South Carolina SC Department of Revenue 2020

What is the South Carolina SC Department of Revenue?

The South Carolina Department of Revenue (SCDOR) is the state agency responsible for administering tax laws and collecting state taxes. It oversees various tax programs, including income tax, sales tax, and property tax. The SCDOR also provides resources and support to taxpayers, ensuring compliance with state tax regulations. Understanding the role of the SCDOR is essential for individuals and businesses navigating the tax landscape in South Carolina.

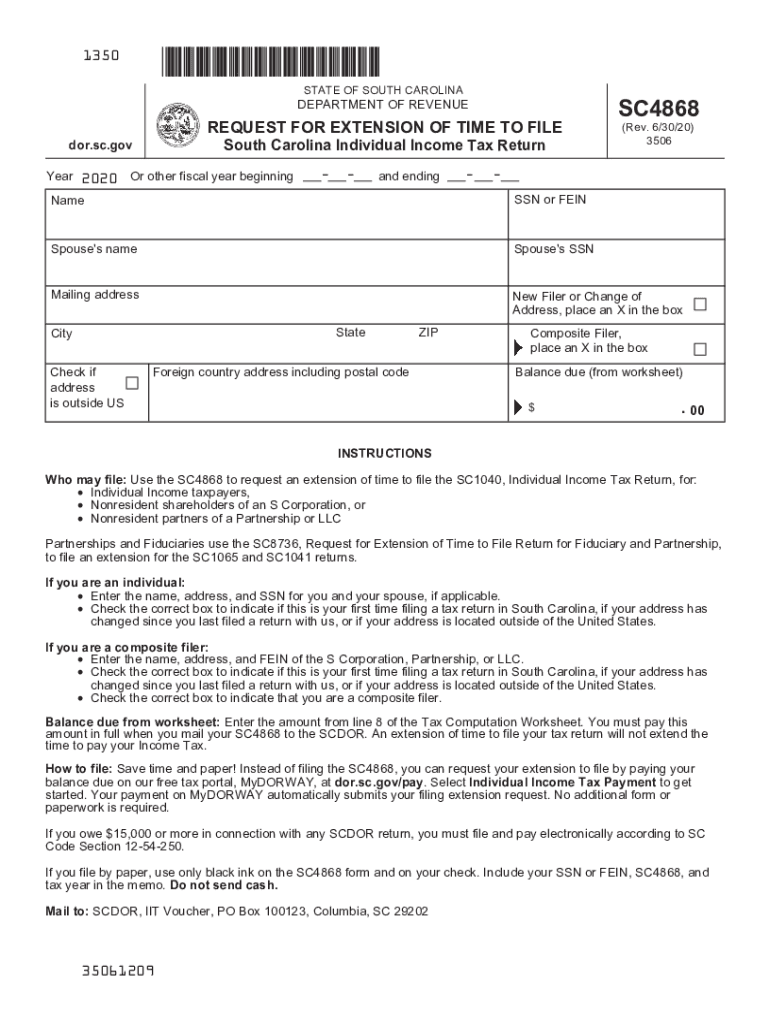

Steps to complete the South Carolina SC Department of Revenue Form SC4868

Completing the SC4868 form, which is the application for an extension of time to file your South Carolina income tax return, involves several key steps. First, ensure you have all necessary personal and financial information, including your Social Security number and estimated tax liability. Next, accurately fill out the form, providing details such as your name, address, and the amount of tax owed. After completing the form, you can submit it electronically through the SCDOR website or mail it to the appropriate address. It's important to file the SC4868 by the due date to avoid penalties.

Filing Deadlines / Important Dates

For taxpayers in South Carolina, knowing the filing deadlines for the SC4868 form is crucial. Generally, the deadline to file for an extension aligns with the original due date of your tax return, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Filing the SC4868 on time ensures you receive an extension and can avoid late filing penalties. Keep track of these important dates to maintain compliance with state tax laws.

Required Documents

When preparing to file the SC4868 form, certain documents are necessary to ensure accurate completion. You will need your previous year’s tax return, which provides a basis for estimating your current tax liability. Additionally, gather any relevant income statements, such as W-2s or 1099s, and documentation of deductions or credits you plan to claim. Having these documents ready will streamline the process and help avoid errors that could lead to complications with the SCDOR.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the SC4868 form can result in significant penalties. If you do not file for an extension by the deadline, you may face late filing fees and interest on any unpaid taxes. Additionally, if your tax return is filed late without an approved extension, the SCDOR may impose further penalties. Understanding these consequences underscores the importance of timely filing and compliance with South Carolina tax laws.

Eligibility Criteria

Eligibility for filing the SC4868 form is generally available to all individual taxpayers in South Carolina who require additional time to file their income tax returns. This includes those who may be self-employed, retired, or have complex tax situations. However, it's important to note that while the SC4868 provides an extension for filing, it does not extend the time to pay any taxes owed. Taxpayers should ensure they meet all eligibility criteria to avoid complications with their tax obligations.

Quick guide on how to complete south carolina sc department of revenue

Effortlessly Prepare South Carolina SC Department Of Revenue on Any Device

Managing documents online has gained signNow traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed forms, as you can easily locate the necessary document and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle South Carolina SC Department Of Revenue on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign South Carolina SC Department Of Revenue with Ease

- Find South Carolina SC Department Of Revenue and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign South Carolina SC Department Of Revenue to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the south carolina sc department of revenue

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is an SC tax extension and why might I need it?

An SC tax extension allows taxpayers in South Carolina to extend the deadline for filing their state income tax returns. This is beneficial for individuals or businesses who may need additional time to gather their financial information or ensure accuracy in their filings.

-

How does airSlate SignNow support the SC tax extension process?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the necessary documents for an SC tax extension. With our solution, you can ensure that your tax extension request is submitted quickly and securely, minimizing the risk of missed deadlines.

-

What features does airSlate SignNow offer for managing SC tax extensions?

Our platform offers various features that facilitate the management of SC tax extensions, such as document templates, automated reminders, and real-time tracking of signed documents. These tools help streamline the process and ensure that all necessary documentation is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for SC tax extensions?

Yes, airSlate SignNow provides several pricing plans to cater to different business sizes and needs. Our cost-effective solutions make it easy to manage SC tax extensions without breaking the bank, offering great value for your investment.

-

Can I integrate airSlate SignNow with other accounting software when filing for SC tax extensions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to synchronize your data and simplify the process of filing for SC tax extensions. This integration ensures that you have all your financial information at your fingertips for a smooth filing experience.

-

What benefits can I expect from using airSlate SignNow for my SC tax extension?

Using airSlate SignNow for your SC tax extension offers numerous benefits, including time savings, enhanced accuracy, and improved security. Our platform helps you avoid potential mistakes and ensures that your documents are securely shared and stored, giving you peace of mind during tax season.

-

How do I get started with airSlate SignNow for SC tax extensions?

Getting started with airSlate SignNow is simple. Visit our website, sign up for a free trial, and explore the features tailored for managing SC tax extensions. Once registered, you can easily upload your documents and begin the signing process right away.

Get more for South Carolina SC Department Of Revenue

Find out other South Carolina SC Department Of Revenue

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement