Sc File 2019

What is the SC Tax Extension?

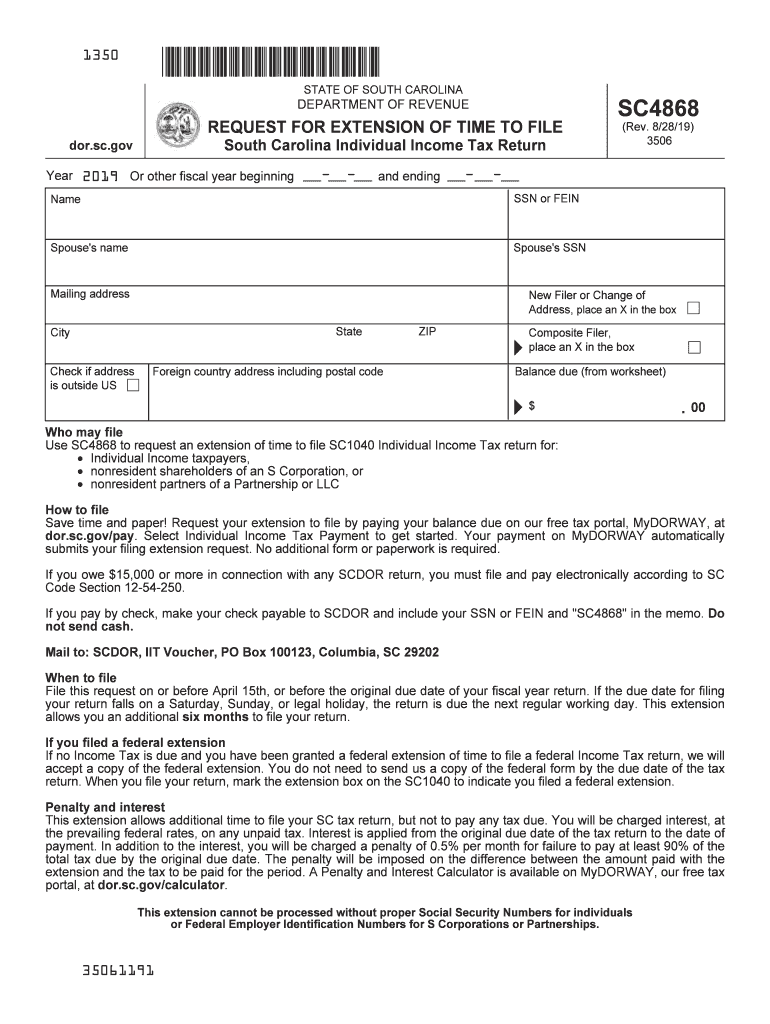

The SC tax extension, formally known as the South Carolina Department of Revenue (SCDOR) extension, allows taxpayers in South Carolina to request additional time to file their state tax returns. This extension is typically granted for six months, providing taxpayers with the opportunity to gather necessary documentation and ensure accurate filing without incurring penalties for late submission. The form used for this purpose is the SC-4868, which must be completed and submitted to the SCDOR to officially request the extension.

Steps to Complete the SC Tax Extension Form

Completing the SC tax extension form requires careful attention to detail. Here are the essential steps:

- Obtain the SC-4868 form from the SCDOR website or through authorized resources.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your estimated tax liability for the year, as this will help determine any necessary payments.

- Sign and date the form to validate your request.

- Submit the completed form to the SCDOR by the original filing deadline, either online or via mail.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the SC tax extension. The original deadline for filing your state tax return typically falls on April 15. If you submit your SC-4868 by this date, you will receive an automatic six-month extension, allowing you to file your return by October 15. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal Use of the SC Tax Extension

The SC tax extension is legally recognized as a valid request for additional time to file your state tax return. To ensure compliance with state regulations, it is essential to submit the SC-4868 form accurately and on time. The extension does not extend the time to pay any taxes owed; therefore, taxpayers should estimate their tax liability and remit any payment due by the original deadline to avoid penalties.

Form Submission Methods

Taxpayers can submit the SC-4868 form through various methods, ensuring flexibility and convenience. The options include:

- Online Submission: Many taxpayers prefer to file electronically through the SCDOR’s online portal, which provides immediate confirmation of receipt.

- Mail: For those who prefer traditional methods, the form can be printed and mailed to the appropriate SCDOR address.

- In-Person: Taxpayers may also visit a local SCDOR office to submit their form directly.

Required Documents

When completing the SC tax extension form, certain documents may be necessary to ensure accurate reporting. These may include:

- Your previous year's tax return for reference.

- Documentation of income, such as W-2s or 1099s.

- Any relevant deductions or credits that may apply to your current tax situation.

Quick guide on how to complete sc4868

Prepare Sc File effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Sc File on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and electronically sign Sc File with ease

- Find Sc File and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, time-consuming form searches, or mistakes that require new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Sc File and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc4868

Create this form in 5 minutes!

How to create an eSignature for the sc4868

How to make an eSignature for the Sc4868 online

How to create an electronic signature for your Sc4868 in Chrome

How to create an electronic signature for signing the Sc4868 in Gmail

How to generate an eSignature for the Sc4868 straight from your smartphone

How to make an electronic signature for the Sc4868 on iOS devices

How to make an eSignature for the Sc4868 on Android devices

People also ask

-

What is an SC tax extension?

An SC tax extension is a request for additional time to file your South Carolina state tax return. By filing for an SC tax extension, you can receive an automatic six-month extension, ensuring you avoid penalties for late filing while still being required to pay any taxes owed by the original due date.

-

How can airSlate SignNow assist with SC tax extensions?

airSlate SignNow streamlines the process of submitting your SC tax extension requests by allowing you to eSign and send documents securely online. This easy-to-use platform saves time and ensures that your SC tax extension paperwork is handled efficiently, giving you peace of mind during tax season.

-

What are the costs associated with filing an SC tax extension using airSlate SignNow?

Filing an SC tax extension using airSlate SignNow is cost-effective, with flexible pricing plans tailored to suit businesses of all sizes. You can access essential features for submitting your SC tax extension and managing documents without breaking the bank, making it an excellent choice for budget-conscious users.

-

Do I need to pay estimated taxes when filing an SC tax extension?

Yes, even if you file for an SC tax extension, you must pay any estimated taxes owed by the original due date to avoid penalties and interest. Consider utilizing airSlate SignNow to ensure your payment process and documentation are handled quickly and effectively.

-

What features does airSlate SignNow offer for managing SC tax extensions?

airSlate SignNow offers a variety of features designed to simplify the management of SC tax extensions. Users can enjoy secure eSigning, document tracking, and cloud storage, ensuring that all crucial tax-related documents are accessible and organized throughout the filing process.

-

Is airSlate SignNow secure for filing sensitive tax documents?

Absolutely! airSlate SignNow prioritizes the security of sensitive documents, including those related to SC tax extensions. With advanced encryption and compliance with industry regulations, your information remains safe, allowing you to focus on filing without worry.

-

Can airSlate SignNow integrate with my accounting software for SC tax extensions?

Yes, airSlate SignNow offers integrations with various accounting software systems to facilitate the management of your SC tax extensions more efficiently. These integrations help streamline data transfer, making it easier to keep your financial records organized and up-to-date.

Get more for Sc File

- Cms 802 form

- How to fill out pretrial statement form

- Pinal county building permit application 2014 form

- Fire chief application 2014doc ridgefieldct form

- Decd vl155 form

- Decd unpaid leave form

- Application form 7 powerline clearance declaration formdoc plant ecology amp diversity 001 12

- City of boston jobs and living wage ordinance cityofboston form

Find out other Sc File

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy