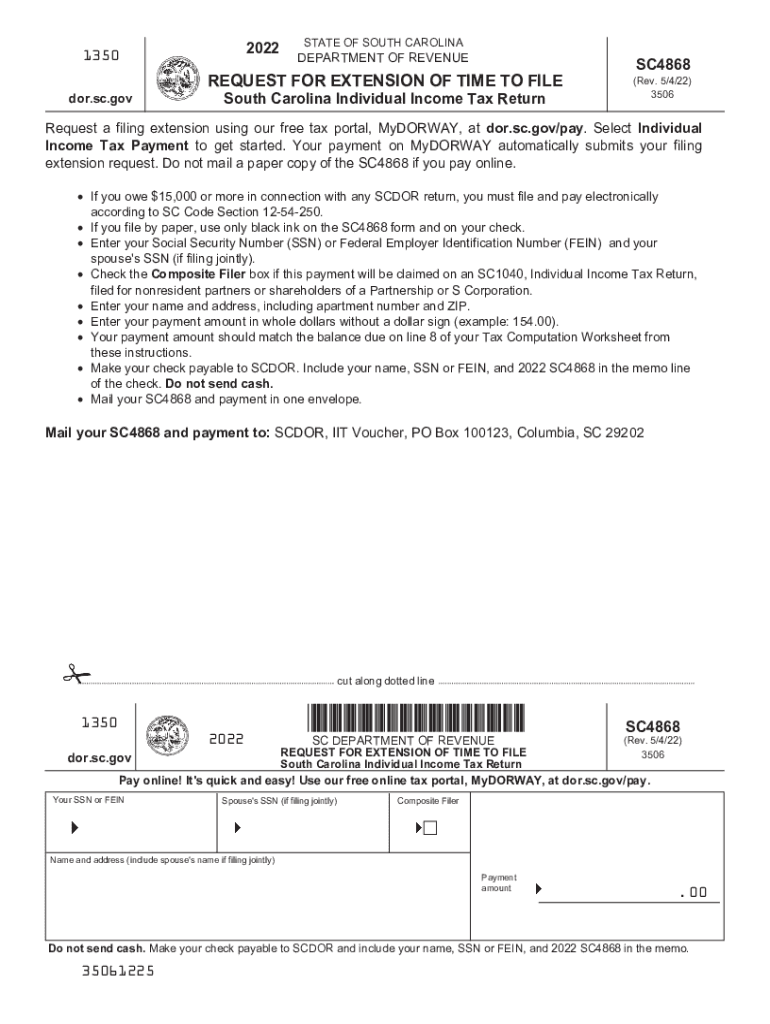

- Access the required forms, which may include the SC-4868 for extensions or other specific documents related to your situation.

- Fill out the forms accurately, ensuring all information is complete and correct.

- Submit the forms through the designated method, whether online, via mail, or in person, as specified by the SCDOR.

Required Documents for SC Issues Tax Relief

When applying for the SC Issues Tax Relief, certain documents are essential for a smooth process. These may include:

- Proof of identity, such as a driver's license or Social Security number.

- Income documentation, including W-2s or 1099s.

- Records of damages or losses due to Hurricane Ian, such as photographs or insurance claims.

- Completed tax forms, including any extensions or specific relief applications.

Eligibility Criteria for Tax Relief

To qualify for the SC Issues Tax Relief, taxpayers must meet specific eligibility criteria. Generally, these include:

- Being a resident of South Carolina or having business operations in the state.

- Experiencing financial impact due to Hurricane Ian, such as property damage or loss of income.

- Filing the necessary forms by the established deadlines set by the SCDOR.

IRS Guidelines Related to State Relief

It is important to consider IRS guidelines when applying for state relief. The IRS provides federal tax relief measures that may complement state offerings. This includes:

- Understanding how federal extensions align with state relief efforts.

- Reviewing any changes to federal tax deductions or credits that may apply to your situation.

- Staying updated on any announcements from the IRS regarding disaster relief provisions.

Form Submission Methods for Tax Relief

Taxpayers have several options for submitting their forms related to the SC Issues Tax Relief. These methods include:

- Online submission through the SCDOR website, which is often the fastest option.

- Mailing completed forms to the appropriate SCDOR address, ensuring to allow adequate time for delivery.

- In-person submission at designated SCDOR offices, which may provide immediate assistance and confirmation.

Quick guide on how to complete sc issues tax relief due to hurricane ian encourages filing by

Effortlessly Prepare SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a superior eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By with Ease

- Locate SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc issues tax relief due to hurricane ian encourages filing by

Create this form in 5 minutes!

How to create an eSignature for the sc issues tax relief due to hurricane ian encourages filing by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help businesses?

airSlate SignNow is a powerful eSignature solution that empowers businesses to send and eSign documents seamlessly. It helps streamline the signing process, eliminating the need for paper and manual signatures, ultimately saving time and costs associated with document handling.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on usage and plans. Generally, our plans are cost-effective, designed to accommodate businesses of all sizes. With flexible options, you can choose a plan that meets your needs without breaking the bank.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features including document templates, advanced authentication options, and customizable workflows. These features allow users to prepare, send, and sign documents efficiently. You can take full advantage of these tools to optimize your document management process.

-

Is airSlate SignNow secure for document signing?

Yes, airSlate SignNow ensures high-level security for all documents signed through the platform. We implement robust security measures including encryption and secure data storage to protect sensitive information. Thus, businesses can confidently manage their documents knowing that their eSignatures are safe.

-

What benefits can businesses expect from using airSlate SignNow?

By using airSlate SignNow, businesses can expect increased efficiency, reduced paperwork, and faster turnaround times on important documents. The ease of use enables teams to focus more on their core tasks rather than administrative burdens. Overall, the service enhances productivity and collaboration.

-

Can airSlate SignNow integrate with other business tools?

Absolutely! airSlate SignNow integrates seamlessly with numerous apps and platforms, enhancing the overall user experience. By connecting with your favorite tools, you can streamline workflows and boost productivity across your business operations.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is easy! You can sign up for a free trial to explore the features and see how it aligns with your business needs. After the trial, you can select a pricing plan that suits you and start sending documents for eSigning.

Get more for SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By

Find out other SC Issues Tax Relief Due To Hurricane Ian, Encourages Filing By

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer