Sc Extension Form 2018

What is the SC Extension Form?

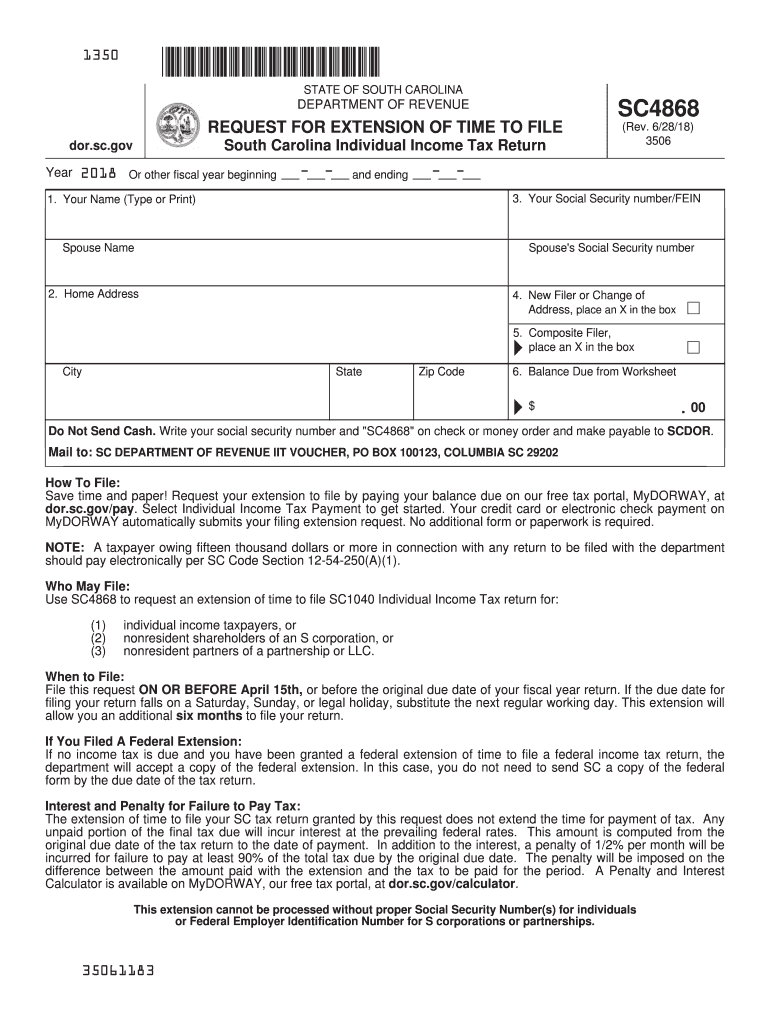

The SC Extension Form, specifically the 2018 SC4868, is a tax form used by residents of South Carolina to request an extension for filing their state income tax returns. This form allows taxpayers to extend their filing deadline, providing additional time to prepare their returns without incurring penalties for late submission. It is important to note that while the extension allows for more time to file, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and submit any payment due by the original filing deadline to avoid interest and penalties.

Steps to Complete the SC Extension Form

Completing the SC4868 involves several straightforward steps:

- Download the form from the South Carolina Department of Revenue website or access it through a trusted e-signature platform.

- Provide your personal information, including your name, address, and Social Security number.

- Estimate your total tax liability for the year and indicate any payments made.

- Sign and date the form. An electronic signature is acceptable if you are submitting the form online.

- Submit the completed form by the original due date of your tax return, either electronically or by mail.

Legal Use of the SC Extension Form

The SC4868 is legally recognized by the South Carolina Department of Revenue as a valid request for an extension of time to file your state income tax return. To ensure compliance, it is crucial to adhere to the guidelines set forth by the IRS and the state. This includes accurately estimating your tax liability and making any necessary payments by the deadline. Failure to comply with these requirements may result in penalties and interest on any unpaid taxes.

Filing Deadlines / Important Dates

For the 2018 tax year, the deadline to file your state income tax return is typically April 15. If you are using the SC4868 to request an extension, it must be submitted by this date. The extension allows you to file your return by October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties. It is essential to keep track of these dates to ensure compliance with state tax laws.

Form Submission Methods

The SC4868 can be submitted through various methods, offering flexibility for taxpayers:

- Online Submission: Use a secure e-signature platform to complete and submit the form electronically.

- Mail: Print the completed form and send it to the appropriate address for the South Carolina Department of Revenue.

- In-Person: Deliver the form directly to a local Department of Revenue office if preferred.

Required Documents

When completing the SC4868, you may need to have certain documents on hand to accurately estimate your tax liability. These documents include:

- Your previous year's tax return for reference.

- W-2 forms from your employer(s) for income reporting.

- Any 1099 forms if you have additional income sources.

- Documentation of deductions or credits you plan to claim.

Quick guide on how to complete power of attorney south carolina department of revenue scgov

Your assistance manual for preparing your Sc Extension Form

If you’re curious about how to generate and submit your Sc Extension Form, here are some concise guidelines to simplify tax processing.

To begin, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to alter, draft, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, allowing for modifications where necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing options.

Follow the procedures below to finalize your Sc Extension Form quickly:

- Create your account and start editing PDFs promptly.

- Utilize our directory to access any IRS tax form; explore various versions and schedules.

- Select Get form to open your Sc Extension Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to errors in returns and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct power of attorney south carolina department of revenue scgov

FAQs

-

How long does it take to receive a South Carolina driver's license after submitting the appropriate paper work with the DMV when moving from out of state into SC?

I can’t speak for SC, but when I moved from NY to PA, it took 6 weeks. I understand that most DMV’s have similar delays.

Create this form in 5 minutes!

How to create an eSignature for the power of attorney south carolina department of revenue scgov

How to generate an electronic signature for your Power Of Attorney South Carolina Department Of Revenue Scgov in the online mode

How to create an electronic signature for your Power Of Attorney South Carolina Department Of Revenue Scgov in Google Chrome

How to create an eSignature for putting it on the Power Of Attorney South Carolina Department Of Revenue Scgov in Gmail

How to make an eSignature for the Power Of Attorney South Carolina Department Of Revenue Scgov straight from your smartphone

How to make an electronic signature for the Power Of Attorney South Carolina Department Of Revenue Scgov on iOS

How to create an electronic signature for the Power Of Attorney South Carolina Department Of Revenue Scgov on Android devices

People also ask

-

What is the 2018 sc4868 form used for?

The 2018 sc4868 form is primarily used for requesting an extension to file your U.S. individual income tax return. By filing this form, taxpayers can get an additional six months to submit their returns. It's crucial for anyone looking to avoid penalties while ensuring they have enough time to gather their documents.

-

How can airSlate SignNow help with the 2018 sc4868 filing process?

With airSlate SignNow, you can easily prepare, send, and eSign the 2018 sc4868 form quickly and securely. Our platform simplifies document management, allowing you to focus on other aspects of your tax situation. Plus, with our built-in tools, tracking the status of your submitted forms is hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 2018 sc4868?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, making it a cost-effective choice for working with forms like the 2018 sc4868. We provide various subscription options, allowing you to select a plan that aligns with your requirements and budget. Take advantage of our free trial to explore the features before committing.

-

What features does airSlate SignNow offer for managing the 2018 sc4868?

airSlate SignNow includes features such as template creation, automated reminders, and secure cloud storage specifically for documents like the 2018 sc4868. Our user-friendly interface streamlines the signing process, ensuring your forms can be completed efficiently. Additionally, you can collaborate with team members in real time to ensure accuracy.

-

Can I integrate airSlate SignNow with other tools for the 2018 sc4868?

Absolutely! airSlate SignNow offers robust integrations with popular applications such as Google Drive, Dropbox, and more, which can be especially beneficial when handling the 2018 sc4868 form. These integrations help streamline your workflow, making document sharing and management seamless. Enhance your efficiency by utilizing the tools you already use.

-

What are the benefits of using airSlate SignNow for the 2018 sc4868?

Using airSlate SignNow for the 2018 sc4868 offers numerous benefits, including increased accuracy, reduced processing time, and enhanced compliance. The intuitive eSigning feature eliminates the need for printing, scanning, and mailing, which saves both time and resources. With our secure platform, you can have peace of mind knowing that your sensitive information is protected.

-

How secure is the submission of the 2018 sc4868 form through airSlate SignNow?

Security is a top priority at airSlate SignNow, and we implement stringent measures to protect your 2018 sc4868 submissions. Our platform uses encryption protocols to ensure that your data remains confidential during transmission and storage. Additionally, we comply with industry standards to provide you with a secure eSigning experience.

Get more for Sc Extension Form

- State of iowa receipt of nomination papers iowa secretary of state sos iowa form

- Calorie counter spreadsheet form

- Asq 48 months form

- Morretesinglesa0 form de cadastramento de famlias

- Letter of intent to join the military pdf form

- Notarized proof of identification form

- Scars disfigurementdisability benefits questionnaire form

- Salary non disclosure agreement template form

Find out other Sc Extension Form

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online